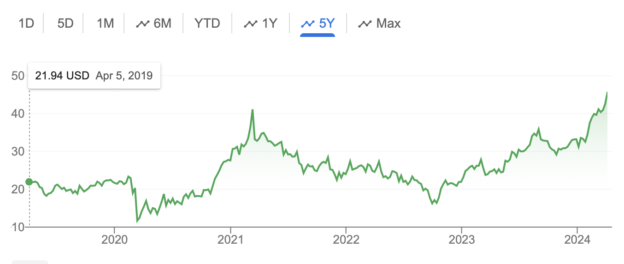

This has been a long hold and it is finally paying off. The stock hit an all time high today. I’ve thought of selling it many times over the last two years but the have always been adding to their backlog of business and I always felt at some point that had to matter.

Net debt is down to $740M from $890M and with the increasing cash they are now producing, don’t be surprised to see more repayments or a buyback in the near future.

The Release:

Primoris Services Corporation (NYSE: PRIM) (“Primoris” or the “Company”) today announced financial results for its fourth quarter and full year ended December 31, 2023 and provided the Company’s initial outlook for 2024.

For the full year 2023, Primoris reported the following highlights (1):

- Revenue of $5.7 billion, up $1.3 billion, or 29.3 percent, compared to the full year of 2022 driven by strong growth in the Energy and Utilities segments, including contributions from the acquisitions of PLH and B Comm

- Net income of $126.1 million, or $2.33 per diluted share, down 5.2 percent from the full year of 2022 due to higher income tax and interest expense, partially offset by higher operating income

- Adjusted net income of $154.7 million, or $2.85 per diluted share, an increase of 13.9 percent from the full year of 2022

- Record total backlog of $10.9 billion, up 19.8 percent from 2022 year end, including total Master Service Agreements (“MSA”) backlog of $5.7 billion, up from $5.5 billion at year end 2022

- Adjusted earnings before interest, income taxes, depreciation and amortization (“Adjusted EBITDA”) of $379.5 million, up 33.9 percent from the full year of 2022

- Full year net cash provided by operating activities of $198.6 million, up $115.2 million from the full year of 2022, driven primarily by improved working capital.

For the fourth quarter 2023, Primoris reported the following highlights(1):

- Revenue of $1.5 billion, up $186.4 million, or 14.0 percent, compared to the fourth quarter of 2022 driven by renewables growth in the Energy segment

- Net income of $37.7 million, or $0.69 per diluted share, down 9.3 percent from the fourth quarter of 2022 primarily due to higher income tax and interest expense, partially offset by higher operating income

- Adjusted net income of $46.4 million, or $0.85 per diluted share, down 7.6 percent from the fourth quarter of 2022

- Adjusted EBITDA of $104.2 million, or 6.9 percent of revenue, up 8.9 percent, from the fourth quarter of 2022

- Fourth quarter net cash provided by operating activities of $205.7 million driven primarily by favorable changes in working capital.

(1)

Please refer to “Non-GAAP Measures” and Schedules 1, 2, 3 and 4 for the definitions and reconciliations of our Non-GAAP financial measures, including “Adjusted Net Income,” “Adjusted EPS” and “Adjusted EBITDA.”

“Our 2023 results mark another record year for Primoris and demonstrate the successful execution of our strategy and the strength of our end markets. Revenue reached a new high of $5.7 billion, up more than 29 percent, and our total backlog closed the year at a record $10.9 billion, up nearly 20 percent from the backlog record we set in 2022. We were able to accomplish this through a very strong close to the year in solar project awards that totaled over $1 billion in the fourth quarter and additional contributions from our acquisitions of PLH and B Comm in 2022,” said Tom McCormick, President and Chief Executive Officer of Primoris.

“We also saw a very strong year in terms of generating cash from operations, which is a key priority for the company. This allowed us to pay down $120 million of borrowings under our revolving credit facility in the 4th quarter. In addition to exceeding a number of our financial goals, I am proud to highlight that we finished 2023 with our best safety performance in the company’s history. A testament to our employees’ dedication to each other and to our customers to complete their projects safely.”

“Looking ahead into 2024, we are optimistic about our continued success across many of our end markets. We are focused on improving our margins in the Utilities segment through increasing our mix of project work in power delivery and executing at a higher level of productivity on contracts that have been updated to current market rates beginning in 2024. We are also well-positioned to grow revenue and remain a leader in utility-scale solar construction by leveraging our strong customer relationships and continuing our track record of successful execution. I am confident that our commitment to margin improvement, cash flow generation and allocating capital to our businesses that offer higher returns will benefit Primoris, our employees and our shareholders in 2024 and beyond.”

Fourth Quarter 2023 Results Overview

Revenue was $1.5 billion for the three months ended December 31, 2023, an increase of $186.4 million, compared to the same period in 2022. The increase in revenue was driven by the Energy segment, primarily utility scale solar facilities and industrial construction activity. Gross profit was $156.6 million for the three months ended December 31, 2023, an increase of $3.2 million compared to the same period in 2022. The increase was due to higher contributions from solar and industrial projects and improved pipeline margins in the Energy segment, partially offset by lower margins in the Utilities segment. Gross profit as a percentage of revenue decreased to 10.3 percent from 11.5 percent for the same period in 2022.

This press release includes Non-GAAP financial measures. The Company believes these measures enable investors, analysts and management to evaluate Primoris’ performance excluding the effects of certain items that management believes impact the comparability of operating results between reporting periods. In addition, management believes these measures are useful in comparing the Company’s operating results with those of its peers. Please refer to “Non-GAAP Measures” and Schedules 1, 2, 3, and 4 for the definitions and reconciliations of the Company’s Non-GAAP financial measures, including “Adjusted Net Income,” “Adjusted EPS” and “Adjusted EBITDA.”

During the fourth quarter of 2023, net income was $37.7 million, or $0.69 per diluted share, a decrease of 9.3 percent compared to $41.5 million, or $0.77 per diluted share, in the previous year. Adjusted Net Income was $46.4 million, or $0.85 per diluted share, for the fourth quarter, a decrease of 7.6 percent compared to $50.2 million, or $0.93 per diluted share, for the fourth quarter of 2022. Adjusted EBITDA was $104.2 million for the fourth quarter of 2023, an increase of $8.5 million, or 8.9 percent, compared to $95.6 million for the same period in 2022.