Some people out there want to beat the market.

As a result, many try different things, in order to achieve their goals and objectives.

One of these things they try centers around concentrating portfolios.

The book “The Warren Buffett Portfolio” has some interesting stats on the subject.

They isolated 1200 companies that displayed measurable data, including revenues, earnings, and ROE from 1979 through 1986.

Then they asked the computer to randomly assemble, from these 1200 companies, 12000 portfolios of various sizes.

The portfolios were equally weighted.

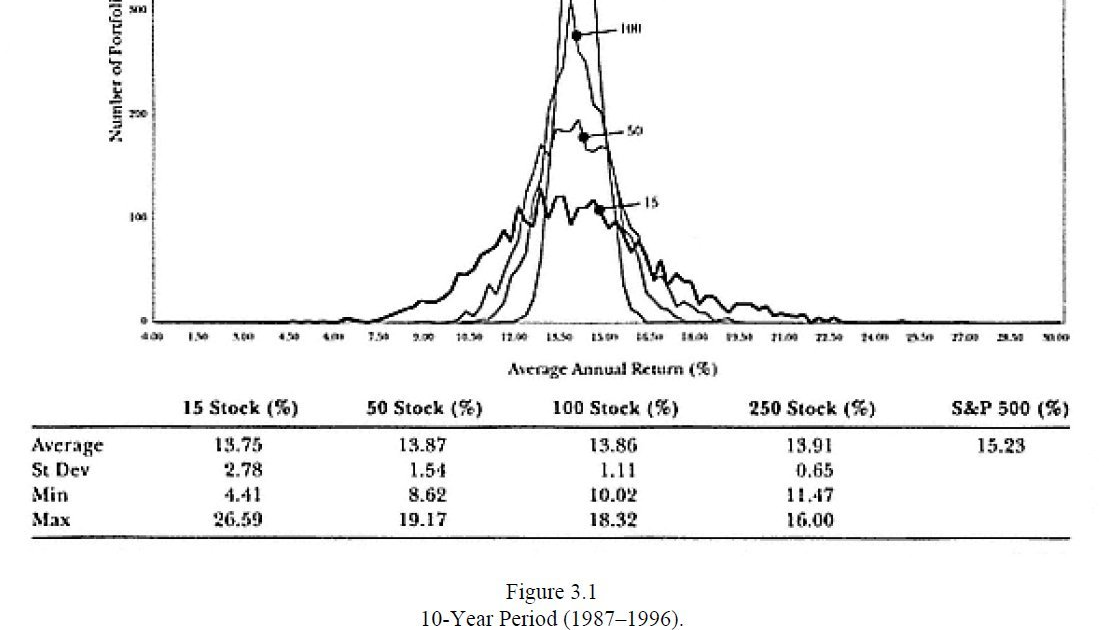

They had the following portfolios for which they calculated 10 and 18 year returns:

1. 3,000 portfolios containing 250 stocks

2. 3,000 portfolios containing 100 stocks

3. 3,000 portfolios containing 50 stocks

4. 3,000 portfolios containing 15 stocks

Here’s what they found:

1. For the 250-stock portfolios the best return was 16% and the worst was 11.4%

2. For the 100-stock portfolios the best return was 18.3% and the worst was 10.0%

3. For the 50-stock portfolios the best return was 26.6% and the worst was 8.6%

4. For the 15-stock portfolios the best return was 26.6% and the worst was 4.4%

These were the focus portfolios in the study, and only in this group were the best returns substantially

higher than the S&P 500.

For 18 year periods, findings were along a similar line

These results lead to two inescapable conclusions:

1. You have a much higher chance of doing better than the market with a focus portfolio.

2. You also have a much higher chance of doing worse than the market with a focus portfolio.

The following data supports the conclusions above

• Out of 3000 15-stock portfolios, 808 beat the market

• Out of 3,000 50-stock portfolios, 549 beat the market

• Out of 3000 100-stock portfolios, 337 beat the market

• Out of 3000 250-stock portfolios, 63 beat the market

There is no free lunch in investing of course. When you take a risk, you may do very well, but you may also do worse than expected as well.

In other words, if you concentrate in good companies, you can do very well. But, if you chose poorly, you’d not do as well

The study does show that you do need to choose companies for your portfolio intelligently

But it does put into perspective the trade-offs experienced by investors who decide to concentrate or diversify.

Where do I stand on the subject?

I believe in wide diversification, limiting initial exposure per company, but letting winners run. This is essentially the Coffee Can Portfolio principle in a nutshell. I am thinking of starting with at least 50 to about 100 companies. I start by investing a certain amount per company that fits my entry criteria and then keep adding to it, for as long as it fits my entry criteria. I do limit how much I would put in a given company at cost to about say 3% of portfolio value. I hold on for as long as possible, until it hits my exit criteria (dividend cut or acquisition). That could happen 1 month after investment or 50 years later. I cut the losers short, but let the winners really run. I do not rebalance or sell because a stock is up. I hold. I have a very low annual portfolio turnover. I start out very diversified, but let the portfolio concentrate on its own.

I am selective about what I invest in however, as the only companies in my portfolio should be the ones that hit my entry criteria. Experience has taught me that I do not know in advance which one of those companies will be the best performer, and which one would be the worst. I do know that a well diversified portfolio should do ok over time, and while the prices will fluctuate, the dividends would be paid on time, and increased too.

I have built my portfolio one company at a time, over time, brick by brick. So those 50 – 100 companies are not bought right away typically. Different companies and industries are available at good prices at different times. Hence, building a well-rounded diversified dividend growth portfolio takes a few years to accomplish. Given that the typical accumulation phase can be a couple of decades, that’s not really a problem.