A solid Friday to close the week helped push indices towards a challenge of 2015 highs. Volume climbed to register strong accumulation for the Dow and S&P, although things were quieter for the Nasdaq and Nasdaq 100.

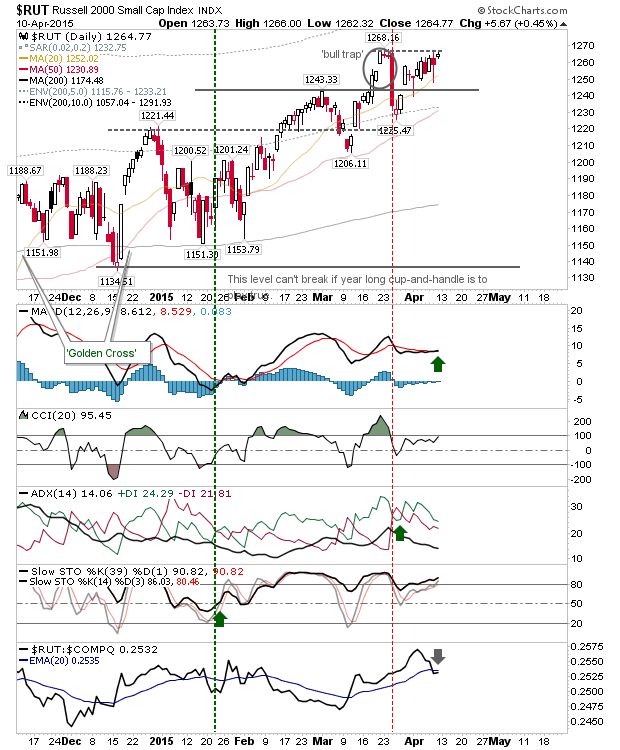

The Russell 2000 sits just 4 points shy of a new all-time high. Last week’s action offered step-by-step advance towards breaking the ‘bull trap’ at 1268. There is a good chance this high will be posted by Monday’s close.

The Dow still has to push above 18,200 which would offer a challenge of the February ‘bull trap’; getting there would be enough to negate the ‘bear flag’. Even at Friday’s close, it appears to be forming a solid base off 18,288 with a measured move target of 19,000.

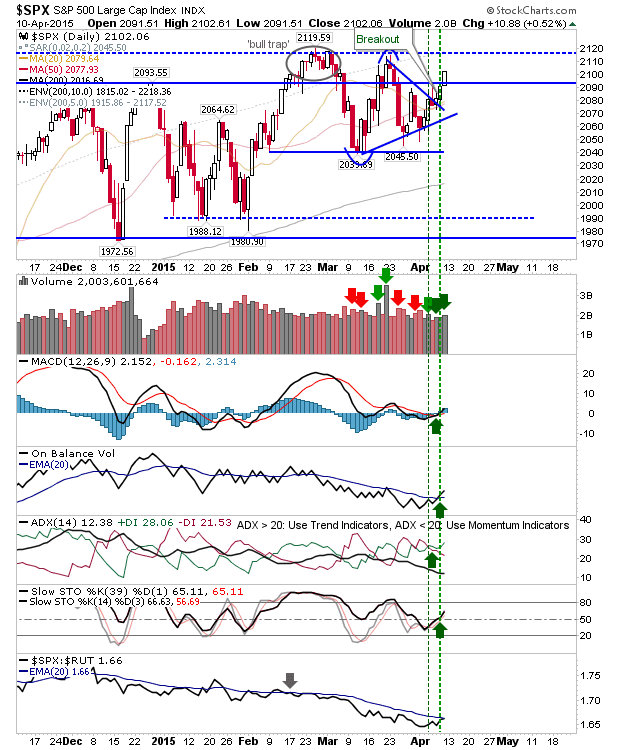

The S&P is also well placed. It got back inside the ‘bull trap’ zone last challenged in March with a nice pick up in volume. There is still room to run before it makes it to 2120, so if sellers do emerge they may target Large Caps indices first.

The Nasdaq, like the Russell 2000, is close to taking out the March ‘bull trap’. It did finish Friday with a strong ‘buy’ in the MACD, alongside a return to net bullish technicals. As with the Russell 2000, Monday could be a good day for the index.

Unusually, the Nasdaq 100 is not sitting as pretty as the Nasdaq. It’s probably done enough to avoid the easy short attack by regaining wedge support. However, it’s still 2-3 days worth of gain away from breaking to new highs.

Contributing to the lackluster Nasdaq 100 is an underperforming Semiconductor Index. After a great run from the October ‘island reversal’ it has all gone a little scrappy. There is an opportunity for a bearish wedge, but a loss of rising wedge support is needed to confirm.

For Monday, watch the Russell 2000 and Nasdaq for bullish leads. If things start quiet, then shorts will probably start looking at Large Caps and Semiconductor index for opportunities. Overall, I still think bulls have the edge and what we are seeing is typical bullish base formation for a push to new highs.

You’ve now read my opinion, next read Douglas’ and Jani’s.

—

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday’s at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil – all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY – IT’S FREE!

SOURCE: Fallon Financial Commentary – Read entire story here.