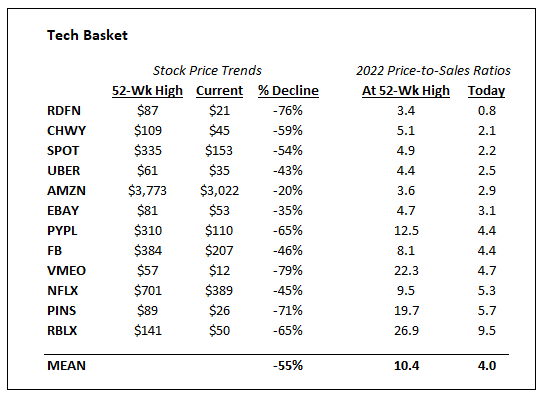

You will notice I highlight price-to-sales ratios (PSR) instead of price-to-earnings (PE). I think it makes for a more apples-to-apples comparison when you have companies at different life stages. I am not fundamentally opposed to a growth company employing the Amazon “reinvest every dollar that comes in” approach – even if it cannot possibly work for everyone – and so if you believe in certain businesses long term regardless of current profitability, using the PSR can help you weed out the “priced to perfection” crowd (e.g. 20x sales).

Even still, the PSR is not a shortcut method. An e-commerce play has a different margin profile than a software company and thus the sales multiple should reflect that. I think the key is finding a mismatch where the multiple implies low profit margins at maturity but the business positioning could indicate otherwise. As an example, we see Uber at 2.5x sales and Chewy at 2.1x. One could argue that gap should be wider.

Anyway, I just wanted to share a list I have been working off of lately. I suspect the basket itself will do well over the next few years given the depressed prices. Picking the relative winners and losers is a trickier task, but one that might be well worth digging into.