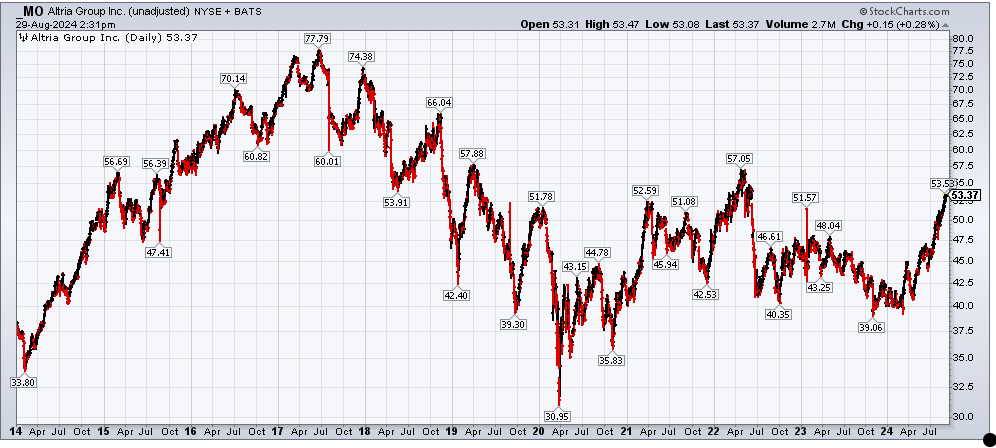

Altria (MO) reached an all time high of $77.79/share in 2017

Today, the stock sells for $53.50/share

If you look at prices alone, you can reach all sorts of conclusions

However, share prices do not really tell the whole story.

If you look at total returns, which takes into consideration the impact of reinvested dividends, you can see a different picture

You can see that shareholders who bought at the highs in 2017 are making a profit, when taking into consideration the impact of reinvested dividends.

Those rising dividends mattered, because they allowed shareholders to reinvest on a predictable schedule into more stock. Holding on to a rising dividend over time, aka being paid to hold and being paid to wait, definitely made it easier to stick to Altria through the ups and downs as well. It’s easy to be patient when you are showered with rising streams of cash.

I wanted to take something else into consideration as well.

Notably valuation and the sources of returns.

As we have discussed before, shareholder returns are a function of:

1. Dividends

2. EPS or FCF/Share Growth

3. Change in Valuation

The first two items are the fundamental sources of returns, which tend to drive most if not all investor returns over the long run.

The last item is the speculative source of return. It is noise, that is impacted in the short run by investors moods of fear and greed. Over the long run, changes of valuation account for pretty much no returns.

Over the short-run however, they do impact returns due to their inherent noise.

Intelligent investors either tune this noise out or take advantage of it (e.g. buy good quality companies at a depressed valuation).

In the case of Altria, FCF/Share rose from $1.86 in 2016 to $2.45 in 2017 all the way up to $6.07 in 2023.

Annual Dividends Per Share rose from $2.35 in 2016 to $2.54 in 2017 to $3.84 in 2023

This means that at the highs in 2017, the stock was selling for 31.75 times forward FCF for 2017 or a whopping 41.82 times PY FCF (2016).

That was a pricey stock back then, as investors were excited to hold a staple with recession resistant cashflows, which were also expected to grow at a steady clip over time.

Forward Dividend yield was at 3.26%.

Fast forward to today, the dividend yield is at 7.70%, as the annual dividend is $4.08.

The stock sells at only 8.80 times FCF from 2023.

Despite the fact that FCF/share has basically tripled from 2016 to 2023, the stock price declined.

That’s because valuation decreased from very overvalued in 2016/2017 to undervalued in 2023/2024,

This low valuation since at least 2019 has actually been beneficial for those who reinvest their dividends. That’s because you get more bang for your buck when you reinvest at a lower price than when you do at a higher price.

Share price returns resulted in a negative source of returns due to the valuation collapse.

But dividends accounted for basically all the total returns.

If the stock had remained at an FCF Multiple of 30 however, Altria would have been selling for over $180 per share today.

Back in 2016/2017, folks were excited for the stock, willing to pay a premium for it. Perhaps they were excited for the prospects of the business, which were good.

Today, they are depressed by the stock, and willing to give it away for a pittance. I believe the prospects of the business are still as good. You can also see that the business can withstand some management incompetence as well (e.g. Juul) and still do well.

Perhaps in a few years, the business would be re-valued by the marketplace and command a higher multiple. But I do believe that it would still continue to have good fundamental returns, and that it would have a higher FCF/share in a decade. Plus, the business would continue to shower shareholders with rising annual dividends.

Today, we learned about the importance of dividend reinvestment.

Dividends are an important portion of total returns. Hence, when you look at performance metrics, make sure to look at total returns, not just prices alone.

Today, we also learned the sources of total returns over time. It is helpful to break returns down by sources, in order to understand what really happened.

Those are just a few random thoughts I have, which made it into this article. I would likely keep updating/reformating going forward…