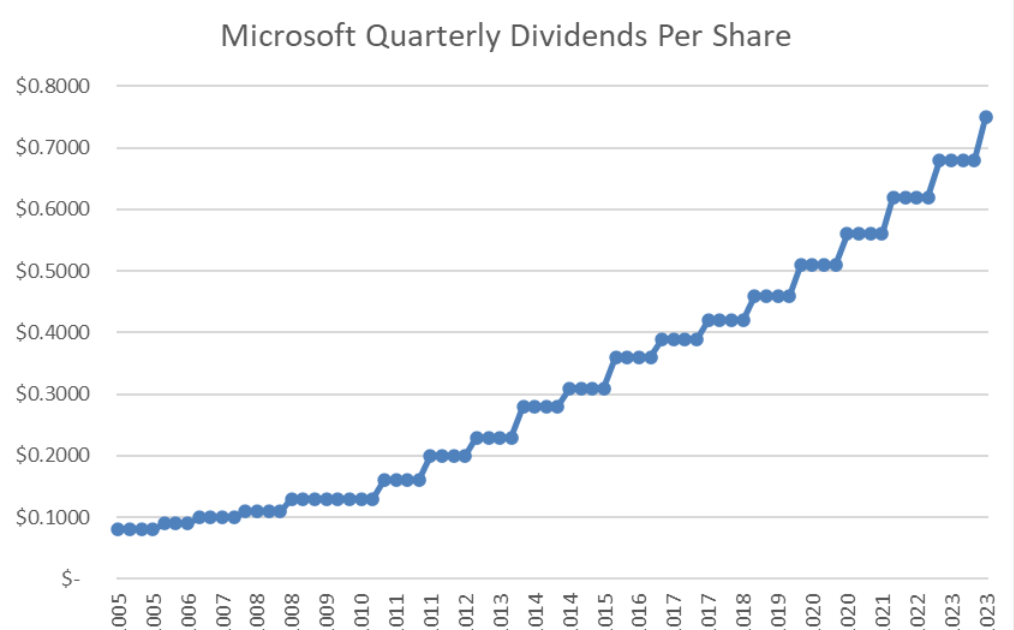

Back in September 2023, Microsoft increased quarterly dividends by 10% to $0.75/share. This was the 19th year of consecutive annual dividend increases for this dividend achiever.

This prompted me to think about the investment history of Microsoft as an investment from a lense of a dividend growth investor.

If you bought Microsoft $MSFT at the end of 2012 you paid $26.71/share

You’d have received $19.08/share in dividends

Investors who owned Microsoft for over 10 years have received over 70% of their original investment back in the form of dividends

Dividends represent a return on investment and a return of investment

Microsoft grew FCF/Share from $2.93 in 2013 to $7.99 in 2022

The valuation multiple increased from 9 times FCF in 2012 to over 40 times FCF in 2023

The 2012 investor is earning an yield on cost of 11.23%

It’s also helpful to look at another company, Altria (MO).

If you bought Altria $MO at the end of 2012 you paid $31.44/share.

You’d have received $31.08/share in dividends.

Investors who owned Altria for over 10 years have received more in dividends than what they paid for the stock

Dividends represent a return on investment and a return of investment.

I explained in a previous post that Altria delivered the same level of FCF/share growth as Microsoft over the past decade. However, it delivered a worse total returns. That’s because the valuation multiple shrunk for Altria, but increased for Microsoft.