In his preview of the next few days, DB’s Jim Reid has some good news for those who feel like it’s already Friday: “It doesn’t feel like its going to be the most exciting week ahead of us” although with earnings season now in full throttle and with a seemingly extremely tight US election just two weeks tomorrow there is undoubtedly plenty to think about and react to.

Having said the election is tight, Reid notes that over the last two weeks the probability markets have been shifting back towards Trump. At the start of October a Republicans sweep was a 28% probability on Polymarket.com but that’s now shifted to a 42% chance. A Democrats sweep has fallen from 21% to 14%.

Outside of the tax and spending implications, Trump last week said that “the most beautiful word in the dictionary is tariff”. So that should have reminded markets that he is serious on this matter if he gets elected. In terms of fiscal, Deutsche Bank economists believe that the deficit will be between around 7 to 9% from 2026-2028 whatever political configuration we have in the White House.

Staying on debt we do have the IMF and World Bank annual meetings in Washington from today and across the rest of the week. There is expected to be a focus on the unsustainability of global debt in these meetings but that is probably more of a medium-term concern rather than anything markets will latch on to this week. There are plenty of central bankers speaking at the various Washington events but in particular watch out for ECB President Lagarde and BoE’s Governor Bailey (both tomorrow). Ahead of that, today sees quite a bit of Fedspeak. There is also the BRICS summit held in Kazan, Russia from tomorrow to Thursday hosted by Putin. China’s President Xi and India’s Prime Minister Modi are expected to attend.

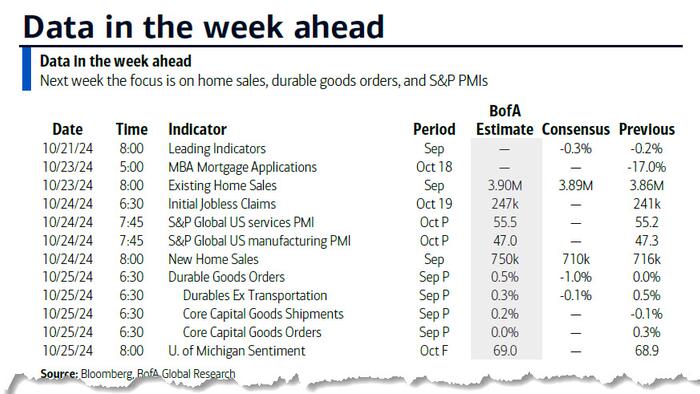

In terms of data, the main highlight is probably the round of global flash PMIs (Thursday). Walking through the data day-by-day, the other highlights are German PPI, French retail sales and the US leading index today, the US Phili Fed tomorrow, US existing home sales, the Beige book, Eurozone consumer confidence and the Bank of Canada meeting on Wednesday, US initial jobless claims on Thursday, and US durable goods, Tokyo CPI, and the German Ifo on Friday. Recent strikes and storms will likely distort US claims and durable goods so it will be tough to get a clean data read at the moment. The Beige book may give us a bit more insight into current economic momentum.

In corporate earnings, the main highlights are SAP (today), Texas Instruments, GE, and GM (tomorrow), and Tesla, IBM, and Boeing (Wednesday). We list others in the day-by-day calendar at the end.

Courtesy of DB, here is a Day-by-day calendar of events

Monday October 21

- Data: US September leading index, China 1-yr and 5-yr loan prime rates, Germany September PPI, France September retail sales

- Central banks: Fed’s Logan, Kashkari and Schmid speak, ECB’s Simkus speaks

- Earnings: SAP

Tuesday October 22

- Data: US October Philadelphia Fed non-manufacturing activity, Richmond Fed manufacturing index, business conditions, UK September public finances, EU27 September new car registrations, Canada September industrial product price index, raw materials price index

- Central banks: Fed’s Harker speaks, ECB’s Centeno, Knot, Holzmann, Villeroy and Rehn speak, BoE’s Bailey, Greene and Breeden speak

- Earnings: General Electric, Danaher, Texas Instruments, Philip Morris, Verizon, RTX, Lockheed Martin, Fiserv, Moody’s, Freeport-McMoRan, General Motors, Deutsche Boerse

Wednesday October 23

- Data: US September existing home sales, Eurozone October consumer confidence

- Central banks: Fed’s Beige Book, Bowman and Barkin speak, BoC decision, ECB’s Lagarde, Lane, Cipollone, Escriva, Knot and Centeno speak, BoE’s Bailey and Breeden speak

- Earnings: Tesla, Coca-Cola, T-Mobile US, Thermo Fisher Scientific, IBM, ServiceNow, NextEra Energy, AT&T, Boston Scientific, Lam Research, Iberdrola, Boeing, Atlas Copco, Amphenol, CME, GE Vernova, Newmont, Hilton, Heineken

- Auctions: US 20-yr Bond (reopening, $13bn)

Thursday October 24

- Data: US, UK, Japan, Germany, France and Eurozone October flash PMIs, US September Chicago Fed national activity index, new home sales, October Kansas City Fed manufacturing activity, initial jobless claims, France October manufacturing confidence

- Central banks: Fed’s Hammack speaks, ECB’s Kazaks and Lane speak, BoE’s Mann speaks

- Earnings: S&P Global, Union Pacific, Honeywell, KKR, UPS, SK Hynix, Equinor, Dassault Systemes, Keurig Dr Pepper, Nasdaq, Dow, Evolution AB, Neste Oyj, Norsk Hydro

- Auctions: US 5-yr TIPS ($24bn)

Friday October 25

- Data: US September durable goods orders, October Kansas City Fed services activity, UK October GfK consumer confidence, Japan October Tokyo CPI, September PPI services, Germany October Ifo survey, France October consumer confidence, Q3 total job seekers, Italy October consumer confidence index, manufacturing confidence, economic sentiment, Eurozone September M3, Canada August retail sales

- Central banks: ECB consumer expectations survey

- Earnings: Sanofi, HCA Healthcare, Colgate-Palmolive, Mercedes-Benz, Eni, Sika, Centene

* * *

Finally, turning to the US, Goldman writes that the key economic data release this week is the durable goods report on Friday. There are several speaking engagements from Fed officials this week.

Monday, October 21

- There are no major economic data releases scheduled.

- 08:55 AM Dallas Fed President Logan (FOMC non-voter) speaks: Dallas Fed President Lorie Logan will deliver remarks at the 2024 Securities Industry and Financial Markets Association (SIFMA) Annual Meeting. Text and moderated Q&A are expected.

- 01:00 PM Minneapolis Fed President Kashkari (FOMC non-voter) speaks: Minneapolis Fed President Neel Kashkari will take part in a townhall hosted by the Chippewa Falls Chamber of Commerce in Wisconsin. Audience and moderated Q&A are expected. On October 14th, Kashkari noted that “further modest reductions” in the fed funds rate were likely appropriate in coming quarters. Kashkari also said that “a rapid labor weakening does not appear to be imminent” and stressed that “the path ahead for policy will be driven by the actual economic, inflation, and labor market data.”

- 05:05 PM Kansas City Fed President Schmid (FOMC non-voter) speaks: Kansas City Fed President Jeffrey Schmid will deliver remarks on the economic and monetary policy outlook to the Chartered Financial Analyst (CFA) Society in Kansas City. Text and audience Q&A are expected.

- 06:40 PM San Francisco Fed President Daly (FOMC voter) speaks: San Francisco Fed President Mary Daly will take part in a moderated discussion at a Wall Street Journal Live event in California. Moderated and audience Q&A are expected. On October 15th, Daly said that “one or two cuts [this year] was a reasonable” baseline if the economy performs as expected and noted that “it’s clear … the direction of change is down.”

Tuesday, October 22

- 10:00 AM Richmond Fed manufacturing index, October (consensus -17, last -21)

- 10:00 AM Philadelphia Fed President Harker (FOMC non-voter) speaks: Philadelphia Fed President Patrick Harker will speak at the 8th Annual Fintech Conference, hosted by the Philly Fed. Text is expected.

Wednesday, October 23

- 09:00 AM Fed Governor Bowman speaks: Fed Governor Michelle Bowman will deliver opening remarks at the Philly Fed’s Fintech Conference.

- 10:00 AM Existing home sales, September (GS +2.1%, consensus +1.0%, last -2.5%)

- 12:00 PM Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Thomas Barkin will deliver a speech about community colleges at the 2024 Virginia Education and Workforce Conference. Text is expected. On October 10th, Barkin noted that, while he “wouldn’t declare victory” on inflation, he thought it was “definitely headed in the right direction.” Barkin said that the FOMC’s 50bp cut in September was “a recalibration toward a somewhat less restrictive stance” and noted that he “didn’t have a lot of heartburn about whether you got there in three steps or four steps or two and then one.” Barkin noted that the recent labor market data “confirms what I’m hearing … We’re in a low hiring, low firing environment.”

- 02:00 PM Beige Book, November meeting period

Thursday, October 24

- 08:30 AM Initial jobless claims, week ended October 19 (GS 245k, consensus 240k, last 241k); Continuing jobless claims, week ended October 12 (consensus 1,876k, last 1,867k): We estimate that initial claims increased to 245k in the week ended October 19th, reflecting a 5-10k incremental boost from hurricane-related filings on the back of Hurricane Milton but a slight headwind from residual seasonality.

- 08:45 AM Cleveland Fed President Hammack (FOMC non-voter) speaks: Cleveland Fed President Beth Hammack will deliver welcoming remarks at an event hosted by the Cleveland Fed’s Center for Inflation Research.

- 09:45 AM S&P Global US manufacturing PMI, October preliminary (consensus 47.5, last 47.2); S&P Global US services PMI, October preliminary (consensus 55.0, last 55.2)

- 10:00 AM New home sales, September (GS -0.5%, consensus +0.6%, last -4.7%)

- 11:00 AM Kansas City Fed manufacturing index, October (consensus -5, last -8)

Friday, October 25

- 08:30 AM Durable goods orders, September preliminary (GS -2.0%, consensus -1.0%, last flat); Durable goods orders ex-transportation, September preliminary (GS +0.1%, consensus -0.1%, last +0.5%); Core capital goods orders, September preliminary (GS +0.1%, consensus +0.1%, last +0.3%); Core capital goods shipments, September preliminary (GS +0.1%, consensus flat, last -0.1%): We estimate that durable goods orders declined 2.0% in the preliminary September report (month-over-month, seasonally adjusted), reflecting a decline in commercial aircraft orders. We forecast 0.1% increases in core capital goods orders and shipments, reflecting mixed global manufacturing data.

- 10:00 AM University of Michigan consumer sentiment, October final (GS 68.8, consensus 69.5, last 68.9): University of Michigan 5-10-year inflation expectations, October final (GS 3.1%, last 3.0%)

Source: DB, Goldman

Loading…