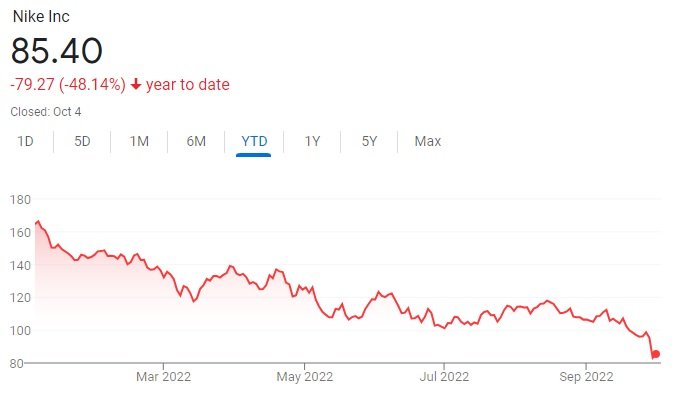

One of the best things about bear markets in stocks is that investors can get pretty good prices for blue chip stocks that trade at material premiums during most of the business cycle. As the market declines we can find more and more examples. Here is one I took a screenshot of a few days ago. Cut in half year-to-date, for a company of this caliber? Wow, despite it being quite overvalued near its peak. Looking back five or ten years from now, how will it look if we put some shares away for the long haul today? Feels like an interesting add to a youngster’s college fund, for instance.