IIPR currently trades at a 7.1% yield vs 4.09% for the average REIT on the S&P 500. Simply put, if we valued IIPR the same way we valued a typical REIT, shares would be trading at $179 a share. THAT is the value here, especially given the growth they’ve seen over the past few years, their balance sheet, and their dominance in the industry.

Let’s look:

Regarding the slowdown in growth in 2023:

For the year, IIP generated total revenues of $310 million and adjusted funds from operations of $256 million, increases of 12% and 10% over 2022, respectively. I would note that these growth results were achieved during a time when we strategically determined to reduce our investment activity in light of macroeconomic uncertainties and significant increase cost of capital.

For 2024:

The pipeline, we’re seeing a lot of attractive new opportunities and we really think about driving revenue growth going forward. There’s the pipeline where we’re seeing opportunistic transactions out there that we can take advantage of and also want to highlight the 460,000 square feet of leasing and LOI activity we had out of our development portfolio, as well as another 128,000 square feet within our operating portfolio that we have under lease or LOI in the last year. So not only the new transactions that we can pursue, but nearly 600,000 square feet of leasing activity between our new leases and LOI and last year, I think, will continue to set us up well for continued revenue growth going forward.

Compared to other REIT’s:

Tenants and the industry’s health:

Federal legislation. On the Federal legislation front, we are closely watching for progress on the DEA’s evaluation of the HHS recommendation to reschedule cannabis to Schedule III.

Most importantly, such a reclassification is expected to end the 280E tax treatment, which has imposed an extreme unsustainable tax burden on regulated operators for years. We expect such a change to be a great win and potentially significant positive catalysts for the industry, immediately providing meaningful improvement in many operators’ financials.

To give you a sense of the magnitude for this potential adjustment, a recent Viridian analysis estimated that removal of 280E earns could reduce the 12 largest publicly-traded operators collective tax burden by $700 million annually, providing for a rational tax structure for these operations, many of which faced effective tax rates of well over 100% under the 280E regime.

We have one of the strongest and most experienced teams of real estate professionals in the cannabis industry, a high-quality portfolio and a conservative and flexible balance sheet with a 12% debt to total gross assets. No variable rate debt, no debt maturities until May 2026.

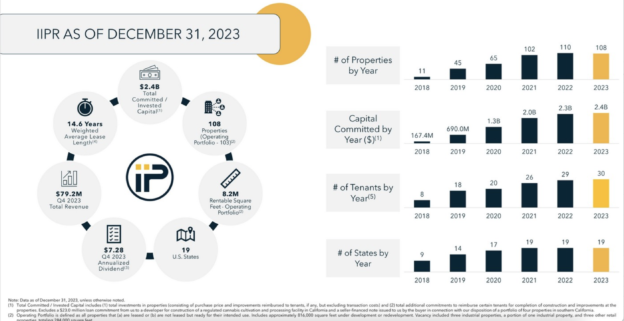

As of December 31, we owned 108 properties across 19 states, comprising 8.9 million rentable square feet, including 1.4 million square feet under development or redevelopment. Of these 108 net properties, 103 properties are included in our operating portfolio, which was 96% leased at year-end with a weighted average remaining lease term of approximately 14.6 years.

Our portfolio continues to be well diversified with no one tenant representing more than 16% of our annualized base rent and no state representing more than 15% of our annualized base rent. We have relationships with some of the largest and most experienced operators in the industry, with our leased operating portfolio comprised of 90% multistate operators and 62% leased to public company tenants.

The total amount of capital invested and committed across our operating portfolio equates to $275 per square foot, which we believe remains significantly below replacement cost.