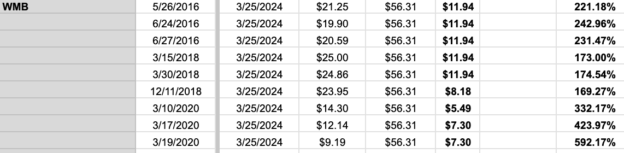

This is another one…. continues to plow ahead. Here are our results:

One gripe? We need a dividend increase to greater than the $1.90 now

Results:

Williams Delivers Record Third-Quarter Results Driven by Continued Strength of Base BusinessTULSA, Okla. – Williams (NYSE: WMB) today announced its unaudited financial results for the three and nine months ended Sept. 30, 2024.Demonstrated track record of year-over-year financial gains•GAAP net income of $705 million, or $0.58 per diluted share (EPS) – up 8% vs. 3Q 2023•Adjusted net income of $528 million, or $0.43 per diluted share (Adj. EPS)•Record 3Q Adjusted EBITDA of $1.703 billion – up $51 million or 3% vs. 3Q 2023•Cash flow from operations (CFFO) of $1.243 billion•Available funds from operations (AFFO) of $1.286 billion – up $56 million or 5% vs. 3Q 2023•Dividend coverage ratio of 2.22x (AFFO basis)•Increased midpoint for full-year 2024 guidance by $125 million to $7.075 billion Adjusted EBITDAProven project execution continues to deliver long-term, stable growth•Placed Transco’s Regional Energy Access into full service ahead of schedule on Aug. 1•Placed MountainWest’s Uinta Basin expansion in-service•Placed portion of Transco’s Southside Reliability Enhancement in-service•Placed Anchor in-service and completed construction on Whale in Deepwater Gulf of Mexico•Began construction on Transco’s Commonwealth Energy Connector•Obtained favorable rulings and began construction on Louisiana Energy Gateway project•Began construction on two solar projects in the Northeast and signed commercial agreements with Florida utility fully subscribing large-scale Lakeland Solar projectCaptured new, high-return growth projects across footprint•Received FERC certificate for MountainWest Overthrust Westbound expansion•Filed FERC application for Transco’s ~1.6 Bcf/d Southeast Supply Enhancement project•Executed agreement on Transco’s Dalton Lateral Expansion II•Executed agreements on three new expansions on Northwest Pipeline, totaling ~260 MMcf/d of firm capacityCEO PerspectiveAlan Armstrong, president and chief executive officer, made the following comments:“Williams delivered another quarter of impressive financial results, with Adjusted EBITDA hitting a third quarter record of $1.7 billion, up 3 percent over third quarter 2023, driven primarily by our natural gas transmission expansions and Gulf Coast storage acquisition. We’ve exceeded financial expectations each quarter this year, and our crisp execution along with our core business strength gives us the confidence to raise our 2024 Adjusted EBITDA guidance midpoint by $125 million to $7.075 billion.“Our teams continue to excel in executing large-scale expansion projects to serve growing natural gas demand for residential, commercial and industrial use. In addition to placing Transco’s Regional Energy Access in service ahead of schedule, we also brought online an expansion to MountainWest as well as a portion of Transco’s Southside Reliability Enhancement. Construction is underway on the Louisiana Energy Gateway project as well as Transco’s Commonwealth Energy Connector. In the Deepwater Gulf of Mexico, we commissioned our large-scale facilities to receive production from both Chevron’s Anchor field in August and Shell’s Whale field as they ramp up production in the fourth quarter.“Not only do we have a clear line of sight to a full roster of projects in execution, but we continue to commercialize vital, high-return projects across our footprint. We executed a precedent agreement on another expansion to the Transco Dalton Lateral driven by load growth from data center demand and industrial re-shoring in the Atlanta area. In the Rockies and Northwest, we entered into new binding agreements for three separate natural gas transmission expansions to serve power and load growth, including a large coal-to-gas power plant conversion. In addition, we filed the FERC application for Transco’s Southeast Supply Enhancement project, a 1.6 Bcf/d expansion to meet growing residential, commercial and industrial demand in cities across the Mid-Atlantic and Southeast.Armstrong added, “All this activity underscores the accelerating demand for natural gas transmission capacity in the United States, particularly in the growing regions where we operate. As the most natural gas-centric energy infrastructure provider with access to the most prolific U.S. basins, Williams is the best positioned to serve steadily increasing domestic needs for clean and affordable energy, while also helping unlock vast U.S. reserves for the global market.”

Williams Summary Financial Information 3Q Year to Date Amounts in millions, except ratios and per-share amounts. Per share amounts are reported on a diluted basis. Net income amounts are from continuing operations attributable to The Williams Companies, Inc. available to common stockholders. 2024 2023 2024 2023 GAAP Measures Net Income $705 $654 $1,737 $2,127 Net Income Per Share $0.58 $0.54 $1.42 $1.74 Cash Flow From Operations $1,243 $1,234 $3,756 $4,125 Non-GAAP Measures (1) Adjusted EBITDA $1,703 $1,652 $5,304 $5,058 Adjusted Net Income $528 $547 $1,768 $1,746 Adjusted Earnings Per Share $0.43 $0.45 $1.45 $1.43 Available Funds from Operations $1,286 $1,230 $4,043 $3,890 Dividend Coverage Ratio 2.22 x 2.26 x 2.33 x 2.38 x Other Debt-to-Adjusted EBITDA at Quarter End (2) 3.75 x 3.45 x Capital Investments (Excluding Acquisitions) (3) (4) $720 $805 $1,946 $2,045 (4) Third-quarter and year-to-date 2024 capital excludes $151 million for the consolidation of our Discovery JV, which closed in August 2024. Year-to-date 2024 capital also excludes $1.844 billion for the acquisition of the Gulf Coast storage assets, which closed January 2024. Third-quarter and year-to-date 2023 capital excludes ($29) million and $1.024 billion, respectively, for the acquisition of MountainWest Pipeline Holding Company, which closed February 2023. GAAP MeasuresThird-quarter 2024 net income increased by $51 million compared to the prior year reflecting $141 million of higher service revenues driven by acquisitions and expansion projects, partially offset by higher net interest expense from recent debt issuances and retirements, higher operating costs, depreciation and interest expense resulting from recent acquisitions, and lower net realized product sales from upstream operations. Third-quarter 2024 gains of $149 million from the sale of our interests in Aux Sable and $127 million associated with the Discovery Acquisition were partially offset by the absence of a $130 million gain on the sale of the Bayou Ethane system in 2023. The tax provision changed unfavorably primarily due to higher pretax income and the absence of a $25 million benefit in 2023 associated with a decrease in our estimated deferred state income tax rate.Year-to-date 2024 net income decreased by $390 million compared to the prior year reflecting an unfavorable change of $643 million in net unrealized gains/losses on commodity derivatives, higher net interest expense from recent debt issuances and retirements, lower realized hedge gains in the West, and higher operating costs, depreciation and interest expense resulting from recent acquisitions. These unfavorable changes were partially offset by a $441 million increase in service revenues driven by acquisitions and expansion projects, and the net favorable change of $146 million from the previously discussed Aux Sable, Discovery, and Bayou Ethane transactions. The tax provision decreased primarily due to lower pretax income.Third-quarter 2024 cash flow from operations was generally consistent with the prior year, while year-to-date 2024 decreased compared to the prior year primarily due to unfavorable net changes in both working capital and derivative collateral requirements, partially offset by higher operating results exclusive of non-cash items.