This is so true. Very few people actually read and listen to earnings calls. They are always a treasure trove of information about a company and the industry they operate in

“Davidson” submits:

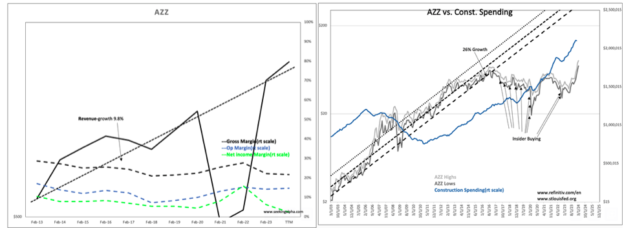

If one is not listening to the details of individual CEOs, one can’t possibly make sense of market macros. The need to get noticed, to have one’s opinions register with an audience is crucial to many a Wall Street career. In the Internet age with tens of thousands of opinions vying for a portion of advertising dollars, the media is a Tower of Babel of conflicting voices seeking recognition. One set of voices cancels another set along a spectrum of nuanced opinion that making investment sense is impossible. The best route in my opinion through this quicksand seeking one’s investment capital is to barbell i.e., have a top-down analysis keyed on hard data and couple this with bottom-up details from managements who honestly lay out what they see and who they are. In the latter assessment one needs to identify who is telling the truth. One of these CEOs is Tom Ferguson who has consistently under-promised and over-delivered. As CEO of AZZ Inc(AZZ), a provider of galvanizing and a variety of anti-corrosion metal coating solutions, he heads a very basic industrial business subject to major economic cycles. Looking at the charts, AZZ is yet in the initial response cycle to a general economic expansion. Shares posted a record high today. The correlation with construction spending should be obvious as should be AZZ’s lagging market response.

Only the next 2yrs-3yrs will provide the answer to how high investors will reprice AZZ shares as they gain confidence in this cycle. AZZ has an M&A strategy to boost revenue over its organically driven demand. It is my estimate that a Pr/Sales of 2x could see AZZ’s significantly higher. AZZ has been a portfolio suggestion throughout the COVID decline and remains so even with most portfolios carrying sizable gains. To develop this stance one needs to have experience matching what the CEO does vs the economic/psychological drivers of the cycle. AZZ has all the right components in my estimation.

AZZ is also telling us that the entire economy is in a fundamental uptrend that has legs enough for several more years.

AZZ Inc(AZZ) is a provider of galvanizing and a variety of metal coating solutions and coil coating solutions to a broad range of end markets in North America. In its Metal Coatings segment, the company offers metal finishing services to protect against corrosion, such as hot dip galvanizing, spin galvanizing, powder coating, anodizing, and plating. The Precoat Metals Segment offers aesthetic and corrosion-resistant coatings for steel and aluminum coils.

Statement from Feb 1, 2024 guidance affirmation:

“Tom Ferguson, President, and Chief Executive Officer of AZZ, said, “We are confident about AZZ’s operating performance as we conclude our fiscal year 2024 and prepare to enter fiscal year 2025. Our focus next fiscal year will be to drive sustainable, profitable growth and continue to generate strong free cash flow. We intend to grow market share and ensure that superior customer service, quality, and operational excellence remain differentiators for AZZ. We expect capital expenditures for fiscal year 2025 to be approximately $100 – $120 million, which includes $40 – $50 million for the greenfield plant construction in Washington, Missouri (completion expected in FY25) and the balance to be allocated to maintenance, productivity enhancements, and environmental, health and safety initiatives. We anticipate exceeding our $100 million targeted debt paydown in FY2024. In FY2025 we will continue to allocate our strong cash flow generated from operations to further deleverage the company by approximately $60 – $100 million.”

“Finally, we will continue to focus on working capital improvements, as well as enhancing incremental operational productivity across both segments, while further optimizing our corporate structure. AZZ is the leading independent hot-dip galvanizing and coil coating company across North America with irreplaceable footprints in our served markets. We generate industry-leading margins, returns and free cash flow. We have access to the capital necessary to sustain our operations, while actively pursuing initiatives to drive future growth and enhance shareholder value. We are excited about the opportunities ahead,” Ferguson concluded.”