China is well on its way to becoming the world’s largest economy. While this in itself is not news, the focus on China’s path to that economic super status often overshadows the fact that it is gaining an ever greater share in the global financial markets. And, even more importantly, its influence on the performance of those markets.

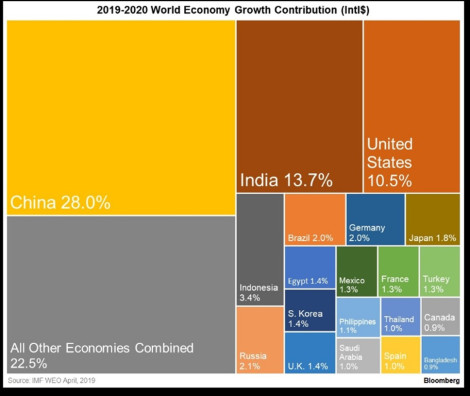

China is now the world’s second largest economy, with nominal GDP at almost USD 13 trillion. This year, the country will overtake the Eurozone as a whole in GDP terms. And in 2019 and 2020, it is expected to account for almost 30{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} of total world economic growth, almost three times as much as the United States. And despite being in the midst of transitioning from an investment-led to a services-driven economy, China still makes up the bulk of global demand for commodities.

Index weight

When you look at these numbers, it’s no surprise that China packs quite a punch on the global bond and stock markets. But that’s not all. China’s direct presence in the those markets is also gradually increasing. The Chinese A-shares market, comprising the Shanghai and Shenzhen exchanges, has already surpassed the stock markets in Japan and Hong Kong by market capitalization.

The weight of Chinese mainland stocks in the leading indices has increased significantly. This year, the weight of A-shares in the MSCI Emerging Markets Index has shot up from almost nothing to 4{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}. In time, this may increase to 17{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}. For the sake of completeness, this is on top of the 30{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} weight of Chinese stocks listed in Hong Kong.

We see a similar trend in fixed income markets. Chinese bonds were included in the market-leading benchmark for global bonds – the Bloomberg Barclays Global Aggregate Index – for the first time in April this year. Over a period of 20 months, over 360 Chinese names will be added, giving China a significant weight in the index. In addition, the inclusion of Chinese bonds is expected to help further open up China’s capital market.

Theoretically, this will make it easier for foreign parties to enter the Chinese market, as well as enable them to realize more diversification and use a larger universe of instruments, i.e. derivatives, to manage portfolios. At least as important, however, is the even greater influence it will give Chinese markets on the global markets. Movements in Chinese yields and liquidity are becoming increasingly relevant.

Growing correlation

China’s increasing share in both the global economy and stock markets is also driving its correlation with key market indicators. Which is precisely what the graph above shows. The MSCI Emerging Markets Index (and also other indices such as the MSCI World Index) has moved very much in tandem with the Chinese 10-year yield in recent years. We often see a similar pattern for the 10-year yield in the US.

The more the Chinese yield is driven by market factors, the more that yield reflects investor expectations – for example, regarding future growth. The situation for liquidity is similar. The graph below shows the very high correlation between the changes in the balance sheet size of China’s central bank and the changes in global stock prices.

More research

Of course, we shouldn’t overestimate China’s impact on (the health of) financial markets (which is confirmed in part by the above graph). China does not have a truly open capital market and its economy remains a relatively closed one, with a lack of free market structures. China’s share in most of the leading indices is still small.

Nevertheless, it cannot be denied that China’s influence – including financial markets – is gradually increasing. More attention for and research into the relationship between China and the markets is therefore a must. Even though, given the sometimes opaque nature of Chinese data, that’s easier said than done.

SOURCE: Jeroen Blokland Financial Markets Blog – Read entire story here.