A great company, however does not always translate into a great investment for numerous reasons.

This is a fairly large and mature company with 37 Billion USD market cap. with stock up 15x in past 15 years, not bad.

If you remember Warren Buffett’s money spinning antennae turned on when he saw a Rich Person smoking expensive Cigar during the depression era, salivating over the profits for the business owner.

One of the prestigious products of Hermes is a Birkin Bag, costing as much as sports car, ~50,000 to ~80,000 USD. In Auctions it can go up to 150,000 USD. Money isn’t enough, there is a waiting list for many years. Birkin Bag is classic example of a Veblen Good (http://en.wikipedia.org/wiki/Veblen_good)

http://www.therichest.com/luxury/shoes-hand-bags/the-journey-to-own-an-hermes-birkin-bag/

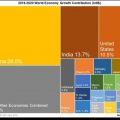

Now, imagine your company controlled 80% or more of the raw material that goes into that bag. Imagine you controlled 50% of global supply of that material. What if you can’t build the company but one such company exists on the planet that you could buy a part of. You really need to traipse through muddy places to find moats with crocodiles these days.