– by New Deal democrat

The Bonddad Blog

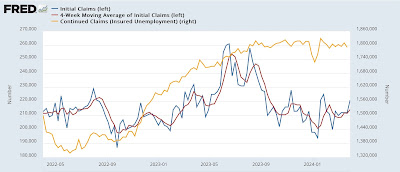

Initial claims in the last week rose 9,000 to 221,000, while the four week moving average increased 2,750 to 214,250. With the usual one week lag, continuing claims declined 19,000 to 1.791 million:

On the more important YoY% basis for forecasting purposes, initial claims are up 2.3%, while the four week average is down -4.5%. Continuing claims are still up, by 5.1%:

The important takeaways are that the four week average is still giving a positive signal, while the YoY% change in continuing claims is the lowest increase since the beginning of March 2023. The net is a slightly positive continuing signal for economic expansion.

With tomorrow’s jobs report, including the unemployment rate, we’ll get the “official” monthly update to the Sahm rule. Since initial (and continuing) claims both lead the unemployment rate, here’s that updated forecast.

On a monthly basis, initial claims were down -6.0% for March. Continuing claims were higher by 6.7%. This suggests downward pressure on YoY comparisons in the unemployment rate in the next few months:

On an absolute basis, initial claims are down significantly since last summer, while continuing claims have been stable. This likewise suggests either downward pressure on the unemployment rate to 3.7% or even 3.6%, or at worst stability at 3.9%:

The forecast is that the Sahm recession rule is not going to be triggered in the months ahead. Additionally, per my posts earlier this week, tomorrow I expect to see a continued decelerating trend in YoY wage growth.

Decline in continuing claims, stability in initial claims suggest downward pressure on the unemployment rate, The Bonddad Blog

Initial claims remain somnolent, while continuing claims pop slightly, Angry Bear, by New Deal democrat