- VanEck’s head of digital asset research stated BlackRock has over $2 billion lined up in incremental flows in the first week.

- This would create a new record as in the history of ETF launches, it would be the largest volume.

- VanEck itself expects about $2.5 billion in trading volume in the first quarter of trading.

- Senator Warren backed Better Markets and sent a last-minute letter to the SEC Secretary asking for a rejection of the spot Bitcoin ETFs.

The spot Bitcoin ETF race is in its last leg, and the competition seems to be heating up, with BlackRock set to blow its competitors out of the water. The world’s largest manager apparently has billions of dollars lined up in the first week, which would create history in the ETF market.

BlackRock set to nuke the ETF market

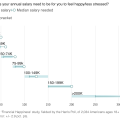

During a recent Twitter Spaces event, the Head of Digital Asset Research at VanEck, Matthew Sigel, stated that BlackRock would likely create a new record for the largest flow of volume for the first day or week of trading for an exchange-traded fund (ETF).

The quote provided by The Block’s editor-in-chief and the host of said Twitter space read,

“I heard from a pretty well placed source that Blackrock has more than $2 billion lined up in week one in new incremental flows from existing Bitcoin holders who are adding to positions — I can’t vouch for that. But you know, that’s what everyone is doing. Just making phone calls and trying to find the folks who can write checks into these products. And our estimates — that, you know, if that $2 billion happened in week one, you know, that would blow away our estimates.

Per the comment, Sigel went on to provide VanEck’s estimated trading volume from the spot Bitcoin ETF in the first quarter, which, based on the past flows into the first gold ETF and adjusting by the US money supply, is set at $2.5 billion. This sets their two-year target at $40 billion.

Bloomberg ETF analyst Eric Balchunas, while they did not validate the comment, did provide some credibility by saying,

“This caught my attn too, hadnt heard this but it would be on brand for BlackRock. They’ve lined up and injected big cash into new ETFs on first day of trading so it registers as volume/flows. *If* it’s true, $2b would blow away all first day/week volume/aum records for an ETF.

Attempts at stopping Bitcoin ETFs

While most of the TradFi market, along with the crypto market, is keenly awaiting the approval and launch of the spot Bitcoin ETFs, an entity known as Better Markes is attempting a last-minute obstruction in the process.

The nonprofit, known to be supported by Senator Elizabeth Warren in the past, sent a letter to the Secretary of the Securities and Exchange Commission (SEC) saying the regulatory body should reject the ETF requests. The supplemental letter also asked the SEC not to let the Grayscale lawsuit ruling interfere with the regulator’s earlier standing of rejecting the applications.

Bloomberg ETF analyst James Seyffart tweeted, addressing the letter, that it would be criminal to accept Better Market’s request at the eleventh hour.

Would be an absolutely criminal move for this to happen considering the time effort and energy from all these issuers AND from the SEC staff over the last few months https://t.co/QZR4pqcyga

— James Seyffart (@JSeyff) January 5, 2024