Going into the fourth quarter, interest rate markets are pricing in a peak in most major central bank monetary policy tightening cycles by the end of this year, if not sooner.

Remarks from policy makers across the spectrum point toward future decisions on cash rates being dependent on the incoming economic data. This is somewhat of a return to normal programming for central bankers.

The pandemic-induced ultra-loose policy stance was followed by clear messaging of tightening for the foreseeable future to combat accelerating price pressures. While the inflation genie is not yet entirely back in the bottle, there is less concern than there was at the start of this year toward damaging increases in the cost of living. A soft landing might be in the offing.

Get your hands on the recently released U.S. Equities Q4 outlook today for exclusive insights into the pivotal catalysts that should be on every trader’s radar.

Recommended by Daniel McCarthy

Get Your Free Equities Forecast

With the uncertainty of the rate path going forward, many equity markets have reflected this unpredictability by being unable to establish lasting directional trends. While there have been some short-term trends emerge, they have been unable to eclipse the highs and lows of the last few years in many circumstances.

For instance, looking at the S&P 500 index, it has traded within an admittedly broad range of roughly 3500 to 4800 for almost 3-years.

S&P 500 WEEKLY CHART

Chart prepared by Dan McCarthy, created with TradingView

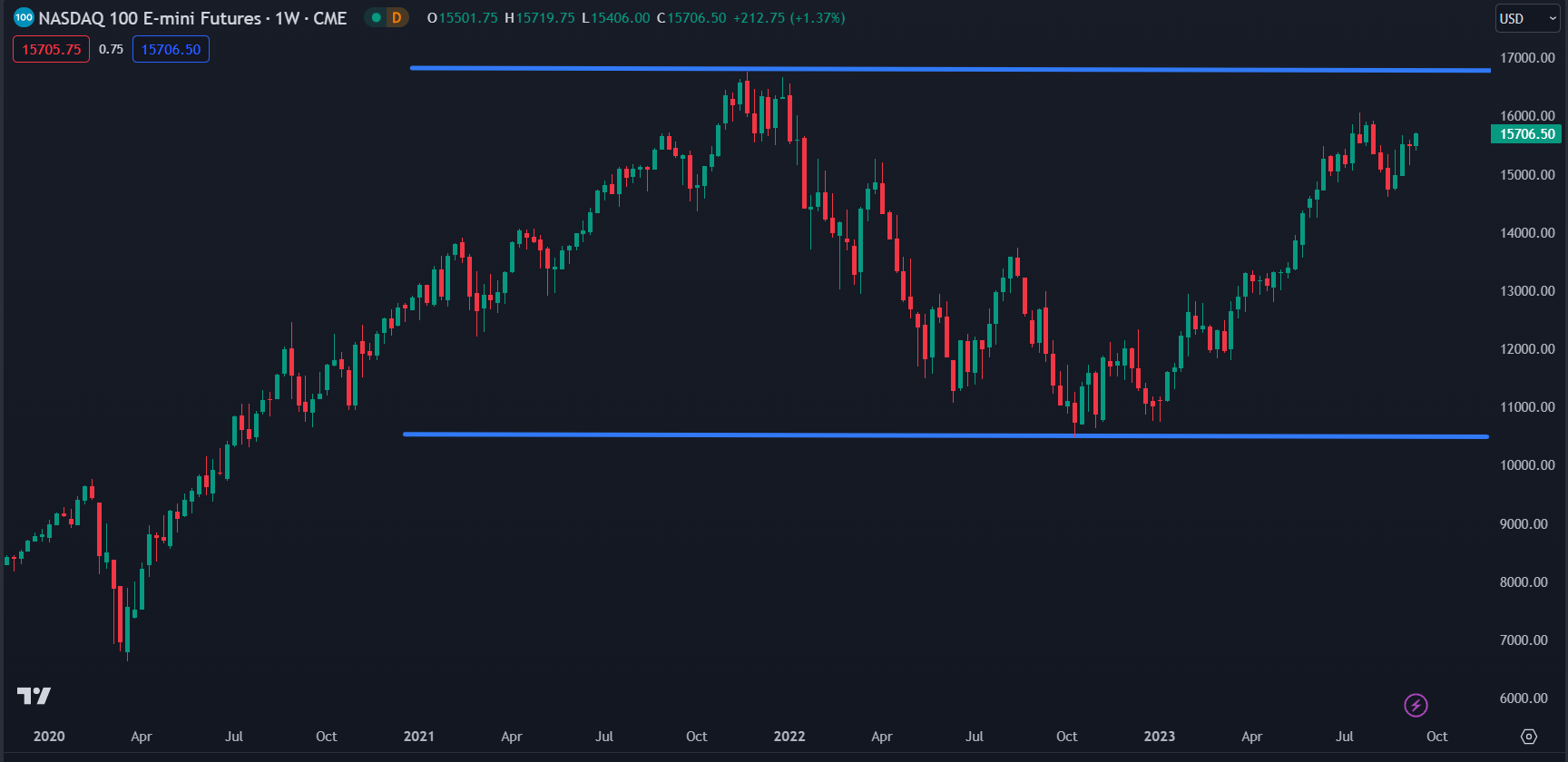

Some more examples of the picture of range trading across equity indices.

Chart prepared by Dan McCarthy, created with TradingView

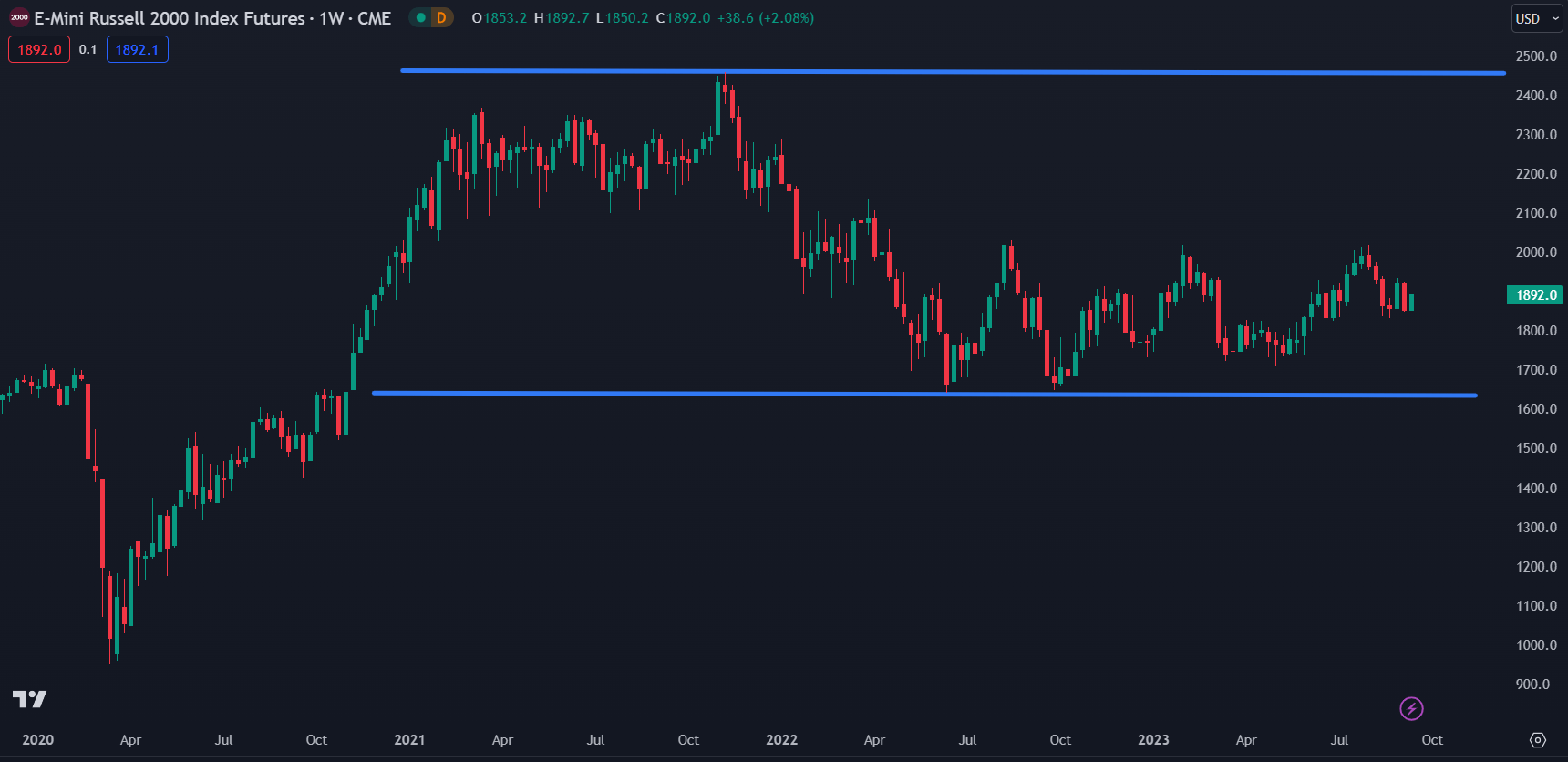

RUSSELL 2000

Chart prepared by Dan McCarthy, created with TradingView

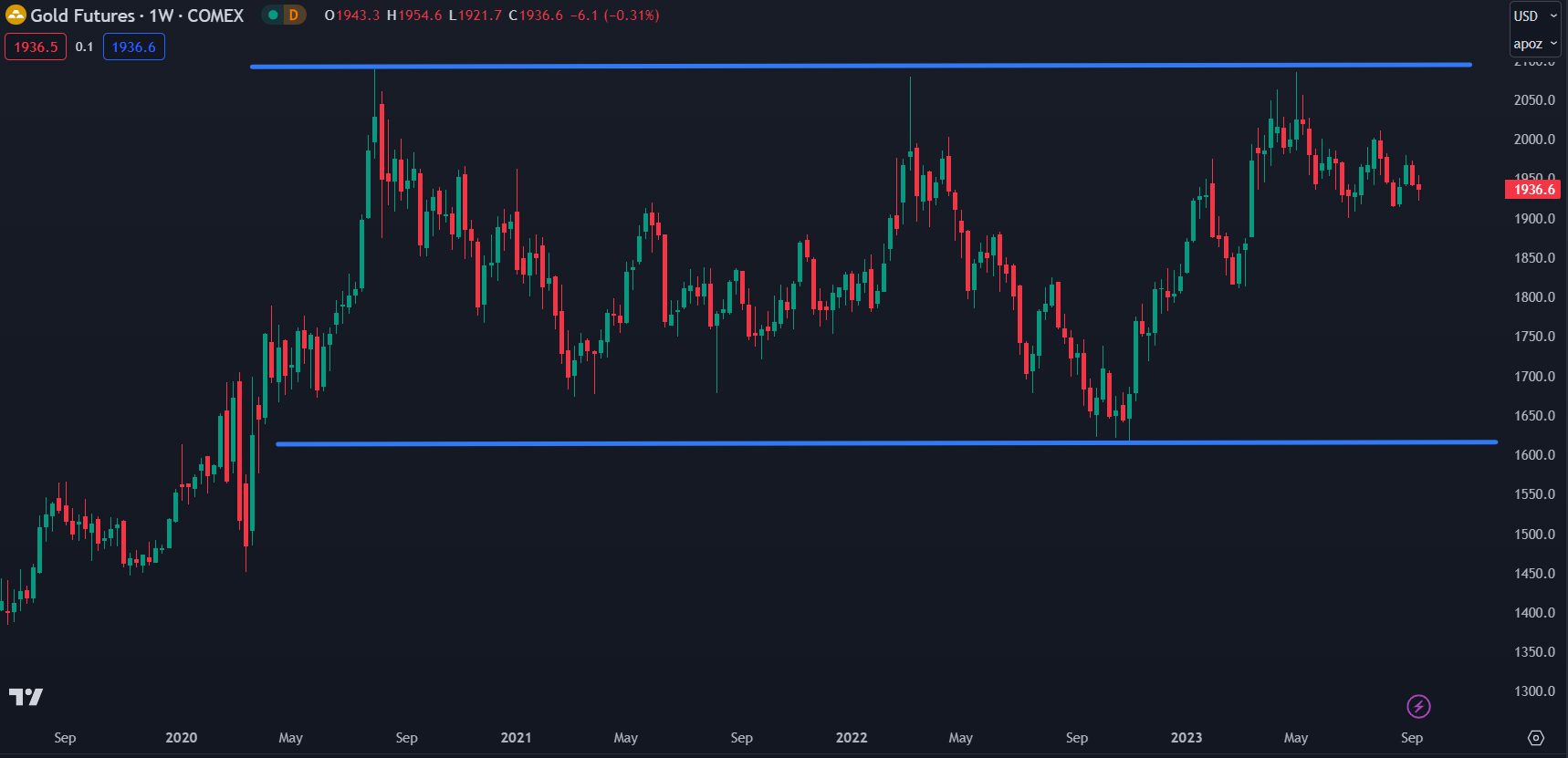

Gold is another example.

Chart prepared by Dan McCarthy, created with TradingView

There are many more markets that have displayed this type of long-term range-bound trading conditions.

Looking for the best trade ideas for Q4? Look no further and download your complimentary guide courtesy of the DailyFX team of Analysts and Strategists.

Recommended by Daniel McCarthy

Get Your Free Top Trading Opportunities Forecast

RANGE TRADING

If the ranges across these various asset classes are to hold, then identifying the opportunity is to recognize when a reversal has taken place.

There are many technical analysis techniques that can assist in this regard. Including, but not limited to.

- Candlestick Patterns (e.g., Island Reversal)

- Oscillation Techniques (e.g., RSI)

- Bollinger Bands

- Momentum Measures (e.g., A Golden Cross of Moving Averages)

A robust approach involves disciplined risk management. A single indicator is rarely consistent in accurately anticipating the reversal.

When a combination of reversal indicators is in line with each other, it might add weight to the reliability of the view. It should be noted though that past performance is not indicative of future results.

Looking forward, the trade opportunity may lie in the monitoring of ranges across various markets and being prepared for potential reversals. Especially so when the asset is nearing the edge of the range.

It is also possible that a short-term false break of the range may occur. These breaks outside the established ranges are often accompanied by stop-loss orders being triggered. Once those positions have been cleared out, a reversal signal might be worth paying attention to.

For more Tips and Tricks Around Range Trading, Feel Free to Download the Complimentary Guide Below.

Recommended by Daniel McCarthy

The Fundamentals of Range Trading

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter