I invest in Dividend Growth Stocks. These are companies that have managed to increase dividends for many consecutive years in a row.

This is not a small achievement. Out of thousands of companies that are traded in the US, there are about 500 or so that have managed to increase annual dividends every single years for a decade.

In order to get there, a company has to have increased earnings for a while. Getting to a ten year streak of consecutive annual dividend increases is typically an end result to a company with a unique business model, with some solid competitive advantages, which can deploy capital at high rates of return, but cannot deploy all capital at those rates. It ends up gushing a ton of cash, showering shareholders with a rising stream of cashflows.

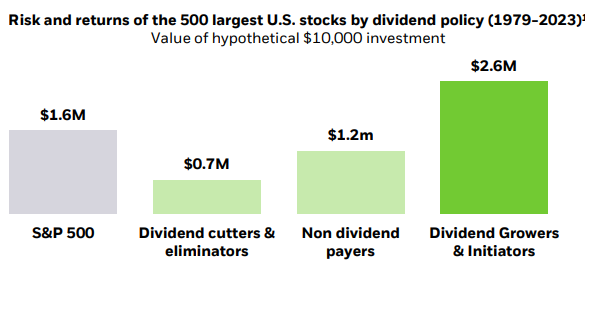

In general, companies that initiate dividends and raise them have tended to do well over time. This study from Blackrock found that dividend growers and initiators did better than dividend cutters & eliminators between 1979 and 2023. Those dividend growers also did better than non dividend payers as well as better than S&P 500.

Of course, our friendly legal department is here to remind us that we need to insert the past performance disclaimer here. Hi Bob.

Anywho, as I mentioned above, I invest in Dividend Growth Stocks.

I review dividend increases as part of my monitoring process. This exercise helps me monitor existing holdings and also to identify new investments for potential research.

I typically focus my attention on the companies that have managed to increase for at least a decade. Over the past week, there were five companies that BOTH managed to increase dividends last week AND also have a ten year track record of increasing dividends. These companies include:

IDACORP, Inc. (IDA) engages in the generation, transmission, distribution, purchase, and sale of electric energy in the United States.

The company increased quarterly dividends by 3.60% to $0.86/share. This is the 13th consecutive annual dividend increase for this dividend achiever. Over the past decade, it has managed to grow dividends at an annualized rate of 7.40%.

Between 2014 and 2023, the company managed to grow earnings from $3.86/share to $5.15/share.

The company is expected to earn $5.39/share in 2024.

The stock sells for 18.97 times forward earnings and has a dividend yield of 3.36%.

Investar Holding Corporation (ISTR) operates as the bank holding company for Investar Bank that provides a range of commercial banking products to individuals, professionals, and small to medium-sized businesses in south Louisiana, southeast Texas, and Alabama in the United States.

The company raised quarterly dividends by 5% to $0.105/share. This is the tenth consecutive annual dividend increase for this newly minted dividend achiever. The company has managed to grow dividends at an annualized rate of 20.80% over the past five years.

Between 2014 and 2023, the company managed to grow earnings from $0.98/share to $1.69/share.

The company is expected to earn $1.49/share in 2024.

The stock sells for 13.20 times forward earnings and has a dividend yield of 2.14%.

JPMorgan Chase & Co. (JPM) operates as a financial services company worldwide. It operates through four segments: Consumer & Community Banking (CCB), Corporate & Investment Bank (CIB), Commercial Banking (CB), and Asset & Wealth Management (AWM).

The company raised quarterly dividends by 8.70% to $1.25/share. This is the 14th consecutive annual dividend increase for this dividend achiever. The company has managed to grow dividends at an annualized rate of 11.50% over the past decade.

Between 2014 and 2023, the company managed to grow earnings from $5.33/share to $16.25/share.

The company is expected to earn $17.60/share in 2024.

The stock sells for 12 times forward earnings and has a dividend yield of 2.37%.

Microsoft Corporation (MSFT) develops and supports software, services, devices and solutions worldwide.

The company raised quarterly dividends by 10.70% to $0.83/share. This is the 20th consecutive annual dividend increase for this dividend achiever.

Over the past decade, it has managed to grow dividends at an annualized rate of 11.10%.

Between 2014 and 2023, the company managed to grow earnings from $1.49/share to $11.86/share.

The company is expected to earn $13.16/share in 2024.

The stock sells for 33 times forward earnings and has a dividend yield of 0.76%.

Texas Instruments Incorporated (TXN) designs, manufactures, and sells semiconductors to electronics designers and manufacturers in the United States and internationally. The company operates through Analog and Embedded Processing segments.

The company increased quarterly dividends by 4.60% to $1.36/share. This is the 21st consecutive annual dividend increase for this dividend achiever. Over the past decade, it has managed to grow dividends at an annualized rate of 16.70%.

Between 2014 and 2023, the company managed to grow earnings from $2.61/share to $7.13/share.

The company is expected to earn $5.29/share in 2024.

The stock sells for 38.45 times forward earnings and has a dividend yield of 2.67%.

Relevant Articles: