If your retirement plan is currently wide open and you’re considering making a domestic move to one of the 50 nifty United States, make sure you understand just what each option will cost you.

Between rising food costs, volatile housing markets and Social Security benefits down the line remaining a huge question mark, it’s best to focus on the finances you can control and how long you can stretch them in your desired retirement destination.

Read Next: 9 Easy Ways To Build Wealth That Will Last Through Retirement

Retirement is a significant milestone, and choosing the right place to enjoy this new chapter in life is crucial. The best states for retirement offer a blend of factors including cost of living, healthcare quality, recreational opportunities and overall lifestyle. Conversely, some states may present challenges that can detract from a comfortable retirement. This article explores the best and worst states to retire, helping you make an informed decision for your golden years.

GOBankingRates researched where to retire based on factors like property taxes, crime rates, home values and general cost of living assessments. Here are some key takeaways:

-

West Virginia is ranked number one based on cost factors and livability standards.

-

The worst state based on the study’s factors is California.

-

The top 10 ranked states — West Virginia, Maine, Kentucky, Wyoming, Alabama, Pennsylvania, North Dakota, Florida, Indiana and Mississippi — have an estimated average income of under $75,000.

-

The state with the highest violent crime rate was South Carolina and the state with the highest property crime rate was Colorado.

Here’s GOBankingRate’s assessment of where you should retire, ranked from best to worst. You can also check out how much you’ll need to do so.

1. West Virginia

-

State population of senior citizens, aged 65 and up: 376,162

-

Median household income: $55,217

-

Average single-family home value: $169,488

-

Average monthly mortgage payment: $992

-

Average monthly expenditure costs: $1,812

-

Total annual cost of living: $33,649

Learn More: The Average Retirement Age in 2024: US vs. Canada

For You: 6 Money Moves You Must Make If You Want To Be Like the Wealthy

Earning passive income doesn’t need to be difficult. You can start this week.

2. Maine

-

State population of senior citizens, aged 65 and up: 312,893

-

Median household income: $68,251

-

Average single-family home value: $407,172

-

Average monthly mortgage payment: $2,384

-

Average monthly expenditure costs: $2,043

-

Total annual cost of living: $53,129

Try This: Trump Wants To Eliminate Social Security Taxes: Here’s How Much the Average Retiree Would Save

3. Kentucky

-

State population of senior citizens, aged 65 and up: 791,113

-

Median household income: $60,183

-

Average single-family home value: $212,244

-

Average monthly mortgage payment: $1,243

-

Average monthly expenditure costs: $1,837

-

Total annual cost of living: $36,958

4. Wyoming

-

State population of senior citizens, aged 65 and up: 107,988

-

Median household income: $72,495

-

Average single-family home value: $349,030

-

Average monthly mortgage payment: $2,044

-

Average monthly expenditure costs: $1,804

-

Total annual cost of living: $46,170

5. Alabama

-

State population of senior citizens, aged 65 and up: 913,013

-

Median household income: $59,609

-

Average single-family home value: $229,129

-

Average monthly mortgage payment: $1,342

-

Average monthly expenditure costs: $1,733

-

Total annual cost of living: $36,894

6. Pennsylvania

-

State population of senior citizens, aged 65 and up: 2,539,054

-

Median household income: $73,170

-

Average single-family home value: $273,043

-

Average monthly mortgage payment: $1,599

-

Average monthly expenditure costs: $1,822

-

Total annual cost of living: $41,048

Trending Now: I’m a Retired Boomer: Here Are 3 Debts You Should Definitely Pay Off Before Retirement

7. North Dakota

-

State population of senior citizens, aged 65 and up: 130,293

-

Median household income: $73,959

-

Average single-family home value: $270,005

-

Average monthly mortgage payment: $1,581

-

Average monthly expenditure costs: $1,832

-

Total annual cost of living: $40,951

8. Florida

-

State population of senior citizens, aged 65 and up: 4,794,414

-

Median household income: $67,917

-

Average single-family home value: $417,817

-

Average monthly mortgage payment: $2,446

-

Average monthly expenditure costs: $1,907

-

Total annual cost of living: $52,239

9. Indiana

-

State population of senior citizens, aged 65 and up: 1,157,426

-

Median household income: $67,173

-

Average single-family home value: $246,647

-

Average monthly mortgage payment: $1,444

-

Average monthly expenditure costs: $1,775

-

Total annual cost of living: $38,633

10. Mississippi

-

State population of senior citizens, aged 65 and up: 513,184

-

Median household income: $52,985

-

Average single-family home value: $182,236

-

Average monthly mortgage payment: $1,067

-

Average monthly expenditure costs: $1,770

-

Total annual cost of living: $34,042

Be Aware: 8 States To Move to If You Don’t Want To Pay Taxes on Social Security

11. Oklahoma

-

State population of senior citizens, aged 65 and up: 661,996

-

Median household income: $61,364

-

Average single-family home value: $210,716

-

Average monthly mortgage payment: $1,234

-

Average monthly expenditure costs: $1,753

-

Total annual cost of living: $35,848

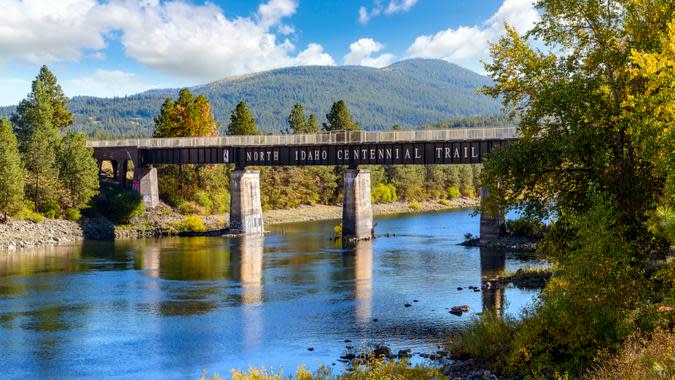

12. Idaho

-

State population of senior citizens, aged 65 and up: 329,530

-

Median household income: $70,214

-

Average single-family home value: $462,357

-

Average monthly mortgage payment: $2,707

-

Average monthly expenditure costs: $1,825

-

Total annual cost of living: $54,380

13. Minnesota

-

State population of senior citizens, aged 65 and up: 995,047

-

Median household income: $84,313

-

Average single-family home value: $346,886

-

Average monthly mortgage payment: $2,031

-

Average monthly expenditure costs: $1,875

-

Total annual cost of living: $46,872

14. Ohio

-

State population of senior citizens, aged 65 and up: 2,168,665

-

Median household income: $66,990

-

Average single-family home value: $237,155

-

Average monthly mortgage payment: $1,389

-

Average monthly expenditure costs: $1,812

-

Total annual cost of living: $38,413

Explore More: Cutting Expenses for Retirement? Here’s the No. 1 Thing To Get Rid Of First

15. Arkansas

-

State population of senior citizens, aged 65 and up: 538,842

-

Median household income: $56,335

-

Average single-family home value: $210,322

-

Average monthly mortgage payment: $1,232

-

Average monthly expenditure costs: $1,684

-

Total annual cost of living: $34,989

16. Michigan

-

State population of senior citizens, aged 65 and up: 1,877,562

-

Median household income: $68,505

-

Average single-family home value: $251,244

-

Average monthly mortgage payment: $1,471

-

Average monthly expenditure costs: $1,778

-

Total annual cost of living: $38,983

17. Rhode Island

-

State population of senior citizens, aged 65 and up: 206,117

-

Median household income: $81,370

-

Average single-family home value: $482,509

-

Average monthly mortgage payment: $2,825

-

Average monthly expenditure costs: $2,054

-

Total annual cost of living: $58,547

18. Wisconsin

-

State population of senior citizens, aged 65 and up: 1,102,386

-

Median household income: $72,458

-

Average single-family home value: $315,903

-

Average monthly mortgage payment: $1,850

-

Average monthly expenditure costs: $1,877

-

Total annual cost of living: $44,721

Find Out: 2 Things Empty Nesters Should Stop Investing In To Boost Retirement Savings

19. Missouri

-

State population of senior citizens, aged 65 and up: 1,113,136

-

Median household income: $65,920

-

Average single-family home value: $253,253

-

Average monthly mortgage payment: $1,483

-

Average monthly expenditure costs: $1,713

-

Total annual cost of living: $38,348

20. New Mexico

-

State population of senior citizens, aged 65 and up: 404,784

-

Median household income: $58,722

-

Average single-family home value: $307,255

-

Average monthly mortgage payment: $1,799

-

Average monthly expenditure costs: $1,771

-

Total annual cost of living: $42,836

21. Arizona

-

State population of senior citizens, aged 65 and up: 1,381,954

-

Median household income: $72,581

-

Average single-family home value: $444,236

-

Average monthly mortgage payment: $2,601

-

Average monthly expenditure costs: $1,856

-

Total annual cost of living: $53,483

22. Montana

-

State population of senior citizens, aged 65 and up: 226,136

-

Median household income: $66,341

-

Average single-family home value: $473,351

-

Average monthly mortgage payment: $2,772

-

Average monthly expenditure costs: $1,886

-

Total annual cost of living: $55,892

Read More: These Are America’s 50 Fastest-Growing Retirement Hot Spots

23. Tennessee

-

State population of senior citizens, aged 65 and up: 1,217,964

-

Median household income: $64,035

-

Average single-family home value: $325,045

-

Average monthly mortgage payment: $1,903

-

Average monthly expenditure costs: $1,699

-

Total annual cost of living: $43,230

24. New Hampshire

-

State population of senior citizens, aged 65 and up: 281,983

-

Median household income: $90,845

-

Average single-family home value: $508,381

-

Average monthly mortgage payment: $2,977

-

Average monthly expenditure costs: $1,958

-

Total annual cost of living: $59,224

25. Nebraska

-

State population of senior citizens, aged 65 and up: 334,897

-

Median household income: $71,722

-

Average single-family home value: $266,070

-

Average monthly mortgage payment: $1,558

-

Average monthly expenditure costs: $1,819

-

Total annual cost of living: $40,530

26. Virginia

-

State population of senior citizens, aged 65 and up: 1,462,042

-

Median household income: $87,249

-

Average single-family home value: $402,453

-

Average monthly mortgage payment: $2,356

-

Average monthly expenditure costs: $1,849

-

Total annual cost of living: $50,460

Discover More: Trump Wants To Eliminate Income Taxes: How Would That Impact You If You Are Retired?

27. Iowa

-

State population of senior citizens, aged 65 and up: 588,879

-

Median household income: $70,571

-

Average single-family home value: $228,033

-

Average monthly mortgage payment: $1,335

-

Average monthly expenditure costs: $1,785

-

Total annual cost of living: $37,442

28. South Dakota

-

State population of senior citizens, aged 65 and up: 165,909

-

Median household income: $69,457

-

Average single-family home value: $309,454

-

Average monthly mortgage payment: $1,812

-

Average monthly expenditure costs: $1,818

-

Total annual cost of living: $43,556

29. Oregon

-

State population of senior citizens, aged 65 and up: 816,714

-

Median household income: $76,632

-

Average single-family home value: $511,920

-

Average monthly mortgage payment: $2,997

-

Average monthly expenditure costs: $2,022

-

Total annual cost of living: $60,224

30. Nevada

-

State population of senior citizens, aged 65 and up: 538,491

-

Median household income: $71,646

-

Average single-family home value: $459,799

-

Average monthly mortgage payment: $2,692

-

Average monthly expenditure costs: $1,909

-

Total annual cost of living: $55,212

Consider This: America’s 50 Most Expensive Retirement Towns

31. Delaware

-

State population of senior citizens, aged 65 and up: 212,180

-

Median household income: $79,325

-

Average single-family home value: $391,529

-

Average monthly mortgage payment: $2,293

-

Average monthly expenditure costs: $1,887

-

Total annual cost of living: $50,161

32. Vermont

-

State population of senior citizens, aged 65 and up: 139,827

-

Median household income: $74,014

-

Average single-family home value: $406,057

-

Average monthly mortgage payment: $2,378

-

Average monthly expenditure costs: $2,002

-

Total annual cost of living: $52,562

33. New York

-

State population of senior citizens, aged 65 and up: 3,564,596

-

Median household income: $81,386

-

Average single-family home value: $455,756

-

Average monthly mortgage payment: $2,669

-

Average monthly expenditure costs: $1,963

-

Total annual cost of living: $55,580

34. Kansas

-

State population of senior citizens, aged 65 and up: 506,342

-

Median household income: $69,747

-

Average single-family home value: $234,020

-

Average monthly mortgage payment: $1,370

-

Average monthly expenditure costs: $1,762

-

Total annual cost of living: $37,586

Check Out: Here Are All the Promises Trump Has Made About Social Security If He’s Reelected

35. Massachusetts

-

State population of senior citizens, aged 65 and up: 1,260,100

-

Median household income: $96,505

-

Average single-family home value: $657,464

-

Average monthly mortgage payment: $3,850

-

Average monthly expenditure costs: $2,264

-

Total annual cost of living: $73,364

36. Louisiana

-

State population of senior citizens, aged 65 and up: 780,061

-

Median household income: $57,852

-

Average single-family home value: $205,122

-

Average monthly mortgage payment: $1,201

-

Average monthly expenditure costs: $1,718

-

Total annual cost of living: $35,027

37. North Carolina

-

State population of senior citizens, aged 65 and up: 1,866,614

-

Median household income: $66,186

-

Average single-family home value: $337,441

-

Average monthly mortgage payment: $1,976

-

Average monthly expenditure costs: $1,868

-

Total annual cost of living: $46,125

38. South Carolina

-

State population of senior citizens, aged 65 and up: 1,008,618

-

Median household income: $63,623

-

Average single-family home value: $302,768

-

Average monthly mortgage payment: $1,773

-

Average monthly expenditure costs: $1,835

-

Total annual cost of living: $43,291

Read Next: I’m a Financial Advisor: 5 Things the Middle Class Wastes Money On

39. Georgia

-

State population of senior citizens, aged 65 and up: 1,644,275

-

Median household income: $71,355

-

Average single-family home value: $336,833

-

Average monthly mortgage payment: $1,972

-

Average monthly expenditure costs: $1,816

-

Total annual cost of living: $45,453

40. Illinois

-

State population of senior citizens, aged 65 and up: 2,164,940

-

Median household income: $78,433

-

Average single-family home value: $275,790

-

Average monthly mortgage payment: $1,615

-

Average monthly expenditure costs: $1,831

-

Total annual cost of living: $41,353

41. Connecticut

-

State population of senior citizens, aged 65 and up: 663,712

-

Median household income: $90,213

-

Average single-family home value: $438,776

-

Average monthly mortgage payment: $2,569

-

Average monthly expenditure costs: $2,072

-

Total annual cost of living: $55,697

42. Hawaii

-

State population of senior citizens, aged 65 and up: 294,654

-

Median household income: $94,814

-

Average single-family home value: $991,137

-

Average monthly mortgage payment: $5,803

-

Average monthly expenditure costs: $2,545

-

Total annual cost of living: $100,177

Learn More: 6 Things the Middle Class Should Sell To Build Their Savings

43. Utah

-

State population of senior citizens, aged 65 and up: 403,699

-

Median household income: $86,833

-

Average single-family home value: $533,040

-

Average monthly mortgage payment: $3,121

-

Average monthly expenditure costs: $1,768

-

Total annual cost of living: $58,672

44. Maryland

-

State population of senior citizens, aged 65 and up: 1,042,779

-

Median household income: $98,461

-

Average single-family home value: $434,761

-

Average monthly mortgage payment: $2,546

-

Average monthly expenditure costs: $1,943

-

Total annual cost of living: $53,869

45. Washington

-

State population of senior citizens, aged 65 and up: 1,309,142

-

Median household income: $90,325

-

Average single-family home value: $616,665

-

Average monthly mortgage payment: $3,611

-

Average monthly expenditure costs: $2,091

-

Total annual cost of living: $68,420

46. Texas

-

State population of senior citizens, aged 65 and up: 4,037,085

-

Median household income: $73,035

-

Average single-family home value: $309,871

-

Average monthly mortgage payment: $1,814

-

Average monthly expenditure costs: $1,801

-

Total annual cost of living: $43,379

For You: 9 Things the Middle Class Should Consider Downsizing To Save on Monthly Expenses

47. Alaska

-

State population of senior citizens, aged 65 and up: 101,474

-

Median household income: $86,370

-

Average single-family home value: $378,750

-

Average monthly mortgage payment: $2,218

-

Average monthly expenditure costs: $2,556

-

Total annual cost of living: $57,293

48. New Jersey

-

State population of senior citizens, aged 65 and up: 1,611,726

-

Median household income: $97,126

-

Average single-family home value: $554,214

-

Average monthly mortgage payment: $3,245

-

Average monthly expenditure costs: $1,939

-

Total annual cost of living: $62,203

49. Colorado

-

State population of senior citizens, aged 65 and up: 915,661

-

Median household income: $87,598

-

Average single-family home value: $564,208

-

Average monthly mortgage payment: $3,304

-

Average monthly expenditure costs: $1,838

-

Total annual cost of living: $61,707

50. California

-

State population of senior citizens, aged 65 and up: 6,158,902

-

Median household income: $91,905

-

Average single-family home value: $810,327

-

Average monthly mortgage payment: $4,745

-

Average monthly expenditure costs: $2,247

-

Total annual cost of living: $83,906

Methodology: For this study, GOBankingRates analyzed each U.S. state to find the best to worst-ranked states. First GOBankingRates found the cost-of-living indexes as sourced from the Missouri Economic and Research Information Center, the average single-family home value as sourced from the Zillow Home Value Index, the total population, population ages 65 and over, total households, median property taxes paid, median home value, and median household income all sourced from the U.S. Census American Community Survey, the violent crime and property crimes as sourced from the Federal Bureau of Investigation’s Crime Data Explorer. For each state, the cost-of-living indexes were used along with the average expenditure costs for retired residents as sourced from the Bureau of Labor Statistics Consumer Expenditure Survey to find the average expenditure costs. Using the median property taxes paid and the median home value, the median property tax rate can be calculated. The average home value can be used along with the national average 30-year fixed mortgage rate and by assuming a 10% down payment, the average mortgage cost can be calculated. With the expenditure and mortgage costs, the monthly cost of living can be calculated. Using the property and violent crimes, the crime rate per 1,000 residents can be calculated for each city. The violent crime rate was scored and weighted at 0.75, the property crime rate was scored and weighted at 0.75, the total cost of living was scored and weighted at 1.00, the property tax rate was scored and weighted at 1.00, the percent of the population that is aged 65 and over was scored and weighted at 1.00. All the scores were summed and sorted to show the best to worst states to retire. All data was collected on and is up to date as of August 16th, 2024.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Best and Worst States To Retire in 2024, Ranked From Best to Worst