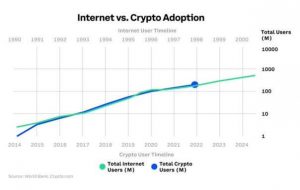

Many people have probably seen this graph comparing the spread of the Internet and the spread of crypto assets (virtual currencies).

Crypto-assets are gaining new users at a rate similar to that of the internet in the 1990s, fueling some surprising predictions about its future.

The Internet, which was essentially idle in 1990, has now reached 5 billion people, garnering 62.5% of the world’s population in 33 years. If crypto-assets follow a similar curve (assuming no population growth), they should reach 5 billion users around 2047, reaching 6 billion if population growth is projected. deaf.

But before I get too excited, I want to say that it’s too optimistic.

The Internet is too broad for comparison. The Internet is used in every aspect of our lives. Cryptocurrencies have many use cases, and while Web3 holds promise, cryptocurrencies are a risky investment or value transfer vehicle for the average consumer.

Focusing on consumer behavior from comparable use cases, let’s analyze adoption with a bottom-up approach.

Consider the proliferation of financial services technology.

- Mobile Banking: Text message banking was introduced in 1997 and the first mobile banking app appeared in 2007. In 2021, McKinsey said in a report that of all bank customers, only 52% in North America, 47% in Western Europe and 45% in Central Europe will use mobile banking. This is in line with a 2023 Cornerstone Advisors report that found 56% of savings account holders actively use mobile banking. But let’s not forget that only 76% of the world’s population has a bank account.

- Equity investments: 61% of Americans own stocks, according to research firm Gallup, and only 35% of Americans own stocks outside of retirement accounts, according to Pew Research. Face-to-face sales are important, with 85% of first-time investors being referred by bankers, according to JPMorgan Chase.

What do these numbers tell us?

People spend decades implementing what many of us in the financial industry consider to be basic financial technology. And crypto assets are far from basic.

Twenty-six years after its introduction, less than 50% of the world uses mobile banking, and only about one-third of Americans actively invest in stocks (New York Stock Exchange). (established in 1792), one cannot help but question the predictions that cryptocurrencies will outgrow early adopters.

Even with a growing population, it may be difficult to reach 5 billion cryptocurrency users by 2047. A more detailed analysis is needed, but a more conservative estimate would be between 2 billion and 3 billion as the traditional banking system continues to digitize.

Remember, cryptoassets are still evolving and need to beat (or join) current methods that aren’t widespread enough.

?Translation: CoinDesk JAPAN

?Editing: Takayuki Masuda

?Image: World Bank, Crypto.com

?Original: Can Crypto Match the Internet and Hit 5B Users?