“Davidson” submits:

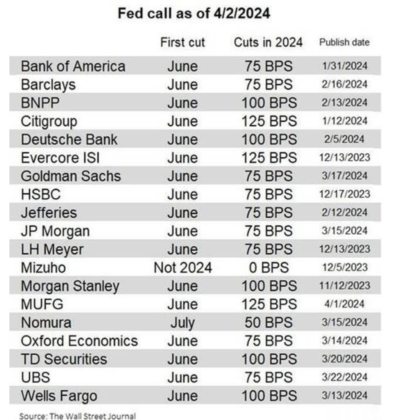

Every firm is expecting rate cuts anticipating a recession but there is no recession in sight. The question is with so many on the same side of the ledger, “What occurs once no recession becomes apparent?” The tables below show only modest adjustments to rate cut expectations with the PMI rising to 50.3. The Wall Street Journal compiled these tables. Employment has been rising with some believing the numbers are manipulated because they believed the PMI was literally screaming recession. Yet, retail sales, personal income, industrial production and especially manufacturer’s new orders and construction spending have supported the employment figures indicating economic expansion. Institutions, however, have piled into the Mag 7 tech expecting recession. In particular, they hold Nvidia and anything AI(Artificial Intelligence) and related while being short oil/gas energy related and industrials. They expect high tech to thrive during recession just like 2020 COVID lockdown while the latter are expected to be good short candidates. These investors expect rates to fall precipitously. What will occur should this scenario not be as expected?

What they have not been sensitive to is a rising economy the last 2+yrs favoring the financial performance of industrials and oil/gas issues. The market has not responded overly as most are waiting for recession. My individually suggested issues remain at significant discounts i.e., 0.1x to 1x Pr/Sales ratios when the cycle prior to COVID had these priced several multiples higher. It is in the revaluation of these underpriced issues that I expect to see a significant push higher for the SP500 even if high-tech disappoints. The rise in M2 and government-directed spending with war spending particularly inflationary virtually guarantees several years of inflation. Inflation will persist. It is this inflation that is not factored into the current rate assumptions of Wall Street. The scramble for issues that are likely to rise in current expansion period may even result in some of the underpriced becoming the new momentum issues till the end of the cycle.

Market psychology will eventually follow economic fundamentals over the long-term. Expectations for rate cuts will rapidly morph into a desire for inflation protections and an exit from fixed income in my opinion. The best strategy remains inflation favored industrials and energy cos.