The most likely scenario is higher oil prices as it been for over a year now. Barring a significant recession, I expect demand to continue to grow and push prices higher.

“Davidson” submits:

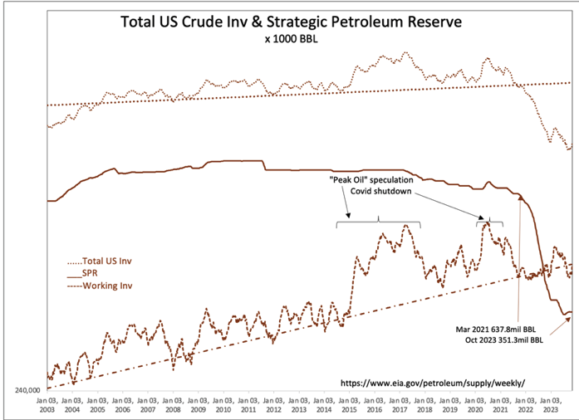

The panic with oil this week deserves a comment. Brent and $WTI plunged this week on news which traders took as a new trend to worry about. The problem is that it is not a new trend. It is US crude inventories being volatile which the chart, —Working Inv, shows has been the pattern since 2003. The trend of working inventory remains the same with last couple of week’s reports simply returning to trend. The news story reveals how mind-blowing one week’s worth of data can be for short-term perspectives, But, when compared to the long-term context, NADA!!.

https://www.zerohedge.com/markets/inflation-deflation-cooperation-confrontation

“Brent crude prices were walloped yesterday; front month futures dropped more than 4.5% to close at $77.52/bbl. That’s soft enough for our own Joe DeLaura to suggest a move to $71.50/bbl is now firmly in the crosshairs. Crude has been under pressure for much of this week after the International Energy Agency suggested that the market would be in surplus early next year and the US Energy Information Administration disclosed a much larger build in inventories than had been expected.”