US DOLLAR OUTLOOK – EUR/USD, GBP/USD, USD/JPY

- The U.S. dollar has largely stalled its rebound, consolidating around the 102.00 level in recent days

- U.S. interest rates expectations shifted in a dovish direction last week, with traders pricing in nearly 160 basis points of easing for the year

- Dovish wagers on the Fed’s path could be scaled back if central bank officials started pushing back against Wall Street’s projections – a situation that could boost yields and the U.S. dollar

Most Read: US Dollar at Critical Juncture after US CPI, Setups on EUR/USD, USD/JPY, GBP/USD

U.S. interest rate expectations turned quite dovish last week even though December headline and core inflation figures surprised to the upside. The chart below shows that traders are now discounting almost 160 bp of easing for 2024, 30 bp higher than seven days ago. In this context, the U.S. dollar (DXY) has stalled its recovery, consolidating slightly above the 102.00 level since the start of the year.

Source: TradingView

Wondering about the U.S. dollar’s technical and fundamental outlook? Gain clarity with our latest forecast. Download a free copy now!

Recommended by Diego Colman

Get Your Free USD Forecast

Although the U.S. central bank is likely to reduce borrowing costs later this year, the deep rate cuts priced in by market participants seem extreme for an economy displaying remarkable resilience and still experiencing above-target and sticky inflation. Given current conditions, it would not be surprising to see traders scale back dovish wagers soon, paving the way for a market reversal.

Looking ahead to next week, the U.S. economic calendar is rather light, with markets closed on Monday for the Martin Luther King Jr. holiday. However, several Fed officials will have public appearances, so it is important to watch whether policymakers start pushing back against Wall Street’s dovish outlook. If they do, yields and the U.S. dollar may head higher.

For a complete analysis of the euro’s medium-term prospects, request a copy of our Q1 forecast!

Recommended by Diego Colman

Get Your Free EUR Forecast

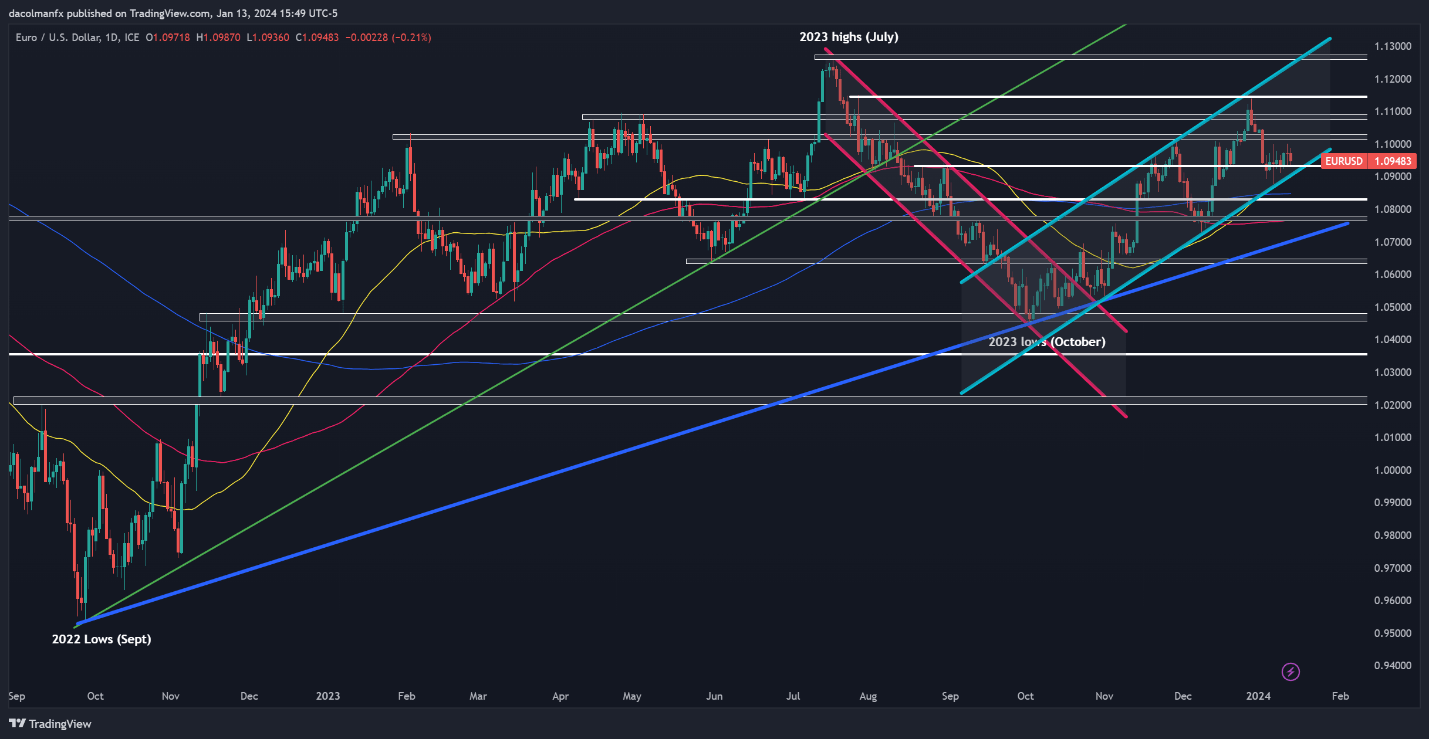

EUR/USD TECHNICAL ANALYSIS

EUR/USD fell modestly on Friday, but remained above support near 1.0930. If this technical floor holds, there is potential for prices to resume their upward journey in the near term, in which case, we can’t rule out an advance towards 1.1020. Continued strength may then redirect attention to 1.1075/1.1095, followed by 1.1140.

On the flip side, should bearish momentum intensify and drive the exchange rate below 1.0930, the possibility of a retracement towards 1.0875 emerges – a key area where the 50-day simple moving average converges with the lower limit of a short-term ascending channel. On further weakness, sellers may initiate an assault on the 200-day SMA.

EUR/USD TECHNICAL CHART

EUR/USD Chart Prepared Using TradingView

For a comprehensive view of the Japanese yen‘s fundamental and technical outlook, make sure to download our Q1 trading forecast today. It is totally free!

Recommended by Diego Colman

Get Your Free JPY Forecast

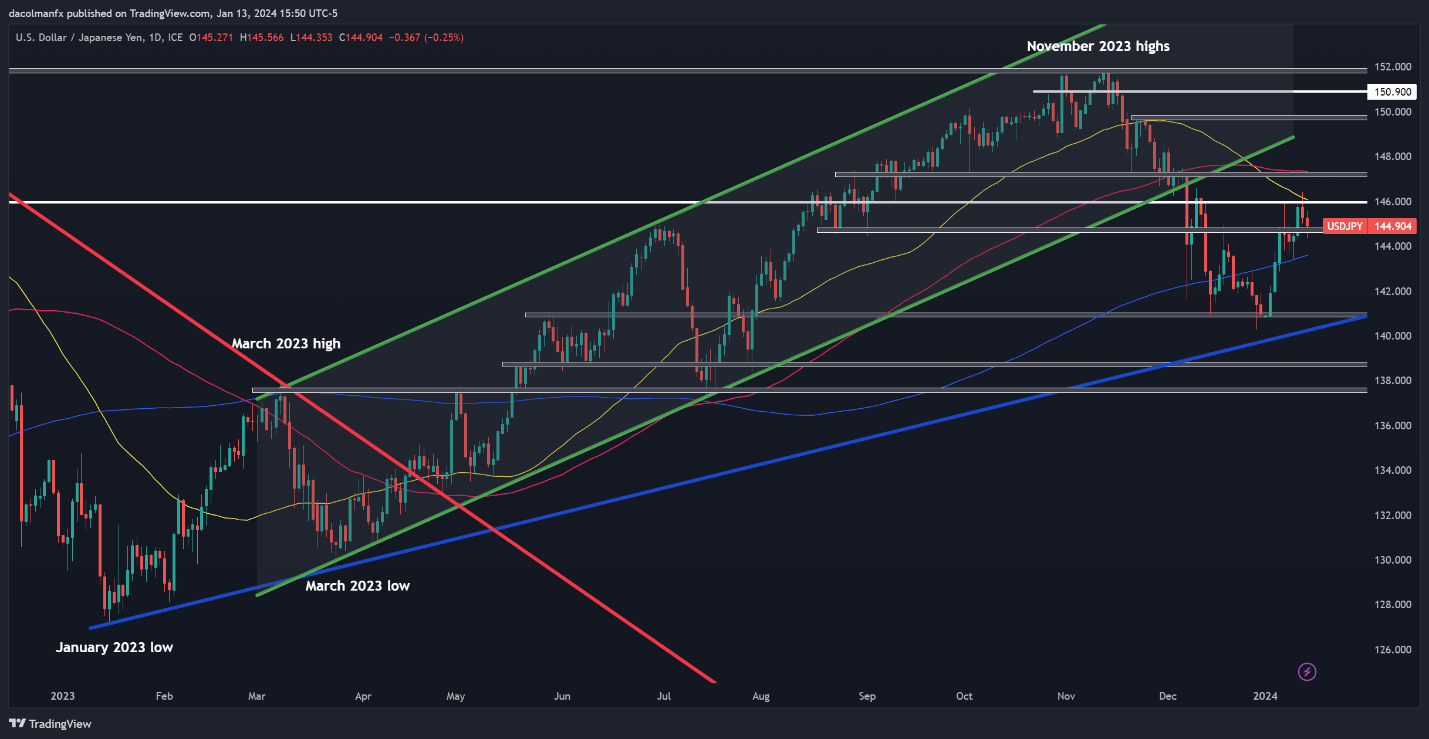

USD/JPY TECHNICAL ANALYSIS

USD/JPY rallied early last week, but its upward momentum started fading when the pair failed to push past resistance near 146.00, eventually leading to a pullback towards support at 144.65. Bulls must defend this floor at all costs; failure to do so could expose the 200-day simple moving average at 143.60. Continued losses from this point onward could draw attention to the December lows below the 141.00 mark.

In the event of bulls regaining control of the market, technical resistance appears at 146.00, right around the 50-day simple moving average. If history is a guide, the pair could be rejected from this region on a retest, but a successful breakout could set the stage for a rally towards 147.25, slightly below the 100-day simple moving average.

USD/JPY TECHNICAL CHART

USD/JPY Chart Created Using TradingView

Interested in learning how retail positioning can offer clues about GBP/USD’s short-term direction? Our sentiment guide has all the answers you seek. Get the complimentary guide now!

| Change in | Longs | Shorts | OI |

| Daily | 2% | 1% | 2% |

| Weekly | 7% | 1% | 4% |

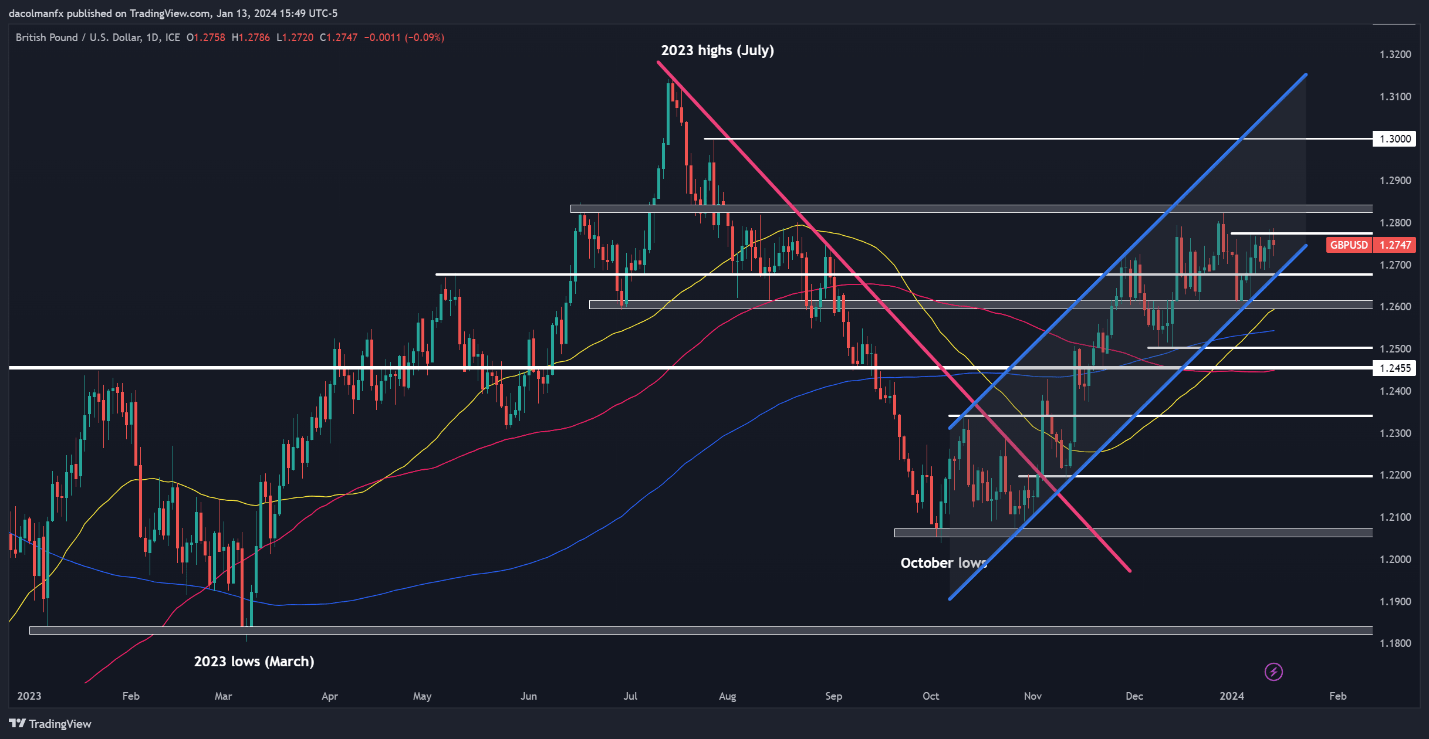

GBP/USD TECHNICAL ANALYSIS

GBP/USD was largely directionless on Friday, fluctuating around overhead resistance in the 1.2765 area. Sellers must staunchly protect this technical ceiling; failure to do so could trigger an upward move toward the December peak situated above the 1.2800 level. On further strength, the bulls might gather the confidence to mount an attack on the psychological 1.3000 threshold.

Conversely, if sellers regain the upper hand and trigger a selloff, primary support looms at 1.2675, which represents the lower boundary of a medium-term ascending channel in play since October. While cable is likely to find stability in this region during a pullback, a breakdown could open the door for a decline towards 1.2600. Subsequent losses beyond this level may prompt interaction with the 200-day SMA.