The Dow Jones U.S. Dividend 100 Index is designed to measure the performance of high-dividend-yielding stocks in the U.S. with a record of consistently paying dividends, selected for fundamental strength relative to their peers, based on financial ratios.

The index universe is defined as the constituents of the Dow Jones U.S. Broad Stock Market Index, excluding REITs.. Source: S&P Global

Stocks must pass the following screens:

• Minimum 10 consecutive years of dividend payments

• Minimum FMC of US$ 500 million

• Minimum three-month ADVT of US$ 2 million

Stocks that pass all screens are ranked by dividend yield. The top half are eligible for inclusion.

Constituent selection is as follows:

1. The eligible securities are ranked by each of four fundamentals-based characteristics:

• Free cash flow to total debt: Annual net cash flow from operating activities divided by total

debt. Companies with zero total debt are ranked first.

• Return on equity: Annual net income divided by total shareholders’ equity.

• IAD yield

• Five-year dividend growth rate

2. The four rankings are equal weighted to create a composite score, and the eligible securities are

ranked based on this composite score.

3. The 100 top-ranked stocks by the composite score are selected to the index, subject to the

following buffer rules that favor current constituents during the annual review.

• The constituent stocks will remain in the index as long as they are among the top 200

rankings by the composite score.

• Non-constituent stocks are added to the index based on their rankings until the

constituent count reaches 100.

• If two non-constituents have the same composite score, the non-constituent with the

higher dividend yield will be selected.

Stocks in the index are weighted quarterly, based on a capped FMC weighted approach. No single stock can represent more than 4.0% of the index and no single Global Industry Classification Standard (GICS®) sector can represent more than 25% of the index, as measured at the time of index construction, annual rebalancing, and quarterly updates.

The index is subject to a daily weight cap check. If the sum of stocks with weights greater than 4.7% exceeds 22%, the index is re-weighted using a quarterly weighting method.

The index is the benchmark used by the popular dividend ETF the Schwab US Dividend Equity ETF (SCHD). It is rebalanced once per year. This years re-constituting just happened. I actually reviewed the ETF in 2016, and didn’t hate it. However I did not buy it then because I did not like the high turnover.

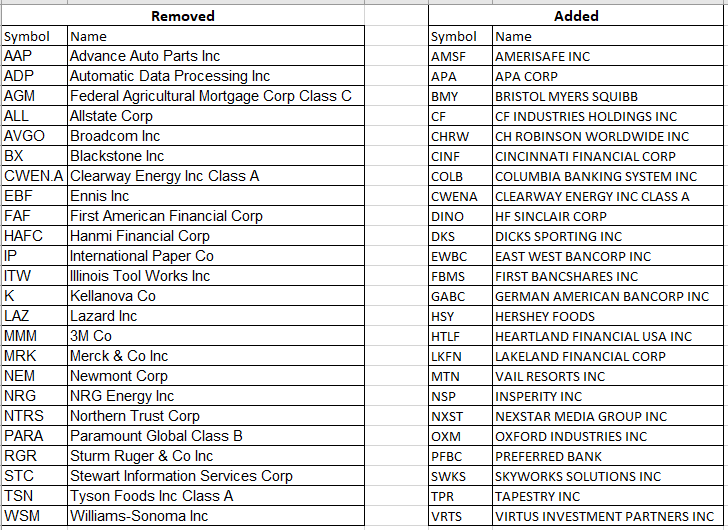

The column on the left shows the 24 companies that were removed. The column on the right shows the 24 companies that were added.

Note I created this list myself by comparing the holdings in the Schwab Dividend ETF today at the Schwab website, versus the holdings int he Schwab Dividend ETF as of Feb 29, available on the Fidelity Study.

It looks like the turnover accounted for something like 24% – 25% of the portfolio weightings. The largest components being taken out include Broadcom (AVGO) with a 5.07% weight, Merck (MRK) with a 4.69% weight and ADP (ADP) with a 3.09% weight.

On a side note, you do not get taxed on those gains from the re-balancing within an ETF as an ETF shareholder. You also do not get any deductions on losses within an ETF from re-balancing either however.

In general I dislike high turnover, because it means that this ETF holds stocks on average for 4 – 5 years only. The number of companies I am investing in is not stable, so in effect it is as if I am investing into a trading strategy almost. I prefer to hold a more passive approach to investing, with low turnover and rarely selling anything. I also prefer to build my own portfolios at home, one company at a time. That way I can control:

1. What companies go in the portfolio

2. The entry valuations

3. Portfolio weights

4. Holding period/Turnover

5. Cost

Relevant Articles: