US Dollar Slips After US Durable Goods, Jobs Data, US Q1 GDP Meets Forecasts

- US Q1 GDP grows by 1.4%, as expected.

- Durable goods revisions and US continuing jobless data soften the US dollar.

For all high impact data and event releases, see the real-time DailyFX Economic Calendar

The US dollar index slipped lower after the latest batch of US data showed economic activity slowing down. The final Q1 US GDP figure came in as forecast at 1.4%, while the May Durable Goods release came in slightly better-than-expected at 0.1% vs forecasts of -0.1%. However, the April monthly figure was downgraded from an original 0.7% to 0.2%.

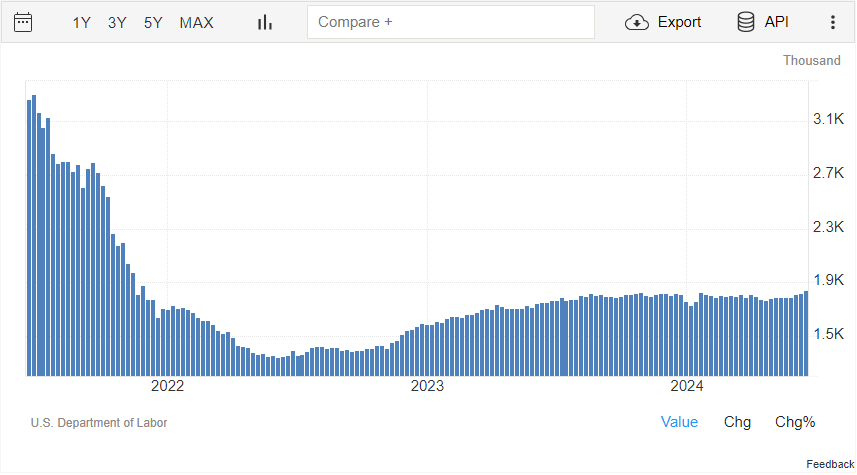

In the labor space, US continuing jobless claims – the number of unemployed workers who filed for benefits at least two weeks ago – crept higher, rising to levels last seen in November 2021.

US Continuing Jobless Claims

Graph via Trading Economics

Recommended by Nick Cawley

Trading Forex News: The Strategy

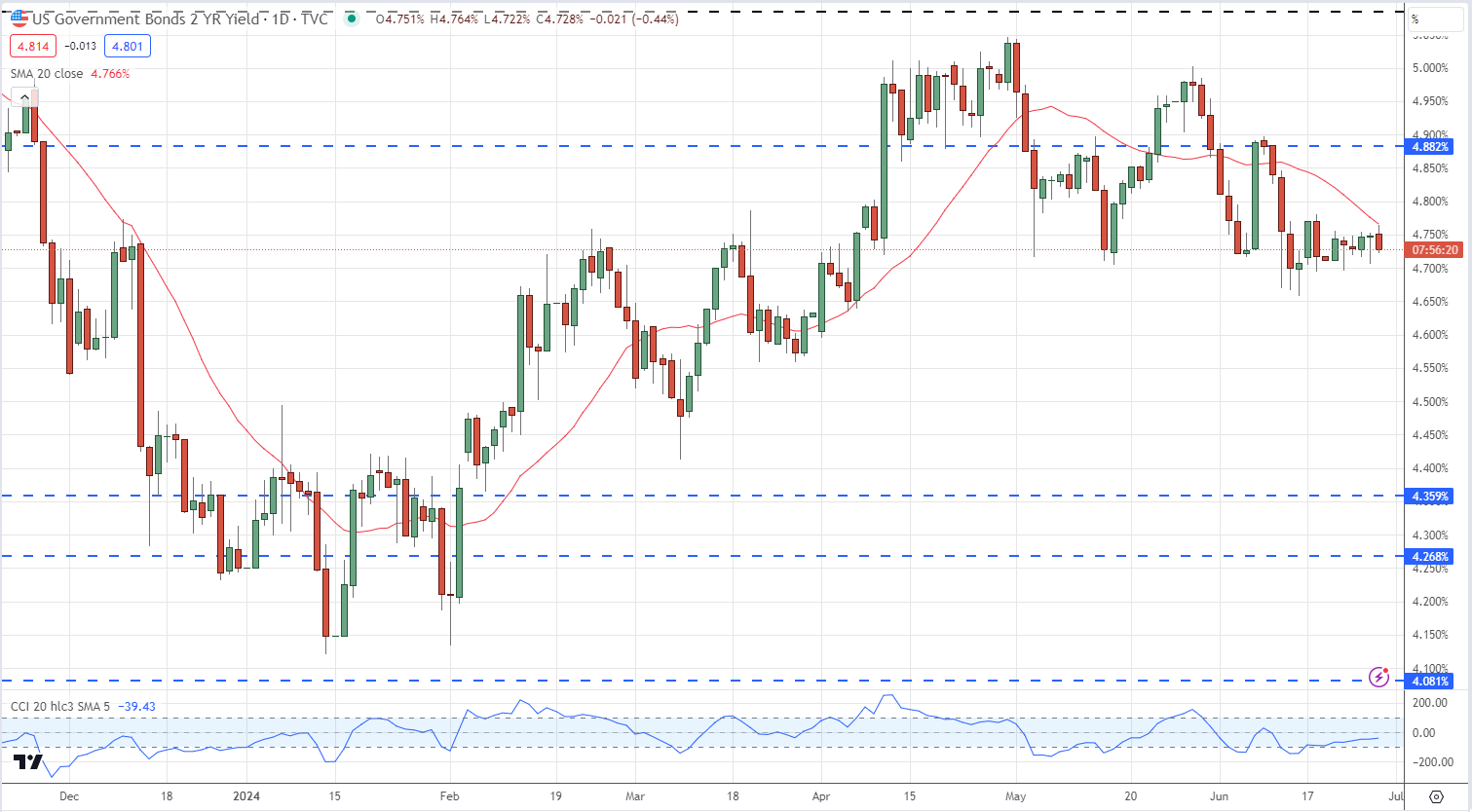

Short-dated US Treasury yields turned three to four basis points lower…

US Treasury Two-Year Yield

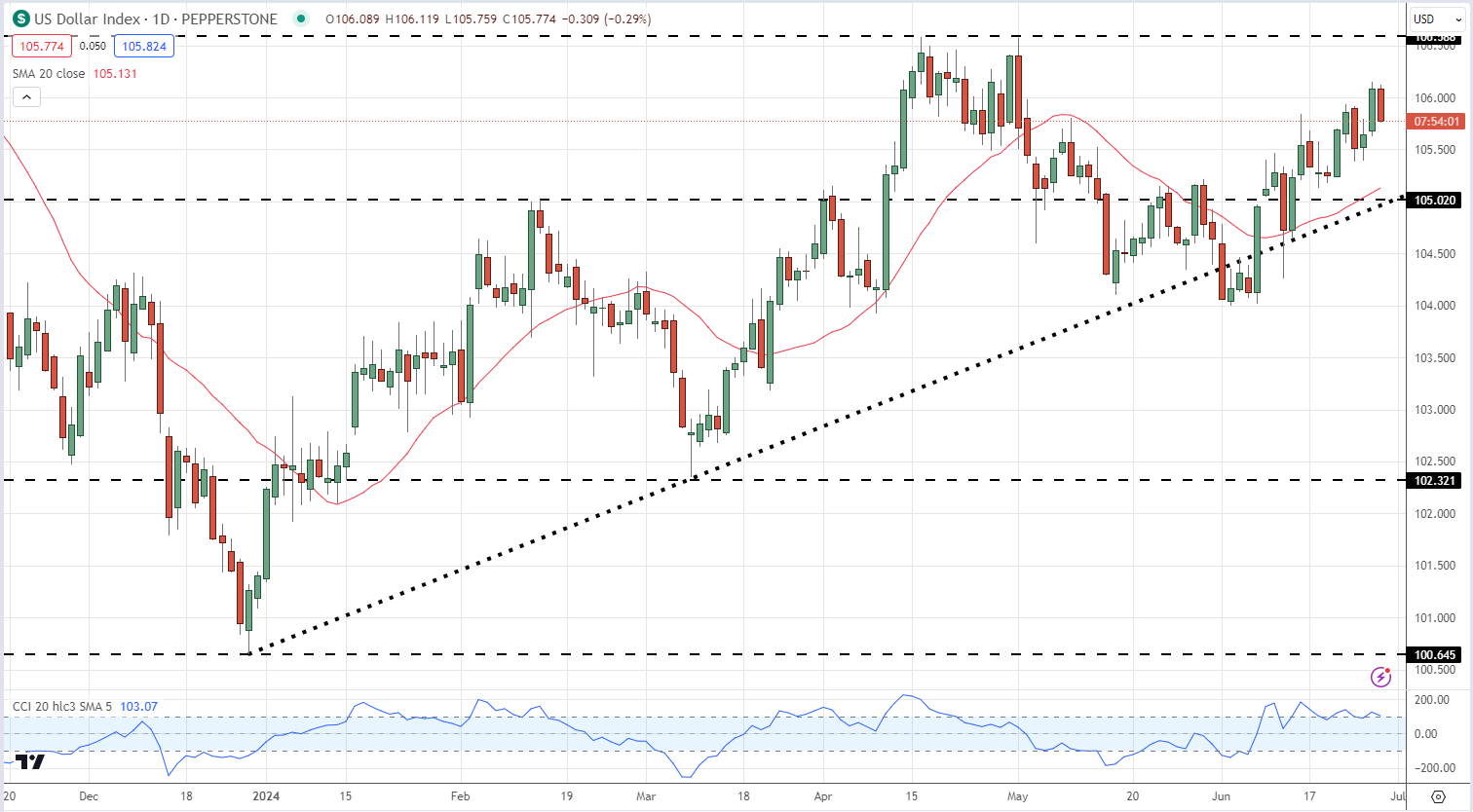

…while the US Dollar Index gave back 30 pips and is currently trading at the low of the day.

US Dollar Index Daily Chart

Recommended by Nick Cawley

Traits of Successful Traders

What are your views on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or contact the author via Twitter @nickcawley1.