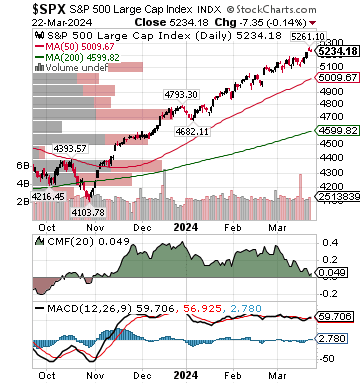

| S&P 500 5,236.6 +2.4% |

Weekly Market Wrap by Edward Jones.

Indices

- Russell 2000 2,074.4 +1.9%

- NYSE FANG+ 10,104.6 +4.4%

- Solactive Roundhill Meme Stock Index 437.4 -.5%

- Goldman 50 Most Shorted 164.7 +2.4%

- Wilshire 5000 52,127.8 +2.5%

- Russell 1000 Growth 3,412.3 +2.9%

- Russell 1000 Value 1,735.2 +1.8%

- S&P 500 Consumer Staples 807.4 +1.0%

- Bloomberg Cyclicals/Defensives Pair Index 143.1 +1.5%

- NYSE Technology 4,839.4 +3.6%

- Transports 16,005.6 +3.3%

- Bloomberg European Bank/Financial Services 100.6 +2.0%

- MSCI Emerging Markets 40.9 +.36%

- Credit Suisse AllHedge Long/Short Equity Index 207.6 +1.9%

- Credit Suisse AllHedge Equity Market Neutral Index 109.1 +.03%

Sentiment/Internals

- NYSE Cumulative A/D Line 496,339 +1.2%

- Nasdaq/NYSE Volume Ratio 9.5 +46.2%

- Bloomberg New Highs-Lows Index 1,800 +1,703

- Crude Oil Commercial Bullish % Net Position -30.6 -2.6%

- CFTC Oil Net Speculative Position 233,788 -2.0%

- CFTC Oil Total Open Interest 1,718,985 +4.7%

- Total Put/Call 1.33 +80.0%

- ISE Sentiment 128.0 -5.0 points

- NYSE Arms 1.54 +59.2%

- Bloomberg Global Risk-On/Risk-Off Index 68.6 +.7%

- Bloomberg US Financial Conditions Index 1.19 +4.0 basis points

- Bloomberg European Financial Conditions Index 1.02 -4.0 basis points

- Volatility(VIX) 12.8 -11.6%

- DJIA Intraday % Swing .71 -11.4%

- CBOE S&P 500 3M Implied Correlation Index 11.9 -13.4%

- G7 Currency Volatility (VXY) 6.96 +5.8%

- Emerging Markets Currency Volatility (EM-VXY) 6.90 +12.4%

- Smart Money Flow Index 16,137.0 +1.2%

- NAAIM Exposure Index 93.2 -11.6

- ICI Money Mkt Mutual Fund Assets $6.047 Trillion -1.0%

- ICI Domestic Equity Long-Term Mutual Fund/ETFs Weekly Flows +$35.238 Million

- AAII % Bears 27.2 +24.2%

- CNN Fear & Greed Index 72.0 (Greed) +2.0

Futures Spot Prices

- Crude Oil 80.7/bbl. -.44%

- Reformulated Gasoline 273.70 +1.1%

- Natural Gas 1.65 -.24%

- Dutch TTF Nat Gas(European benchmark) 27.8 euros/megawatt-hour +1.7%

- Heating Oil 265.7 -2.6%

- Newcastle Coal 124.6 (1,000/metric ton) -3.8%

- Gold 2,162.8 +.3%

- Silver 24.68 -2.0%

- S&P GSCI Industrial Metals Index 425.7 -.9%

- US No. 1 Heavy Melt Scrap Steel 382.0 USD/Metric Tonne +.8%

- China Iron Ore Spot 108.6 USD/Metric Tonne +4.4

%

- CME Lumber 610.50 +1.1%

- UBS-Bloomberg Agriculture 1,503.8 +1.2%

- US Gulf NOLA Potash Spot 312.50 USD/Short Ton -.8%

Economy

- Atlanta Fed GDPNow 1Q Forecast +2.1% -.2 percentage point

- NY Fed Real-Time Weekly Economic Index 1.88 +17.5%

- US Economic Policy Uncertainty Index 82.6 -25.7%

- S&P 500 Current Quarter EPS Growth Rate YoY(12 of 500 reporting) +40.7% n/a

- S&P

500 Blended Forward 12 Months Mean EPS Estimate 249.49 +1.04: Growth

Rate +11.8% +.5 percentage point, P/E 21.0 +.3 - S&P 500 Current Year Estimated Profit Margin 12.83% +1.0 basis point

- NYSE FANG+ Current Quarter EPS Growth Rate YoY(0 of 10 reporting) n/a

- NYSE FANG+ Blended Forward 12 Months Mean EPS Estimate 310.75 -6.06: Growth Rate +29.3% -2.6 percentage points, P/E 32.5 +1.5

- Citi US Economic Surprise Index 31.6 +7.0 points

- Citi Eurozone Economic Surprise Index 46.7 -4.4 points

- Citi Emerging Markets Economic Surprise Index 18.2 -2.4 points

- Fed

Fund Futures imply 12.4%(+6.0 percentage points) chance of -25.0 basis

point cut to 5.0-5.25%, 87.6%(-6.0 percentage points) chance of no

change, 0.0%(unch.) chance of +25.0 basis point hike to 5.5-5.75% on 5/1

- US Dollar Index 104.5 +1.0%

- MSCI Emerging Markets Currency Index 1,732.1 -.06%

- Bitcoin/USD 63,804.5 -6.5%

- Euro/Yen Carry Return Index 177.5 +.9%

- Yield Curve(2s/10s) -38.0 +4.0 basis points

- 10-Year US Treasury Yield 4.22% -8.0 basis points

- Federal Reserve’s Balance Sheet $7.478 Trillion -.36%

- Federal Reserve’s Discount Window Usage $2.172 Billion -7.3%

- Federal Reserve’s Bank Term Funding Program $150.183 Billion -10.3%

- U.S. Sovereign Debt Credit Default Swap 39.7 +2.7%

- Illinois Municipal Debt Credit Default Swap 187.6 +1.1%

- Italian/German 10Y Yld Spread 132.0 +6.0 basis points

- UK Sovereign Debt Credit Default Swap 29.8 +3.1%

- China Sovereign Debt Credit Default Swap 68.8 +1.3%

- Brazil Sovereign Debt Credit Default Swap 135.6 +9.1%

- Israel Sovereign Debt Credit Default Swap 120.9 +4.6%

- South Korea Sovereign Debt Credit Default Swap 36.6 +7.8%

- China Corp. High-Yield Bond USD ETF(KHYB) 24.7 +.2%

- China High-Yield Real Estate Total Return Index 89.84 +.53%

- Atlanta Fed Low Skill Wage Growth Tracker YoY +5.6% unch.

- Zillow US All Homes Rent Index YoY +3.5% unch.

- US Urban Consumers Food CPI YoY +2.2% unch.

- CPI Core Services Ex-Shelter YoY +4.5% unch.

- Cleveland Fed Inflation Nowcast Core PCE YoY +2.78% unch.: CPI YoY +3.37% +4.0 basis points

- 1-Year TIPS Spread 4.08% +1.0 basis point

- Treasury Repo 3M T-Bill Spread 6.5 basis points -1.75 basis points

- 2-Year SOFR Swap Spread -10.75 unch.

- 3-Month EUR/USD Cross-Currency Basis Swap -3.5 +1.0 basis point

- N. America Investment Grade Credit Default Swap Index 52.1 +4.5%

- America Energy Sector High-Yield Credit Default Swap Index 134.0 +.49%

- Bloomberg TRACE # Distressed Bonds Traded 290.0 +28.0

- European Financial Sector Credit Default Swap Index 64.97 +8.6%

- Deutsche Bank Subordinated 5Y Credit Default Swap 192.1 +6.6%

- Emerging Markets Credit Default Swap Index 168.6 +1.4%

- MBS 5/10 Treasury Spread 141.0 unch.

- Bloomberg CMBS Investment Grade Bbb Average OAS 785.0 -25.0 basis points

- Avg. Auto ABS OAS .62 +1.0 basis point

- M2 Money Supply YoY % Change -2.0% unch.

- Commercial Paper Outstanding $1,329.1B +2.8%

- 4-Week Moving Average of Jobless Claims 211,250 +1.2%

- Continuing Claims Unemployment Rate 1.2% unch.

- Kastle Back-to-Work Barometer(entries in secured buildings) 50.6 -3.7%

- Average 30-Year Fixed Home Mortgage Rate 7.12% +3.0 basis points

- Weekly Mortgage Applications 198,200 -1.6%

- Weekly Retail Sales +3.2% +20.0 basis points

- OpenTable US Seated Diners % Change YoY -4.0% unch.

- Box Office Weekly Gross $172.4M +57.0%

- Nationwide Gas $3.53/gallon +.09/gallon

- Baltic Dry Index 2,240.0 unch.

- Drewry World Container Freight Index $3,009.7/40 ft Box -4.8%

- China (Export) Containerized Freight Index 1,244.8 -2.6%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 45.0 unch.

- Truckstop.com Market Demand Index 54.33 -.15%

- Rail Freight Carloads 255,010 -1.2%

- TSA Total Traveler Throughput 2,677,627 +11.4%

Best Performing Style

Worst Performing Style

Leading Sectors

- Disk Drives +4.9%

- Gambling +4.2%

Lagging Sectors

Weekly High-Volume Stock Gainers (18)

- PHAT, WS, CDLX, HROW, YOU, ERJ, FDX, STVN, MYE, EH, URGN, AY, DBI, DFH, ATMU and AES

Weekly High-Volume Stock Losers (12)

- FIVE, PZZA, TMDX, ZGN, EPAM, NKE, ACIC, NMRA, AIR, BROS, LULU and TRML

ETFs

Stocks

*5-Day Change