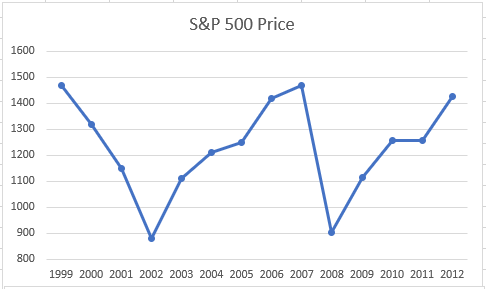

At the end of 1999, S&P 500 index closed at 1469.25 points

By the end of 2012, S&P 500 index closed at 1426.19 points

The price of US Equities went nowhere for 12 years. Investors also saw two large declines of 50% in 2000 – 2003 and 2007 – 2009 as well.

Annual Earnings increased from 51.68 in 1999 to 96.82 in 2012 however. That was an 87% increase in earnings power.

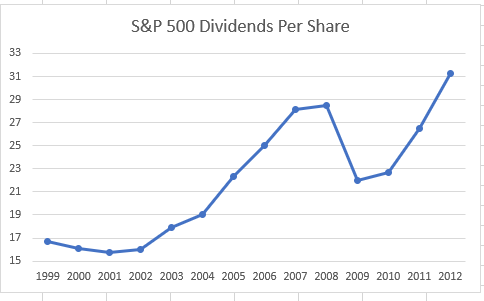

Annual Dividends also increased from 16.69 to 31.25. That was also an 87% increase over the period as well.

All of the returns on S&P 500 during that time period were from dividends

The yield on 10 year Treasury Bonds went from 6.44% in 1999 to 1.76% in 2012.

$100 at the end of 1999 had the same purchasing power as $136.40 in 2012.

Why did the index deliver no price returns, despite an 87% increase in earnings?

It’s because of the valuation multiple (P/E Ratio) shrinking from 28.40 times earnings in 1999 to 14.70 times earnings in 2012.

The dividend yield increased from 1.13% at the end of 1999 to 2.19% in 2012.

As discussed before, it is important to understand the sources of investment returns.

Investment returns are a function of:

1. Dividends

2. Earnings Per Share/FCF Share Growth

3. Changes in valuation

The first two items are the fundamental returns, which are dependent on the performance of the business itself.

The last item is the speculative return. It depends on the “mood” of market participants. In the case of S&P 500, market participants were very excited about equity prospects at the end of 1999, so they were willing to pay a premium for each dollar of earnings and dividends. In 2012 however, market participants were not excited at all about equities, and were not willing to pay much for equities. As a result, stock valuations were high in 1999, but low in 2012.

Lesson: When you overpay for an investment, you may not make much money on it, even if it delivers growth in earnings and dividends