Personal Finance

24/7 Insights

One of the main takeaways from consistently reading the r/ChubbyFIRE subreddit is that once you get into your 50s, all eyes are on retirement. Knowing you are so close, especially when you have millions in assets and home equity, helps you believe you can leave the workforce right now.

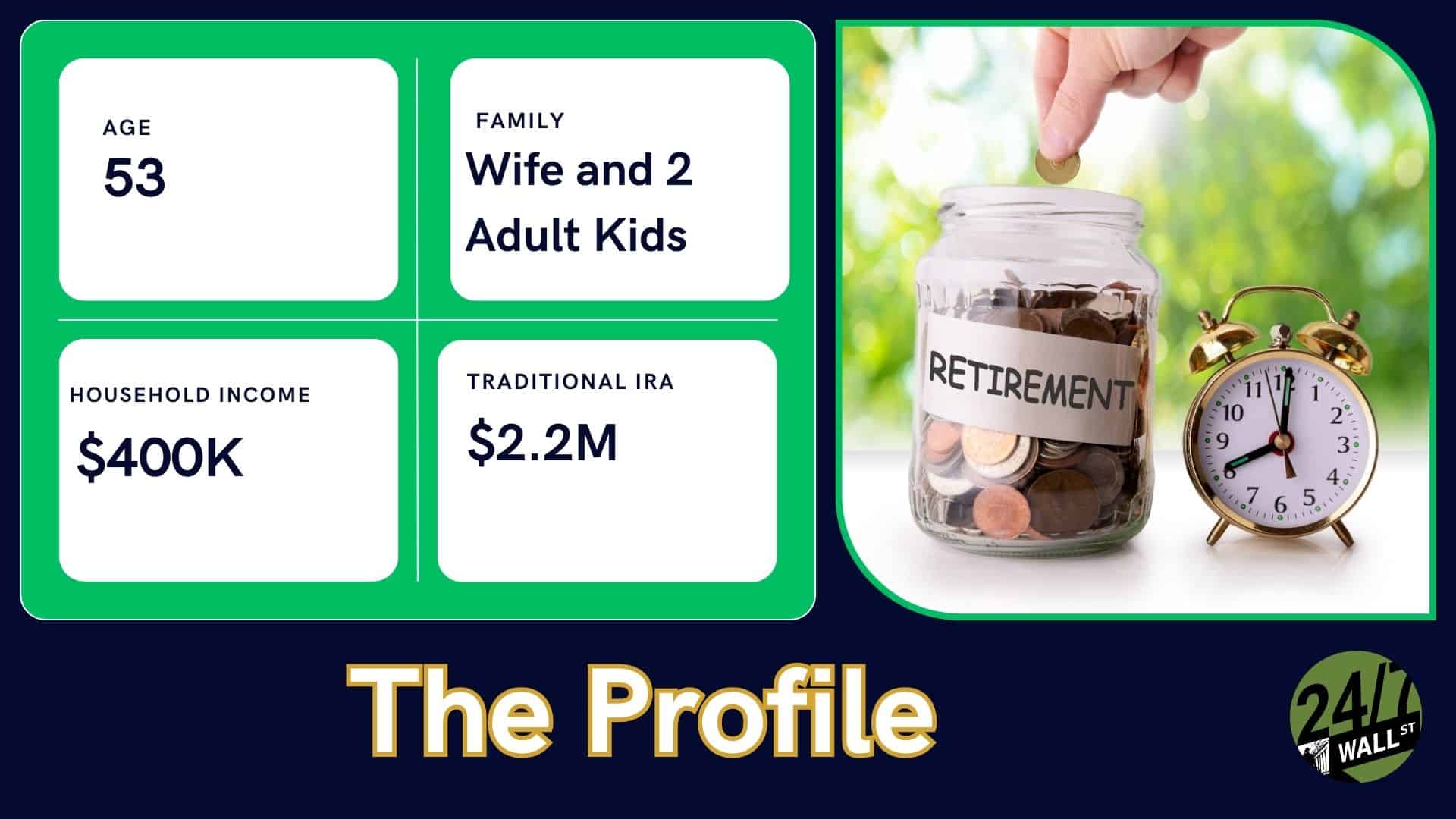

This is exactly the case for this 53-year-old male Redditor, who is asking whether he, too, is ready to leave the employment world. With grown children, two homes, and an older spouse, the consideration of whether or not it is finally time is very real.

I love this post because it’s where everyone hopes to be when they cross the 50-year-old mark.

The Scenario

We are looking at what the Redditor wrote in his post as we learned he is a 53-year-old male married to a 57-year-old female. They have two kids, ages 25 and 21. The oldest is already out of college, and the second one will finish in December 2025. An existing 529 account covers the youngest’s remaining tuition and school needs.

The family earns around $400,000 in annual income and owns two homes. One home is valued at around $700,000 with a $330,000 outstanding mortgage, and the other is valued at around $300,000 with no mortgage. The family plans to move into the first home, an MCOL (medium cost of living), while the youngest is in school and then move to the lower cost of living home.

Regarding assets, the family has $700,000 in cash, earning around 5% annually spread between CDs and high-yield savings accounts. They also have $2.2 million in a traditional IRA, around $350,000 in a Roth IRA, and $70,000 in an HSA. They estimate their current net worth to be around $3.3 million, with no debt outside of the mortgage on the MCOL home.

Interestingly, our Redditor estimates they could comfortably live at $175,000 per year in the MCOL home and with $140,000 when they move into the second home.

The Recommendation

Keeping in mind that I am not a financial advisor, what we are getting is that the Redditor thinks he is close to being able to give up work. However, he’s considering working another three to four years if that would provide extra cushion.

My immediate concern aligns with the first commenter responding to this post. The asset value doesn’t enable the Redditor to hit his desired annual living number. Even at a modest 4% interest earning on $3.3 million, it’s only $132,000. The problem is that over 20% of the family’s money is in cash, which means they aren’t earning any interest.

So, the first move here should be to reduce the amount of available cash and put it into the market. While he has already missed out on some returns, if the cash gets invested now, the family could start earning over the next few years. This said, I don’t see a scenario in which 2025 retirement is likely.

While a true financial advisor can help create a detailed plan, my reading on this scenario is that another few years of working is the best case. Some Redditors believe at least one more year is necessary, but it’s more likely that at least two to three more years of earning and investing will get him where he wants to be.

The Takeaway

Ultimately, the Redditor’s question of whether he is ready to leave work is almost universally no. There’s pretty strong agreement on this in the comment section as well. However, this isn’t to say he isn’t close, but there has to be some quick action with the cash.

Ideally, I’d recommend another 2-3 years in the workforce, which would take him to around 55 and the wife to 59. At this point, the wife is close to starting to draw Social Security early if they need additional cash flow, and the husband isn’t too far away. Assuming the annual income has been historically steady, they are looking at the maximum Social Security payout, which will pad their cost of living.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.