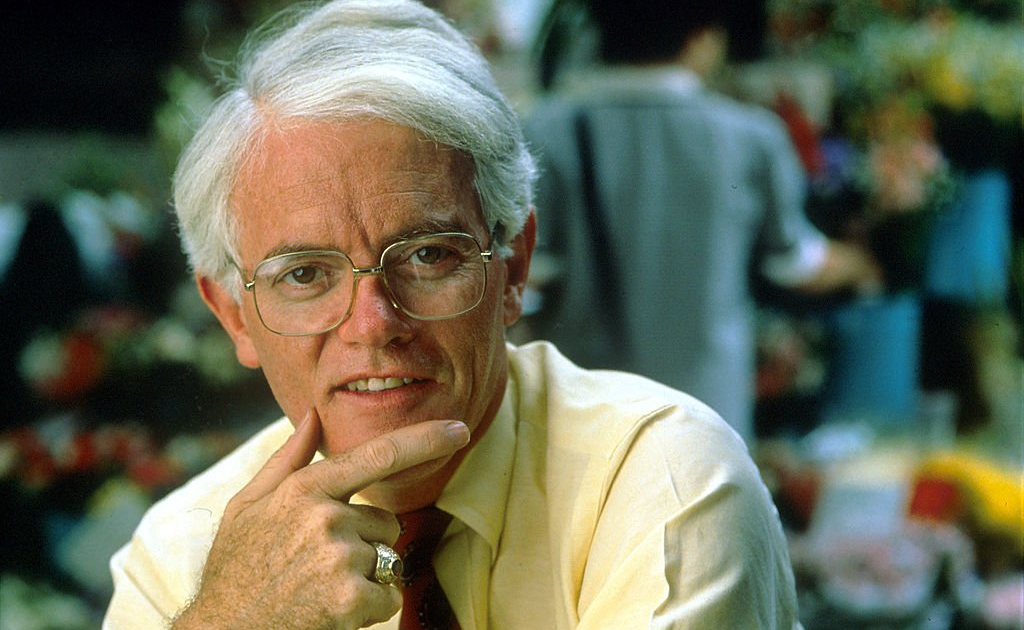

Peter Lynch is probably one of the best-known stock pickers of our time and certainly among the most successful. He was portfolio manager of Fidelity Investments’ Magellan Fund for 13 years, starting out in 1977 with $20 million in assets and winding up his tenure in 1990, with more than 1 million shareholders and assets in excess of $14 billion. During that period, Lynch delivered an average annual return of just over 29 percent.

I have compiled 80 Peter Lynch investing quotes in celebration for his birthday (plus two additional ones as bonus at the end)

1. Go for a business that any idiot can run – because sooner or later any idiot probably is going to be running it

2. Know what you own, and know why you own it

3. Selling your winners and holding your losers is like cutting the flowers and watering the weeds

4. People who succeed in the stock market also accept periodic losses, setbacks, and unexpected occurrences. Calamitous drops do not scare them out of the game

5. When you sell in desperation, you always sell cheap

6. A correction is a euphemism for losing a lot of money rapidly

7. Look for small companies that are already profitable and have proven that their concept can be replicated.

8. Be suspicious of companies with growth rates of 50 to 100 percent a year.

9. The typical big winner in the Lynch portfolio (I continue to pick my share of losers, too!) generally takes three to ten years or more to play out.

10. If you find a stock with little or no institutional ownership, you’ve found a potential winner. Find a company that no analyst has ever visited, or that no analyst would admit to knowing about, and you’ve got a double winner. When I talk to a company that tells me the last analyst showed up three years ago, I can hardly contain my enthusiasm. It frequently happens with banks, savings-and-loans, and insurance companies, since there are thousands of these and Wall Street only keeps up with fifty to one hundred

11. Actually Wall Street thinks just as the Greeks did. The early Greeks used to sit around for days and debate how many teeth a horse has. They thought they could figure it out by just sitting there, instead of checking the horse

12. When looking at the same sky, people in mature industries see clouds where people in immature industries see pie

13. Stick with a steady and consistent performer

14. Find something you enjoy doing and give it everything you’ve got, and the money will take care of itself

15. This is one of the keys to successful investing: focus on the companies, not on the stocks

16. The more cash that builds up in the treasury, the greater the pressure to piss it away

17. Invest in What You Know

18. There are five basic ways a company can increase earnings*: reduce costs; raise prices; expand into new markets; sell more of its product in the old markets; or revitalize, close, or otherwise dispose of a losing operation.

19. Avoid hot stocks in hot industries.

20. Great companies in cold, nongrowth industries are consistent big winners

21. Distrust diversifications, which usually turn out to be diworseifications.

22. Long shots almost never pay off.

23. It’s better to miss the first move in a stock and wait to see if a company’s plans are working out.

24. People get incredibly valuable fundamental information from their jobs that may not reach the professionals for months or even years.

25. Separate all stock tips from the tipper, even if the tipper is very smart, very rich, and his or her last tip went up.

26. Some stock tips, especially from an expert in the field, may turn out to be quite valuable. However, people in the paper industry normally give out tips on drug stocks, and people in the health care field never run out of tips on the coming takeovers in the paper industry.

27. Invest in simple companies that appear dull, mundane, out of favor, and haven’t caught the fancy of Wall Street.

28. The best way to handle a situation in which you love the company but not the current price is to make a small commitment and then increase it in the next sell-off

29. I’m always on the lookout for great companies in lousy industries. A great industry that’s growing fast, such as computers or medical technology, attracts too much attention and too many competitors

30. Once I’ve established the size of the company relative to others in a particular industry, next I place it into one of six general categories: slow growers, stalwarts, fast growers, cyclicals, asset plays, and turnarounds

31. A successful stockpicker has the same relationship with a drop in the market as a Minnesotan has with freezing weather. You know it’s coming, and you’re ready to ride it out, and when your favorite stocks go down with the rest, you jump at the chance to buy more

32. Never invest in any company before you’ve done the homework on the company’s earnings prospects, financial condition, competitive position, plans for expansion, and so forth

33. If you invest $1,000 in a stock, all you can lose is $1,000. But you stand to gain $10,000 or even $50,000 over time if you are patient

34. The average person can concentrate on a few good companies, while the fund manager is forced to diversify. By owning too many stocks, you lose this advantage of concentration. It only takes a handful of big winners to make a lifetime of investing worthwhile

35. So you have flops. Maybe you’re right 5 or 6 times out of 10. But if your winners go up 4- or 10- or 20-fold, it makes up for the ones where you lost 50%, 75%, or 100%

36. Nobody can predict interest rates, the future direction of the economy or the stock market. Dismiss all such forecasts and concentrate on what’s actually happening to the companies in which you’ve invested

37. You have to learn that there’s a company behind every stock and that there’s only one reason why stocks go up.

38. Far more money has been lost by investors preparing for corrections or trying to anticipate corrections than has been lost in the corrections themselves

39. In the business of investing, if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.

40. If you spend 13 minutes a year on economics, you’ve wasted 10 minutes

41. Stocks aren’t lottery tickets. Behind every stock is a company. Find out what it’s doing. If the company does well, over time the stocks do well.

42. In the stock market, the most important organ is the stomach. It’s not the brain

43. If you love a company’s products or services, it usually pays to buy the stock instead

44. You want to buy in the second or third inning and get out in the seventh or eighth

45. The public’s careful when they buy a house, when they buy a refrigerator, when they buy a car. They’ll work hours to save a hundred dollars on a roundtrip air ticket. They’ll put $5,000 or $10,000 on some zany idea they heard on the bus. That’s gambling. That’s not investing

46. Investing is fun, exciting, and dangerous if you don’t do any work

47. Your investor’s edge is not something you get from Wall Street experts. It’s something you already have. You can outperform the experts if you use your edge by investing in companies or industries you already understand

48. Over the past three decades, the stock market has come to be dominated by a herd of professional investors. Contrary to popular belief, this makes it easier for the amateur investor. You can beat the market by ignoring the herd

49. Often, there is no correlation between the success of a company’s operations and the success of its stock over a few months or even a few years. In the long term, there is a 100 percent correlation between the success of the company and the success of its stock. This disparity is the key to making money; it pays to be patient, and to own successful companies

50. Owning stocks is like having children-don’t get involved with more than you can handle

51. If you can’t find any companies that you think are attractive, put your money in the bank until you discover some.

52. Never invest in a company without understanding its finances. The biggest losses in stocks come from companies with poor balance sheets. Always look at the balance sheet to see if a company is solvent before you risk your money on it.

53. With small companies, you’re better off to wait until they turn a profit before you invest

54. If you’re thinking about investing in a troubled industry, buy the companies with staying power. Also, wait for the industry to show signs of revival. Buggy whips and radio tubes were troubled industries that never came back

55. In every industry and every region of the country, the observant amateur can find great growth companies long before the professionals have discovered them

56. A stock-market decline is as routine as a January blizzard in Colorado. If you’re prepared, it can’t hurt you. A decline is a great opportunity to pick up the bargains left behind by investors who are fleeing the storm in panic

57. Everyone has the brainpower to make money in stocks. Not everyone has the stomach. If you are susceptible to selling everything in a panic, you ought to avoid stocks and stock mutual funds altogether

58. There is always something to worry about. Avoid weekend thinking and ignore the latest dire predictions of the newscasters. Sell a stock because the company’s fundamentals deteriorate, not because the sky is falling

59. If you study 10 companies, you’ll find 1 for which the story is better than expected. If you study 50, you’ll find 5. There are always pleasant surprises to be found in the stock market—companies whose achievements are being overlooked on Wall Street

60. If you don’t study any companies, you have the same success buying stocks as you do in a poker game if you bet without looking at your cards

61. Time is on your side when you own shares of superior companies. You can afford to be patient—even if you missed Wal-Mart in the first five years, it was a great stock to own in the next five years. Time is against you when you own options

62. In the long run, a portfolio of well-chosen stocks and/or equity mutual funds will always outperform a portfolio of bonds or a money-market account. In the long run, a portfolio of poorly chosen stocks won’t outperform the money left under the mattress.

63. Among the major stock markets of the world, the U.S. market ranks eighth in total return over the past decade. You can take advantage of the faster-growing economies by investing some portion of your assets in an overseas fund with a good record.

64. If you have the stomach for stocks, but neither the time nor the inclination to do the homework, invest in equity mutual funds. Here, it’s a good idea to diversify. You should own a few different kinds of funds, with managers who pursue different styles of investing: growth, value, small companies, large companies, etc. Investing in six of the same kind of fund is not diversification. The capital-gains tax penalizes investors who do too much switching from one mutual fund to another. If you’ve invested in one fund or several funds that have done well, don’t abandon them capriciously. Stick with them.

65. As companies grow larger and more profitable, their shareholders share in the increased profits. The dividend are raised. The dividend is such an important factor in the success of many stocks that you could hardly go wrong by making an entire portfolio of companies that have raised their dividends for 10 or 20 years in a row.

66. Moody’s Handbook of Dividend Achievers, 1991 edition – one of my favorite bedside thrillers – lists such companies, which is how I know that 134 of them have an unbroken 20-year record of dividend increases, and 362 of them have a 10-year record

67. Here’s a simple way to succeed on Wall Street: buy stocks from the Moody’s Dividend Achievers list, and stick with them as long as they stay on the list.

68. Corporate profits are up fifty-five-fold since World War II, and the stock market is up sixtyfold. Four wars, nine recessions, eight presidents, and one impeachment didn’t change that

69. This is investing, where the smart money isn’t so smart, and the dumb money isn’t really as dumb as it thinks. Dumb money is only dumb when it listens to the smart money

70. If you can follow only one bit of data, follow the earnings – assuming the company in question has earnings

71. Debt is saving in reverse. The more it builds up, the worse off you are

72. To my mind, the stock price is the least useful information you can track, and it’s the most widely tracked

73. One obvious sell signal is that inventories are building up and the company can’t get rid of them, which means lower prices and lower profits down the road. I always pay attention to rising inventories. When the parking lot is full of ingots, it’s certainly time to sell the cyclical. In fact, you may be a little late.

74. Investing in stocks is an art, not a science, and people who’ve been trained to rigidly quantify everything have a big disadvantage

75. All the math you need in the stock market you get in the fourth grade

76. My biggest mistake was that I always sold too early

77. The person that turns over the most rocks wins the game

78. “I can’t recall ever once having seen the name of a market timer on Forbes’ annual list of the richest people in the world. If it were truly possible to predict corrections, you’d think somebody would have made billions by doing it.”

79. “I don’t know anyone who said on their deathbed: ‘Gee, I wish I’d spent more time at the office.’”

80. “The stock doesn’t know you own it.”

81. “During the Gold Rush, most would-be miners lost money, but people who sold them picks, shovels, tents and blue-jeans made a nice profit.”