– by New Deal democrat

Today’s CPI report for October generally showed stable monthly increases, but slight increases in YoY comparisons. But as usual, it was almost all about the usual culprit of shelter, as more fully parsed below; to wit:

– Headline CPI increased 0.2% for the month, the fourth month in a row of such an increase. The YoY% change slightly accelerated to 2.6%, just above last month’s 2.4% which was the best showing since February of 2021.

– On a 3 month annualized basis, prices are increasing 2.4%. On a 6 month annualized basis, they are only increasing 1.4%.

– energy inflation remains non-existent, with prices unchanged for the month and down -4.8% YoY.

– excluding shelter, prices also increased 0.2%, and were up 1.3% YoY, the 18th month in a row the YoY change has been below 2.5%.

– shelter inflation, after being up only 0.2% one month ago, increased 0.4% again this month, which cause the YoY% increase to rise 0.1% from 4.8%, the lowest YoY increase since February 2022, to 4.9%.

– core inflation remained slightly elevated, up 0.3% for the month and 3.3% YoY, the same YoY increase as last month.

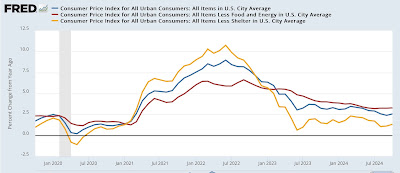

Let’s break this down graphically to better show the trends.

Here are headline (blue), core (red), and ex-shelter (gold) inflation YoY:

Yet again, the only reason for the Fed not to treat inflation as well within its target zone is shelter.

If there is a fly in the ointment, it is that the deceleration in shelter inflation (blue in the graph below) appears to be slowing down. Here is the update vs. the YoY% change in the FHFA Index YoY (red):

Now let’s take a look at the former and remaining problem children.

The former problem child of new (dark blue) vehicle prices were unchanged this month and are down -1.3% YoY. Used (light blue) vehicle prices rose 2.7% and are down -3.4% YoY (shown as the change since right before the pandemic, below). It appears that the decline in used vehicle prices is over. I also show average hourly nonsupervisory wages (red) for comparison, showing that wage growth has outpaced new vehicle prices; although with this month’s increase it is the same as used vehicle prices:

As to the remaining problem children; first, electricity (gold) increased 1.2% for the month, and accelerated YoY to 4.5%. Food away from home (blue) increased 0.2% again, and is up 3.8% YoY. Finally, transportation services including vehicle maintenance, repair, and insurance (red) increased 0.4%, and is up 8.2% YoY:

Although I haven’t shown it above, food at home only increased 0.1% monthly, and is up 1.1% YoY. So much for grocery price inflation! Also, as I have previously pointed out, transportation services inflation is a typical delayed reaction to the previous big increase in vehicle prices. The one issue I have no insight into is why electricity prices are rising so much.

Also, medical care services, which increased 0.7% last month and was up 3.6% YoY, this month increased 0.4%, causing the YoY comparison to decrease to 3.8% YoY:

Finally, the CPI release allows me to update several important wage metrics.

First, real average hourly wages increased 0.2% for the month, and are up 1.5% YoY:

Second, real aggregate nonsupervisory payrolls declined -0.2%:

A one month decline in this metric is not terribly concerning, especially considering that nominally aggregate payrolls were severely impacted by the hurricanes last month. Remember that there has *never* been a recession without real aggregate payrolls turning down first.

In sum, this month’s inflation report was a little “hotter” than last months. The renewed increase in shelter is unwelcome. In the bigger scheme of things, it was one of the more tame reports in the last three years. It does not necessarily suggest any change in the generally decelerating trend of inflation.

As usual, it is almost *all* about shelter.