The S&P Dividend Aristocrats index tracks companies in the S&P 500 that have increased dividends every year for at least 25 years in a row. The index is equally weighted, and rebalanced every quarter.

To qualify for membership in the S&P 500 Dividend Aristocrats index, a stock must satisfy the following criteria:

1. Be a member of the S&P 500

2. Have increased dividends every year for at least 25 consecutive years

3. Meet minimum float-adjusted market capitalization and liquidity requirements defined in the index inclusion and index exclusion rules below.

The group of companies in the Dividend Aristocrats index tend to generate reliable dividend income, and provide the potential for strong total returns. The list is well diversified across sectors.

There are a record 67 companies in the Dividend Aristocrats index for 2023.

For 2024, there were several changes. The index added:

– Fastenal (FAST)

The index removed:

– Walgreens (WBA).

The index also added KenVue, which was a spin-off from Johnson & Johnson later in 2023. The S&P Index Committee assigned the dividend history record of Johnson & Johnson to Kenvue. This is what they had done previously with Abbvie/Abbott in 2013. However, they didn’t do this for Altria/Phillip Morris International/Kraft in 2007/2008.

The index also removed V.F. Corp (VFC) in early 2023, when the company cut dividends.

The 2023 Dividend Aristocrats are listed below:

|

Symbol |

Name |

Sector |

Years of Annual |

10 year Dividend |

Dividend Yield |

|

ABBV |

AbbVie Inc. |

Health Care |

51 |

13.98% |

4.00% |

|

ABT |

Abbott Laboratories |

Health Care |

51 |

13.80% |

2.00% |

|

ADM |

Archer-Daniels-Midland |

Consumer Staples |

48 |

9.00% |

2.49% |

|

ADP |

Automatic Data |

Information Technology |

48 |

12.64% |

2.40% |

|

AFL |

AFLAC Inc |

Financials |

42 |

8.99% |

2.42% |

|

ALB |

Albemarle Corp. |

Materials |

29 |

5.21% |

1.11% |

|

AMCR |

Amcor |

Materials |

28 |

#N/A |

5.28% |

|

AOS |

Smith A.O. Corp |

Industrials |

30 |

18.16% |

1.55% |

|

APD |

Air Products & |

Materials |

41 |

9.51% |

2.56% |

|

ATO |

Atmos Energy |

Utilities |

40 |

7.86% |

2.78% |

|

BDX |

Becton Dickinson & |

Health Care |

52 |

6.13% |

1.56% |

|

BEN |

Franklin Resources Inc |

Financials |

44 |

11.99% |

4.16% |

|

BF.B |

Brown-Forman Corp B |

Consumer Staples |

39 |

6.89% |

1.58% |

|

BRO |

Brown & Brown |

Financials |

30 |

9.89% |

0.73% |

|

CAH |

Cardinal Health Inc |

Health Care |

27 |

5.60% |

1.99% |

|

CAT |

Caterpillar Inc |

Industrials |

30 |

7.89% |

1.76% |

|

CB |

Chubb Ltd |

Financials |

30 |

5.39% |

1.52% |

|

CHD |

Church & Dwight |

Consumer Staples |

27 |

6.89% |

1.15% |

|

CHRW |

C.H. Robinson |

Industrials |

26 |

5.71% |

2.82% |

|

CINF |

Cincinnati Financial |

Financials |

63 |

5.99% |

2.90% |

|

CL |

Colgate-Palmolive Co |

Consumer Staples |

60 |

3.69% |

2.41% |

|

CLX |

Clorox Co |

Consumer Staples |

46 |

5.83% |

3.37% |

|

CTAS |

Cintas Corp |

Industrials |

41 |

20.57% |

0.90% |

|

CVX |

Chevron Corp |

Energy |

36 |

4.47% |

4.05% |

|

DOV |

Dover Corp |

Industrials |

68 |

5.30% |

1.33% |

|

ECL |

Ecolab Inc |

Materials |

32 |

8.71% |

1.15% |

|

ED |

Consolidated Edison |

Utilities |

49 |

2.79% |

3.56% |

|

EMR |

Emerson Electric Co |

Industrials |

67 |

2.31% |

2.16% |

|

ESS |

Essex Property Trust |

Real Estate |

29 |

6.80% |

3.73% |

|

EXPD |

Expeditors |

Industrials |

29 |

8.69% |

1.08% |

|

FAST |

Fastenal |

Industrials |

25 |

13.35% |

2.16% |

|

FRT |

Federal Realty Invt |

Real Estate |

56 |

3.84% |

4.23% |

|

GD |

General Dynamics |

Industrials |

32 |

9.07% |

2.03% |

|

GPC |

Genuine Parts Co |

Consumer Discretionary |

67 |

5.71% |

2.74% |

|

GWW |

Grainger W.W. Inc |

Industrials |

52 |

7.36% |

0.90% |

|

HRL |

Hormel Foods Corp |

Consumer Staples |

58 |

12.46% |

3.52% |

|

IBM |

Intl Business Machines |

Information Technology |

28 |

6.01% |

4.06% |

|

ITW |

Illinois Tool Works |

Industrials |

49 |

13.07% |

2.14% |

|

JNJ |

Johnson & Johnson |

Health Care |

61 |

6.14% |

3.04% |

|

KMB |

Kimberly-Clark |

Consumer Staples |

51 |

4.46% |

3.88% |

|

KO |

Coca-Cola Co |

Consumer Staples |

61 |

5.09% |

3.12% |

|

KVUE |

Kenvue |

|

61 |

#N/A |

1.91% |

|

LIN |

Linde plc |

Materials |

30 |

7.83% |

1.24% |

|

LOW |

Lowe’s Cos Inc |

Consumer Discretionary |

61 |

20.25% |

1.98% |

|

MCD |

McDonald’s Corp |

Consumer Discretionary |

48 |

7.16% |

2.25% |

|

MDT |

Medtronic plc |

Health Care |

46 |

9.76% |

3.35% |

|

MKC |

McCormick & Co |

Consumer Staples |

37 |

8.66% |

2.46% |

|

MMM |

3M Co |

Industrials |

65 |

8.98% |

5.49% |

|

NEE |

NextEra Energy |

Utilities |

29 |

10.98% |

3.08% |

|

NDSN |

Nordson Corp |

Industrials |

60 |

15.36% |

1.03% |

|

NUE |

Nucor Corp |

Materials |

51 |

3.33% |

1.24% |

|

O |

Realty Income Corp. |

Real Estate |

31 |

3.57% |

5.36% |

|

PEP |

PepsiCo Inc |

Consumer Staples |

51 |

8.13% |

2.98% |

|

PG |

Procter & Gamble |

Consumer Staples |

67 |

4.67% |

2.57% |

|

PNR |

Pentair PLC |

Industrials |

48 |

3.16% |

1.27% |

|

PPG |

PPG Industries Inc |

Materials |

52 |

7.70% |

1.74% |

|

ROP |

Roper Technologies, |

Industrials |

31 |

15.26% |

0.55% |

|

SHW |

Sherwin-Williams Co |

Materials |

45 |

13.76% |

0.78% |

|

SJM |

J.M. Smucker |

Consumer Staples |

26 |

6.58% |

3.35% |

|

SPGI |

S&P Global |

Financials |

50 |

12.39% |

0.82% |

|

SWK |

Stanley Black & |

Industrials |

56 |

4.98% |

3.30% |

|

SYY |

Sysco Corp |

Consumer Staples |

53 |

5.86% |

2.73% |

|

TGT |

Target Corp |

Consumer Discretionary |

56 |

10.68% |

3.09% |

|

TROW |

T Rowe Price Group Inc |

Financials |

37 |

12.37% |

4.53% |

|

WMT |

Wal-Mart |

Consumer Staples |

50 |

2.30% |

1.45% |

|

WST |

West Pharmaceutical |

Health Care |

31 |

7.18% |

0.23% |

|

XOM |

Exxon Mobil Corp |

Energy |

41 |

4.11% |

3.80% |

|

Note: Data as of |

|||||

Note: Data as of 12/31/2023

The index has generated strong total returns over time past decade.

The dividend aristocrats index tends to shine during bear markets and low return environments. However, it also pulls its weight when we are in a bull market too. It is the best of both worlds really.

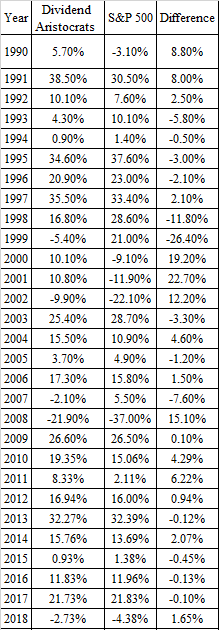

These are the returns since the launch of the Dividend Aristocrats Index in 1989:

You can see the performance of the Dividend Aristocrats Index versus S&P 500 since 1989. The S&P 500 dominated during the 1990’s. However, the Dividend Aristocrats index did very well during the next decade. During the past decade, the Dividend Aristocrats Index has basically matched S&P 500 until early 2020. Over the past two years, it has trailed S&P 500 slightly.

I first stumbled upon the Dividend Aristocrats index in late 2007, and instantly understood why dividend growth investing is such a powerful wealth generating tool. If someone had invested in the Dividend Aristocrats index after reading my review of the list at the beginning of 2008, they would have more than tripled their money.

When I review the list of historical changes in the Dividend Aristocrats index, I see some inconsistencies in the way portfolio components are added or removed.

For example, the Dividend Aristocrats index removed Altria in 2007, after it spun-off Kraft Foods and as a result its dividend decreased. It could be argued that the dividend income for the investor was not decreased, because they kept getting a dividend from Altria as well as dividends from Kraft Foods.

The S&P committee seems to have rectified this issue, and have kept both Abbott and Abbvie after legacy Abbott Laboratories split in two companies in early 2013.

Ironically, Dave Fish had Altria listed as a Dividend Champion. However, he didn’t have Abbott nor Abbvie listed as a dividend champion ( they are listed as Dividend Aristocrats however).

This is why you need to perform your own checks as an investor.

In addition, I wanted to let you know that I would not purchase all companies from either lists blindly. I run my entry criteria screen to come up with a list of companies for further research. Before investing in any individual stock, I research it enough to gain some understanding of the business and its trends in fundamentals.

Relevant Articles:

– Dividend Champions, Contenders & Challengers: The most complete list of US dividend growth stocks available

– Dividend Aristocrats List for 2017

– Dividend Aristocrats for Dividend Growth and Total Returns

– Where are the original Dividend Aristocrats now?

– Historical changes of the S&P Dividend Aristocrats

– Why do I like the Dividend Aristocrats?

– Dividend Aristocrats List for 2016