The Reserve Bank of New Zealand (RBNZ) cut its Official Cash Rate (OCR) by 50 basis points from 4.75% to 4.25% in November, marking its second consecutive 50bps rate cut after October’s surprise move.

In its statement, RBNZ noted that inflation has returned within its target band, with annual consumer price inflation falling to 2.2% in Q3 2024.

The central bank particularly noted the sharp decline in tradables inflation to -1.6%, while emphasizing that non-tradables inflation still needs to decline further to sustainably meet their inflation target.

Link to RBNZ’s November 2024 policy statement

RBNZ members were concerned about continued weakness in domestic economic activity. The central bank estimates that GDP contracted by 0.2% in Q3 2024, with ongoing weakness in:

- Consumer spending and business investment

- Labor market conditions, with unemployment rising to 4.8% in Q3

- Net immigration flows, which continue to slow

- Credit demand, which remains subdued despite lower interest rates

Meanwhile, RBNZ’s November projections also supported the members’ dovish stance:

- GDP to resume modest growth in Q4 2024, with above-potential growth beginning in 2025

- Unemployment rate expected to peak at 5.2% in early 2025 before gradually declining

- Annual inflation to reach 2.1% by end-2024 and stabilize around 2% by 2026

- OCR projected to decline to 4.6% by end-2024, falling further to 3.7% by end-2025 and ultimately reaching 3.1% by late 2027

Link to RBNZ’s November 2024 economic outlook

In his presser, RBNZ Governor Adrian Orr noted that while they had considered various options, the Committee agreed that a 50bps cut was appropriate to maintain price stability while avoiding unnecessary economic instability.

He also described the move as consistent with their mandate and said they were confident about inflation converging to target.

Link to RBNZ’s November 2024 press conference

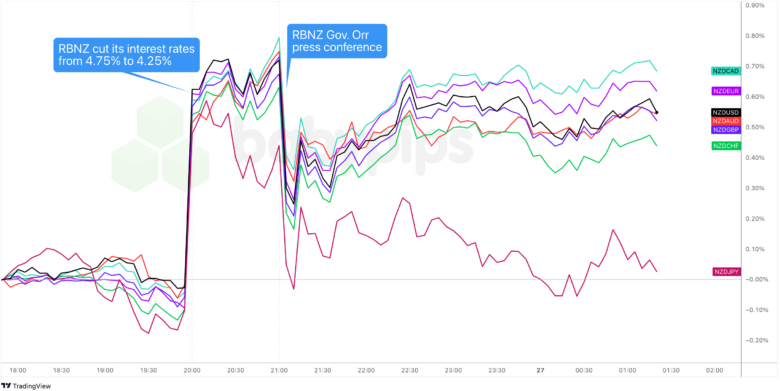

New Zealand dollar vs. Major Currencies: 5-min

Overlay of NZD vs. Major Currencies Chart by TradingView

The New Zealand dollar edged lower ahead of the RBNZ event, with some of the pressure coming from uncertainty around Trump’s potential tariffs.

Kiwi spiked after the RBNZ surprised markets with a 50bps rate cut. It looks like a classic case of “sell the rumor, buy the news,” with the risk-sensitive currency catching a lift.

But the rally didn’t last long. RBNZ Governor Orr doubled down on the 50bps cut, defending it and hinting at more aggressive easing as soon as February. During the press conference, NZD took a sharp dive but managed to claw back some of its losses—though it stayed shaky against the Japanese yen.

A few hours later, the Kiwi is holding gains against most currencies but is still struggling to find its footing against the yen