This article examines the fundamental factors that are likely to influence the trajectory of the U.S. dollar in the first quarter of 2024. For technical insights about price action dynamics, download the complete Q1 forecast!

Recommended by Diego Colman

Get Your Free USD Forecast

US Dollar – Market Recap

The U.S. dollar, as measured by the DXY index, started the fourth quarter on the front foot, briefly reaching its strongest position in almost a year. These gains were underpinned by the steady and consistent rise in U.S. Treasury yields, catalyzed by bets that the Federal Reserve would keep a restrictive stance for an extended period to restore price stability in the economy.

However, the greenback was unable to maintain its upward momentum for long. Shortly after setting a new 2023 high in early October, DXY shifted lower, undercut by the sharp downward correction in real and nominal yields following benign inflation readings.

With inflationary forces downshifting, markets began to price in aggressive rate cuts over the next few years in an attempt to front-run the FOMC next easing cycle. The U.S. central bank initially resisted the pressure to pivot, but relented at its December meeting, when it indicated that “talk” of cutting borrowing costs had already begun.

The Fed’s pivot accelerated the pullback in yields, sending the 2-year note below 4.40 %, a significant retracement from the cycle high of 5.25%. Simultaneously, the 10-year note plunged beneath the 4.0% threshold, when weeks earlier it was threatening to breach the psychological 5.0% level. In this context, the U.S. dollar index plummeted, hitting its weakest point since August.

The chart below shows how U.S. Treasury yields have performed in the fourth quarter.

US Treasury Yields Q4 Performance

Source: TradingView, Prepared by Diego Colman

Wondering about the U.S. dollar’s technical and fundamental outlook? Gain clarity with our latest forecast. Download a free copy now!

Recommended by Diego Colman

Get Your Free USD Forecast

US Dollar Fundamental Outlook

The Fed’s unexpected dovish pivot is a clear signal that officials want to shift policy in time to engineer a soft landing; in other words, they are prioritizing growth over inflation. This bias won’t change overnight, but will likely consolidate further in the near term, so the path of least resistance remains lower for both bond yields and the U.S. dollar, at least for the first couple of months of 2024.

Navigational winds, however, could shift in favor of the greenback by the end of the first quarter, when additional data will become available for a more complete assessment of the macroeconomic picture.

The significant relaxation of financial conditions observed in November and December, which ignited a powerful surge in stocks, is likely to amplify the wealth effect heading into the new year, helping sustain sturdy household consumption—the key driver of GDP. In this context, the prospect of an economic upswing in the medium term should not be completely ruled out.

Any reacceleration in growth should boost employment gains and reinforce labor market tightness, putting upward pressure on wages. In this environment, inflation could settle well above the 2.0% target while staying skewed to the upside, preventing the Federal Reserve from pursuing a forceful easing campaign.

Although there is a heightened sense of optimism regarding the U.S. inflation outlook following encouraging CPI and Core PCE reports in the latter part of 2023, it is premature to declare victory. Any pause in progress or an upward reversal of the underlying trend in consumer prices next year could be cataclysmic for sentiment, prompting a hawkish repricing of interest rate expectations.

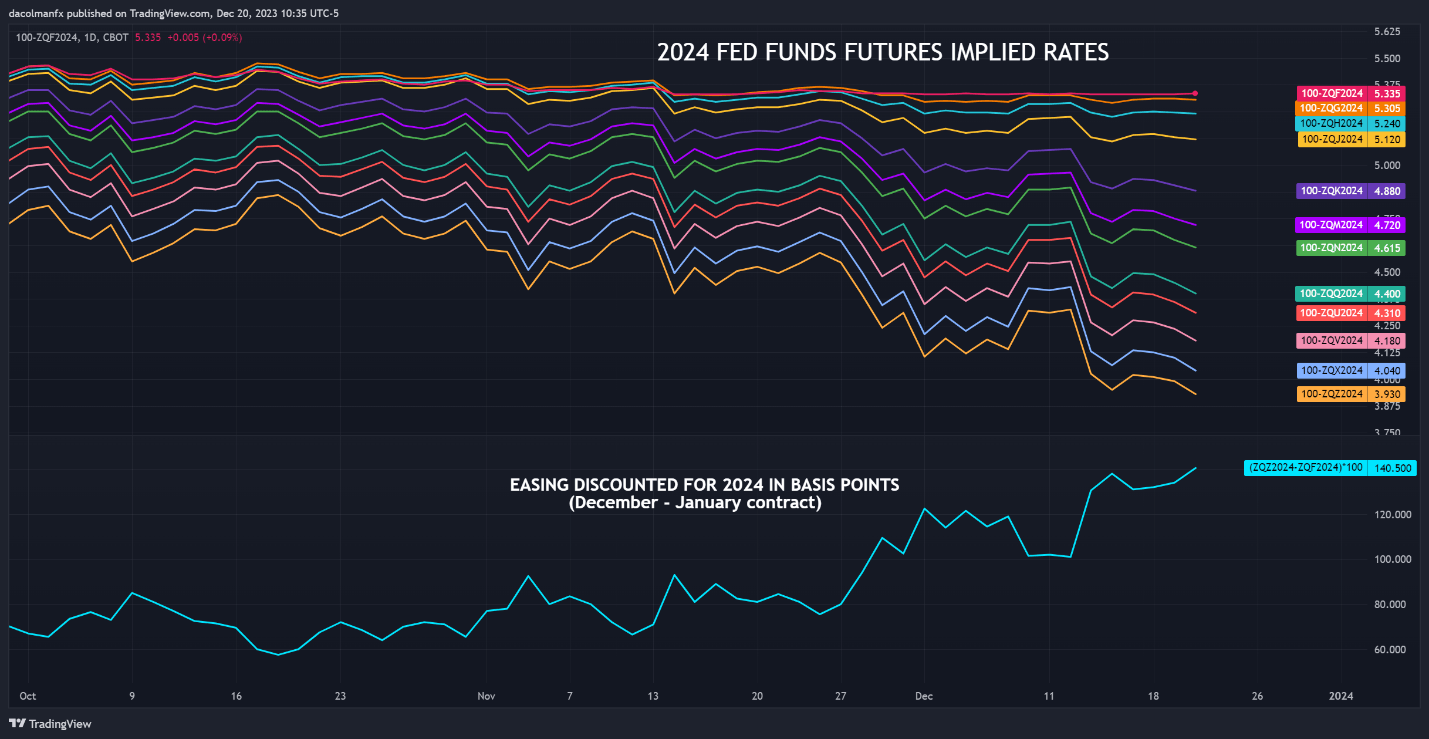

The chart outlines market expectations for monetary policy easing in 2024.

Looking for new strategies for 2024? Explore the top trading ideas developed by DailyFX’s team of experts

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

2024 Fed Funds Futures Implied Yields by Monthly Contracts

Source: TradingView, Chart Created by Diego Colman

Winds May Shift in Favor of US Dollar Late in Q1

As the transition from Q1 to Q2 approaches, traders may finally grapple with the realization that the Fed won’t have the flexibility to cut rates as aggressively as once discounted. Adjusting to a new reality and shifting market assumptions, U.S. yields could stage a moderate comeback, fostering optimal conditions for the U.S. dollar to rebound more sustainably against its major peers.