Allan Roth has another thought-provoking article called Beat Inflation Handily, and Risk-Free with a very attractive proposition:

Do you want an expected return of nearly 6% annually above inflation but also want to be assured you will beat inflation in a worst-case scenario? Until now, I would have responded “only in your dreams.” But today, that dream is a reality.

Previously, he wrote about a simpler “No Risk” Portfolio that guaranteed your money back in nominal (face value) terms. For example, if you started with $100,000, you’d end up with $100,000 after 10 years. However, inflation would mean that the buying power of your $100,000 would be less after 10 years.

This new & improved “No Risk” portfolio uses individual TIPS to guarantee that even if your stocks go to zero, your total money invested will at least match inflation and maintain buying power. This is because current TIPS guarantees returns of roughly 2.5% above inflation, all by itself.

At current TIPS yields, this can effectively be achieved with roughly 50% stock index ETFs and 50% individual 25-year TIPS. At current yields, every ~$50,000 in 25-year TIPS will end up at a real (inflation-adjusted) $100,000 after 25 years. That means you could throw in ~$50,000 into stocks and every single penny from your stock index ETF returns is gravy on top!

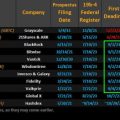

Here’s how the total annualized real (after-inflation) return of your portfolio would look, depending on real (after-inflation) stock returns:

I don’t plan to change my portfolio to this one. Instead, it serves as a useful tool and alternative perspective about asset allocation. There are clear benefits from holding guaranteed bonds, both of the nominal and inflation-linked type. You may think insuring against a total loss from stocks is overkill, and I would tend to agree. But it sure does feel nice to have a floor somewhere, as there have been decades historically where stocks have experienced a negative real return.

Stocks offer some of the highest historical average returns and the highest expected future returns. But if you haven’t experienced a prolonged bear market, your faith hasn’t been truly tested yet. If you’re in your 20s, the stress is different than if you are in your 60s. Imagine the peace of mind from knowing your “worst-case” scenario is still a reasonably-comfortable retirement for you and your loved ones.