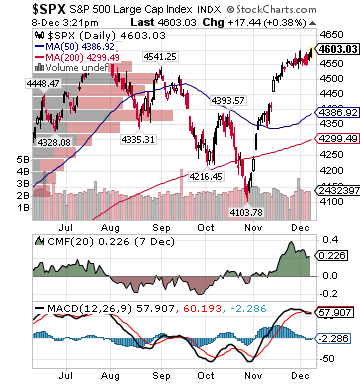

| S&P 500 4,604.2 +.2% |

Weekly Market Wrap by Edward Jones.

Indices

- Russell 2000 1,881.0 +.93%

- NYSE FANG+ 8,296.0 +1.1%

- Roundhill Meme Stock ETF 38.93 +5.4%

- Goldman 50 Most Shorted 143.6 +1.4%

- Wilshire 5000 45,931.2 +.24%

- Russell 1000 Growth 2,957.4 +.72%

- Russell 1000 Value 1,559.43 -.35%

- S&P 500 Consumer Staples 738.31 -1.2%

- MSCI Cyclicals-Defensives Spread 1,325.49 +.83%

- NYSE Technology 4,116.8 +.74%

- Transports 15,240.6 -1.4%

- Bloomberg European Bank/Financial Services 90.29 +1.8%

- MSCI Emerging Markets 39.01 -1.6%

- Credit Suisse AllHedge Long/Short Equity Index 188.60 -.06%

- Credit Suisse AllHedge Equity Market Neutral Index 106.19 -.51%

Sentiment/Internals

- NYSE Cumulative A/D Line 464,548 +.63%

- Nasdaq/NYSE Volume Ratio 10.6 +103.8%

- Bloomberg New Highs-Lows Index 46 -94

- Crude Oil Commercial Bullish % Net Position -26.9 +6.4%

- CFTC Oil Net Speculative Position 183,171 -11.7%

- CFTC Oil Total Open Interest 1,563,737 +.65%

- ISE Sentiment 113.0 -14.0 points

- NYSE Arms .68 -25.0%

- Bloomberg Global Risk-On/Risk-Off Index 60.4 -.66%

- Bloomberg US Financial Conditions Index .62 +10.0 basis points

- Bloomberg European Financial Conditions Index .32 +9.0 basis points

- Volatility(VIX) 12.6 -1.6%

- DJIA Intraday % Swing .55% -43.0%

- CBOE S&P 500 3M Implied Correlation Index 20.54 -4.0%

- G7 Currency Volatility (VXY) 8.0 +7.1%

- Emerging Markets Currency Volatility (EM-VXY) 7.92 +1.2%

- Smart Money Flow Index 13,755.14 +3.8%

- NAAIM Exposure Index 76.1 -5.3

- ICI Money Mkt Mutual Fund Assets $5.898 Trillion +1.1%

- ICI Domestic Equity Long-Term Mutual Fund/ETFs Weekly Flows +$6.307 Million

Futures Spot Prices

- Crude Oil 71.28/bbl. -4.3%

- Reformulated Gasoline 205.27 -3.1%

- Natural Gas 2.56 -6.7%

- Dutch TTF Nat Gas(European benchmark) 38.6 euros/megawatt-hour -12.0%

- Heating Oil 258.03 -3.2%

- Newcastle Coal 153.7 (1,000/metric ton) +13.4%

- Gold 2,000.24 -3.4%

- Silver 23.03 -9.6%

- S&P GSCI Industrial Metals Index 398.0 -3.5%

- US No. 1 Heavy Melt Scrap Steel 430.0 USD/Metric Tonne +12.3%

- China Iron Ore Spot 134.7 USD/Metric Tonne +4.5

%

- CME Lumber 528.50 +.57%

- UBS-Bloomberg Agriculture 1,551.90 -1.6%

- US Gulf NOLA Potash Spot 322.50 USD/Short Ton unch.

Economy

- Atlanta Fed GDPNow 4Q Forecast +1.25% +6.0 basis points

- NY Fed Real-Time Weekly Economic Index 2.48 +17.0%

- US Economic Policy Uncertainty Index 95.1 +67.2%

- S&P 500 Current Quarter EPS Growth Rate YoY(498 of 500 reporting) +4.4% -.1 percentage point

- S&P

500 Blended Forward 12 Months Mean EPS Estimate 242.35 +.28: Growth

Rate +9.4% +.1 percentage point, P/E 18.9 unch. - S&P 500 Current Year Estimated Profit Margin 12.11% -2.0 basis points

- NYSE FANG+ Current Quarter EPS Growth Rate YoY(10 of 10 reporting) +47.7% -2.9 percentage points

- NYSE FANG+ Blended Forward 12 Months Mean EPS Estimate 285.80 +1.34: Growth Rate +34.0% +.6 percentage point, P/E 28.8 -1.2

- Citi US Economic Surprise Index 20.3 -5.3 points

- Citi Eurozone Economic Surprise Index -21.0 +2.7 points

- Citi Emerging Markets Economic Surprise Index 26.2 +.4 point

- Fed

Fund Futures imply .00%(-0.0 percentage point) chance of -25.0 basis

point cut to 5.0-5.25%, 98.2%(-.6 percentage point) chance of no change, 1.8%(+.6 percentage point) chance of +25.0 basis point hike to 5.5-5.75% on 12/13

- US Dollar Index 104.01 +.77%

- MSCI Emerging Markets Currency Index 1,710.12 -.26%

- Bitcoin/USD 43,927.5 +10.5%

- Euro/Yen Carry Return Index 167.26 +.24%

- Yield Curve(2s/10s) -48.0 -13.5 basis points

- 10-Year US Treasury Yield 4.24% +1.0 basis point

- Federal Reserve’s Balance Sheet $7.701 Trillion -.75%

- Federal Reserve’s Discount Window Usage $2.110 Billion -17.5%

- Federal Reserve’s Bank Term Funding Program $121.695 Billion +6.9%

- U.S. Sovereign Debt Credit Default Swap 47.70 +1.4%

- Illinois Municipal Debt Credit Default Swap 185.5 +4.0%

- Italian/German 10Y Yld Spread 180.0 +6.0 basis points

- UK Sovereign Debt Credit Default Swap 36.07 +1.9%

- China Sovereign Debt Credit Default Swap 62.21 +6.7%

- Brazil Sovereign Debt Credit Default Swap 147.89 +1.3%

- Israel Sovereign Debt Credit Default Swap 109.49 -4.5%

- South Korea Sovereign Debt Credit Default Swap 28.22 +2.5%

- China Corp. High-Yield Bond USD ETF(KHYB) 25.5 +.14%

- China High-Yield Real Estate Total Return Index 74.20 -1.4%

- Atlanta Fed Low Skill Wage Growth Tracker YoY +5.9% unch.

- Zillow US All Homes Rent Index YoY +3.2% unch.

- US Urban Consumers Food CPI YoY +3.3% unch.

- CPI Core Services Ex-Shelter YoY +3.9% unch.

- Cleveland Fed Inflation Nowcast Core PCE YoY +3.46% unch.: CPI YoY +3.04% unch.

- 10-Year TIPS Spread 2.21% -2.0 basis points

- TED Spread 24.5 -1.25 basis points

- 2-Year SOFR Swap Spread -19.5 -1.25 basis points

- 3-Month EUR/USD Cross-Currency Basis Swap -9.0 +3.0 basis points

- N. America Investment Grade Credit Default Swap Index 61.49 +.24%

- America Energy Sector High-Yield Credit Default Swap Index 176.0 +5.9%

- Bloomberg TRACE # Distressed Bonds Traded 377.0 +32.0

- European Financial Sector Credit Default Swap Index 76.0 -.8%

- Deutsche Bank Subordinated 5Y Credit Default Swap 221.66 -5.2%

- Emerging Markets Credit Default Swap Index 185.22 -1.5%

- MBS 5/10 Treasury Spread 149.0 -3.0 basis points

- Bloomberg CMBS Investment Grade Bbb Average OAS 952.0 +8.0 basis points

- Avg. Auto ABS OAS .83 -5.0 basis points

- M2 Money Supply YoY % Change -3.3% unch.

- Commercial Paper Outstanding 1,251.2 -1.9%

- 4-Week Moving Average of Jobless Claims 220,750 +.23%

- Continuing Claims Unemployment Rate 1.2% -10.0 basis points

- Kastle Back-to-Work Barometer(entries in secured buildings) 48.98 +24.8%

- Average 30-Year Fixed Home Mortgage Rate 7.41% -16.0 basis points

- Weekly Mortgage Applications 181,100 +2.8%

- Weekly Retail Sales +3.0% -90.0 basis points

- OpenTable US Seated Diners % Change YoY -4.0% +2.0 percentage points

- Box Office Weekly Gross $132.8M -36.1%

- Nationwide Gas $3.19/gallon -.06/gallon

- Baltic Dry Index 2,495.0 -21.8%

- China (Export) Containerized Freight Index 858.40 +.08%

- Oil Tanker Rate(Arabian Gulf to U.S. Gulf Coast) 35.0 -6.7%

- Truckstop.com Market Demand Index 45.2 +90.1%

- Rail Freight Carloads 272,577 +24.3%

- TSA Total Traveler Throughput 2,373,456 +27.3%

Best Performing Style

Worst Performing Style

Leading Sectors

- Homebuilding +5.4%

- Regional Banks +3.2%

Lagging Sectors

Weekly High-Volume Stock Gainers (27)

- MBI,

ALXO, SAVA, PARA, NETI, AAOI, ARVN, AX, CLSK, AMBC, UPST, CVNA, LULU,

AFRM, DOCU, ALLE, QNST, SRRK, DAVA, IMCR, AGO, CARR, INSP, S, SRAD, RBLX

and ALB

Weekly High-Volume Stock Losers (14)

- MEI, SMAR, CIEN, GTES, MNSO, CRSP, SWBI, MDGL, RH, AGRO, XPOF, HCP, NOVA and MDRX

ETFs

Stocks

*5-Day Change