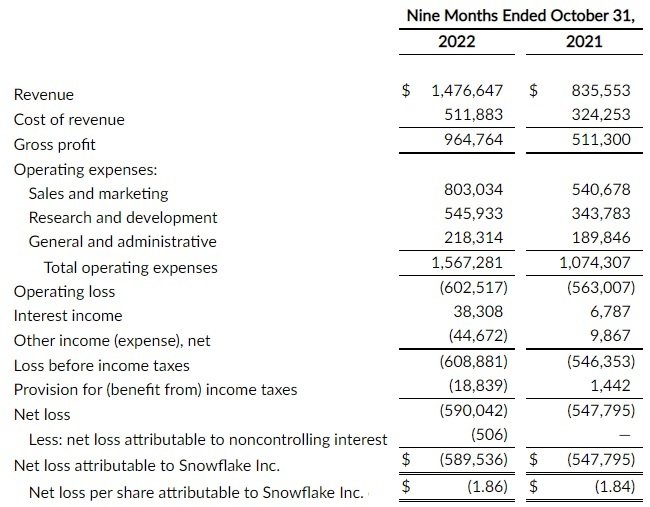

$633 million! That equates to 40% of total operating expenses! No wonder it’s so easy for a large investor in your company to go on television and rave about your free cash flow generation. You are excluding 40% of your expenses from the equation!

Now, let me be clear. Snowflake’s market position is very strong; nobody is refuting that. This funding strategy says nothing about the company, other than how it is doling out shares and then ignoring that fact when it discussed profitability. The company is not profitable today, which makes a near-30x sales multiple look silly.

That said, they will make money at some point. With gross margins rising and approaching 70% right now, the business could easily earn 20% net margins in the future once they get their cost base in-line with other more mature software firms. Those future margins could command a valuation above the market overall (a 30x P/E with 20% margins implies a 6x sales multiple).

Bur the reality today is that the company is growing without any regard to expenses and the only way it is worth this price is if everything goes wonderfully for the next 5-10 years. Many believe that will happen. Gerstner claimed in his interview that SNOW will grow free cash flow 50% annually for many years and that the valuation will stay where it is today – for a total stock return of 50% annually over the same period. Neither of those seem like reasonable hurdles to clear in my eyes, but we’ll have to see how it plays out.

Bottom line: don’t get fooled into thinking that in tech land “free cash flow = profitability.” Normally it does, but not when you use stock-based compensation to a degree never seen in prior economic cycles (not even in Silicon Valley). And for investment managers who don’t hesitate to make their largest position something fetching 100 times revenue, ask yourself if that’s is what history says is a wise move financially, or if more likely that was what their investor base at the time wanted – and thus they had to figure out a way to justify doing it. Why they are still sticking to their guns is a question I can’t answer.