- The recent slide of -170 pips seen in the AUD/USD from Monday, 6 November high of 0.6520 has reached a key inflection zone.

- The latest higher level of inflation forecasts in Australia by the RBA may put a pause on the current minor corrective decline seen in the AUD/USD.

- Short-term technical elements have turned positive for a potential bullish reversal scenario for the AUD/USD.

- Watch the 0.6330 key short-term support and 0.6400 potential upside trigger level for the AUD/USD.

This is a follow-up analysis of our prior report, “AUD/USD Technical: AUD/USD Technical: RBA hike has already been priced in, minor corrective decline in progress” published on 7 November 2023. Click here for a recap.

The price actions of AUD/USD have shaped the expected corrective decline and hit the 0.6395/6370 short-term support zone. It printed an intraday low of 0.6452 in today, 10 Nov Asian session at this time of the writing reinforced by a mild hawkish Fed speak from Fed Chair Powell that indicated the US Federal Reserve may enact another interest rate if needed.

In a similar hawkish vibe, the Australian central bank, RBA has raised an “elevated inflationary environment” alarm via its latest messaging and inflation forecasts portrayed on its latest monetary policy statement released today.

RBA highlighted that inflation was more persistent than expected, the Australian economy grew slightly above expectations, and inflation pressures may see further upside surprises due to both domestic and external factors.

RBA’s current CPI forecasts (November 2023) were revised upwards to 4.5% end 2023, 3.5% end 2024, and 2.9% end 2025 from prior projections made in August 2023 at 4.1% end 2023, 3.3% end 2024, and 2.8% end 2025.

Hence, it seems that the RBA is more skewed toward inflation-fighting mode rather than looking at an imminent interest rate cut in the first half of 2024 to address growth concerns in Australia.

Therefore, the current slide of the AUD/USD in place since Monday, 6 November may be negated soon as market participants adjust their future expectations toward a more potentially less dovish RBA in the short to medium term.

Medium-term uptrend remains intact

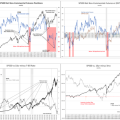

Fig 1: AUD/USD medium-term trend as of 10 Nov 2023 (Source: TradingView, click to enlarge chart)

The ongoing short-term uptrend of the AUD/USD since the bullish breakout of its ‘Descending Wedge” bullish reversal configuration on 2 November 2023 remains intact.

In addition, the daily RSI momentum indicator has pull-backed but remained above its parallel ascending support at the 42 level after it flashed out a bullish divergence condition earlier on 3 October 2023.

Watch 0.6330 key short-term support

Fig 2: AUD/USD minor short-term trend as of 10 Nov 2023 (Source: TradingView, click to enlarge chart)

The current price actions of the AUD/USD have started to trade sideways right at the pull-back support of the former ‘Descending Wedge” resistance which is also close to the 0.6330 short-term pivotal support defined by the minor congestion area of 1 November 2023, 76.4% Fibonacci retracement of the prior upmove from 26 October low to 6 November 2023 high, and 1.00 Fibonacci extension of the current slide from 6 November high to 7 November low projected from 8 November 2023 high.

In addition, the hourly RSI momentum indicator has started to exit from its oversold region which suggests the current short-term downside momentum is likely to have abated.

A clearance above 0.6400 near-term resistance (also the 50-day moving average) may see a potential bullish reversal towards the intermediate resistances of 0.6440 and 0.6520 in the first step.

On the other hand, a break below 0.6330 invalidates the bullish scenario for a further slide to expose the medium-term support zone of 0.6270/0.6200.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.