How to Successfully Pass a Funding Account: A Step-by-Step Guide.

I. Introduction: Nowadays, proprietary trading (prop trading) is a lucrative opportunity for professional traders to trade other companies’ funds. However, obtaining these funds requires a better understanding of the market and a good risk management strategy. If you have a good trading strategy that ensures low risk and high reward, you can easily pass the evaluation and get funded quickly. In this way, our signal followers get funded accounts. Now it is your turn!

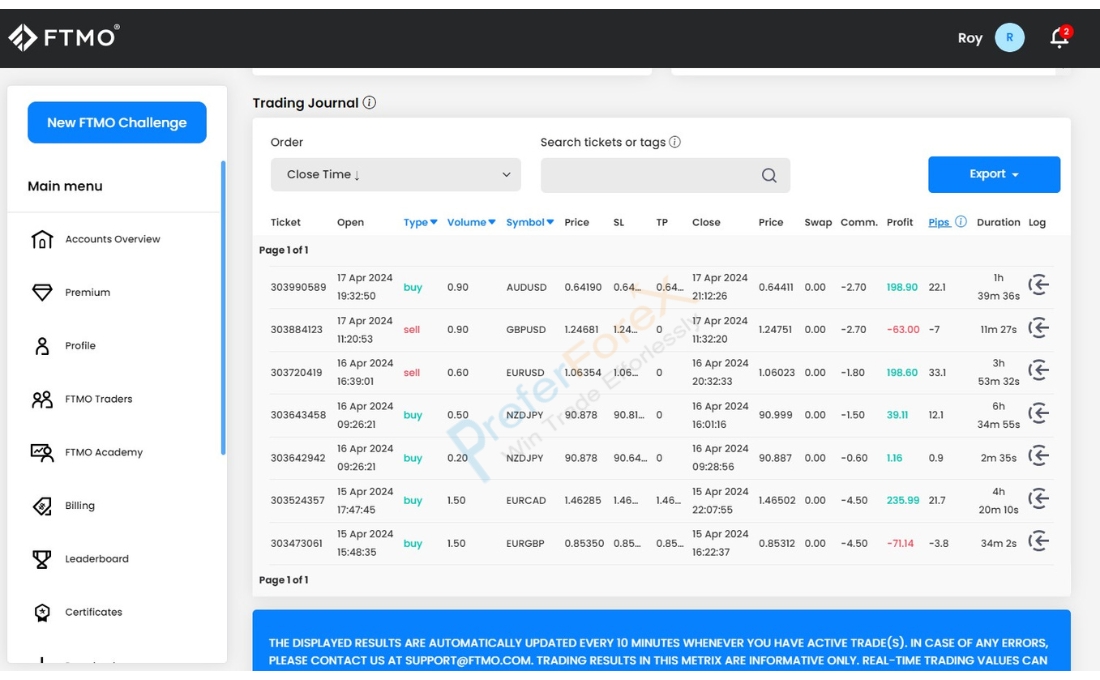

This article will discuss the necessary rules and strategies to help you pass the prop firm evaluation with only 5-7 trades in 2-3 days. The first rule is a minimum of 2 days of trading and the maximum is unlimited days 1 month 2 months or even a year but we took only 3 days The maximum daily loss limit is 5% which is $500 for a 10K account. You can see here our loss is only 118.28 which is around 1% loss. Here is the account screenshot:

Explanation of funding accounts

Funding accounts, such as those provided by FTMO, offer a unique opportunity for traders to access capital and trade the financial markets. FTMO, for instance, provides funding accounts to traders who pass their evaluation process, allowing them to trade with the company’s capital and retain a share of the profits. These funding accounts typically come with specific trading objectives and risk parameters that traders must adhere to, and they often offer a profit split arrangement where traders can keep a portion of the profits generated. Additionally, funding accounts from FTMO and similar providers may include risk management tools, performance tracking, and ongoing support to help traders succeed in their trading endeavors. Overall, funding accounts like those offered by FTMO serve as a platform for aspiring traders to access funding, gain valuable experience, and potentially grow their trading careers.

Importance of passing funding accounts successfully

Successfully passing funding accounts holds significant importance for traders, as it represents a gateway to accessing substantial capital and leveraging it for trading activities. By meeting the requirements and showing proficiency in trading, individuals can gain access to the funded account of up to 1 million dollars for some prop firms. Moreover, passing funding accounts successfully can validate one’s trading skills and discipline, potentially opening doors to further career advancement and collaborations with financial institutions. Additionally, it allows traders to operate with a larger capital base, enabling them to diversify their trading strategies, manage risk more effectively, and potentially achieve higher returns. Ultimately, the successful passage of funding accounts can be said to be financial freedom.

The Few Good Habite for Prop firm pass successfully

For traders aiming to prove their skills and access significant capital, FTMO’s funded account program offers a unique opportunity. However, successfully passing the evaluation phase requires more than just trading proficiency; it demands a strategic approach. In this guide, we’ll teach you effective strategies tailored for the prop firm evaluation process. Whether you’re a seasoned trader or just starting, understanding these strategies can significantly increase your chances of passing the evaluation and securing funding.

Note The following Points

- Risk Management: Prioritize risk management above all else. Prop firm evaluates not just your profitability but also how well you manage risk. This means keeping your risk per trade within specified limits, usually around 1-2% of your trading capital. Utilize stop-loss orders effectively to limit potential losses, and ensure your risk-reward ratio is favorable.

- Consistency Over High Returns: While high returns may seem appealing, consistency is key to passing funded trader evaluations. Aim for stable, consistent returns rather than volatile, high-risk trades. Prop trading typically prefers traders who can demonstrate steady profitability over time, even if the returns are moderate.

- Trade Selection: Be selective in choosing your trades. Focus on setups that have a high probability of success and fit within FTMO’s evaluation criteria. Avoid overtrading or trading on impulse. Quality over quantity is essential.

- Journaling and Analysis: Keep a detailed trading journal to track your trades, analyze your performance, and identify areas for improvement. Reflect on your trades regularly to learn from both successes and failures. This self-analysis will help you refine your strategy and adapt to market conditions.

- Psychological Discipline: Maintain emotional discipline throughout the evaluation process. Trading can be mentally challenging, especially under pressure. Stick to your trading plan, avoid revenge trading, and manage your emotions effectively. Psychological resilience is crucial for enduring the evaluation period.

How You can pass FTMO or other Prop Evaluation Easily

We are showing details of an account that took us 3 days to pass, with 7 trades. trades are as follows – the main features of those trades are high-profit targets and very tight stop loss. So to get this kind of entry one needs to practice for years. It needs at least double reward than risk. But it is rare to find such signal providers online all can give signals but when you check the risk-reward sometimes we notice they offer signals that stop loss is bigger than the target that never works. In this account, we executed 7 trades 2 losses 5 wins but in the below, you can see the trading journal that small are very small why? Because entry was highly probable as per our trading method you can access one of our direct entry methods in this free smart money master class here the link https://preferforex.com/forex-mentorship/

The Trading History Overview

Out of 6 trades, 4 are profits and 2 are small losses, because of our secured entries methods. You can learn the same entry methods in our training program. Join the Master Class Here

The first one is a losing trade with a 0.7% loss then 2nd one is 235$ which is more than 2% profit from a single trade The 3rd one is a small profit of 0.4% we closed this trade early. The 4th one is around 2% profit The 5th trade is a loss of 0.6% And the final trade is around 2% profit, As you can see our profit is more than 2 times higher than the loss. Risk Reward is more than 2:1.

So we made an overall 5.2% profit and the target has been achieved. From this discussion so per you got the point that the importance of secure entry and maintaining risk reward is how crucial to being a successful prop trader. If you can ensure this you can trade other funds. To get some ideas about our strategy please join the master class.