Oil (Brent, WTI) News and Analysis

- EIA data reveals weaker US demand for gasoline – storage data picks up

- 20 DMA presents potential support in a falling market

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Recommended by Richard Snow

Get Your Free Oil Forecast

EIA Data Reveals Weaker US Demand for Gasoline – Storage Data Picks up

Oil prices have shot up since July as OPEC supply cuts, coupled with further discretionary Saudi and Russian cuts led to an extremely tight market. Despite a global growth slowdown, oil demand has been largely unaffected, until now.

EIA data has revealed a drop in US gasoline demand which the market was not very fond of. The US economy has proven more robust than its peers leading many to believe in the possibility of a soft landing. Therefore, any signs of fragility can land up causing a notable reaction. The issue of ‘demand destruction’ – a reduction in oil demand caused by higher oil prices – could be unfolding.

The graph below shows the rise in US gasoline storage after trending below the 5 year average.

A concerning data point in yesterday’s US services PMI report pointed to a sharp drop off in ‘new orders’, which may suggest a tougher Q4 than anticipated as higher costs restrict purchase orders from businesses and households.

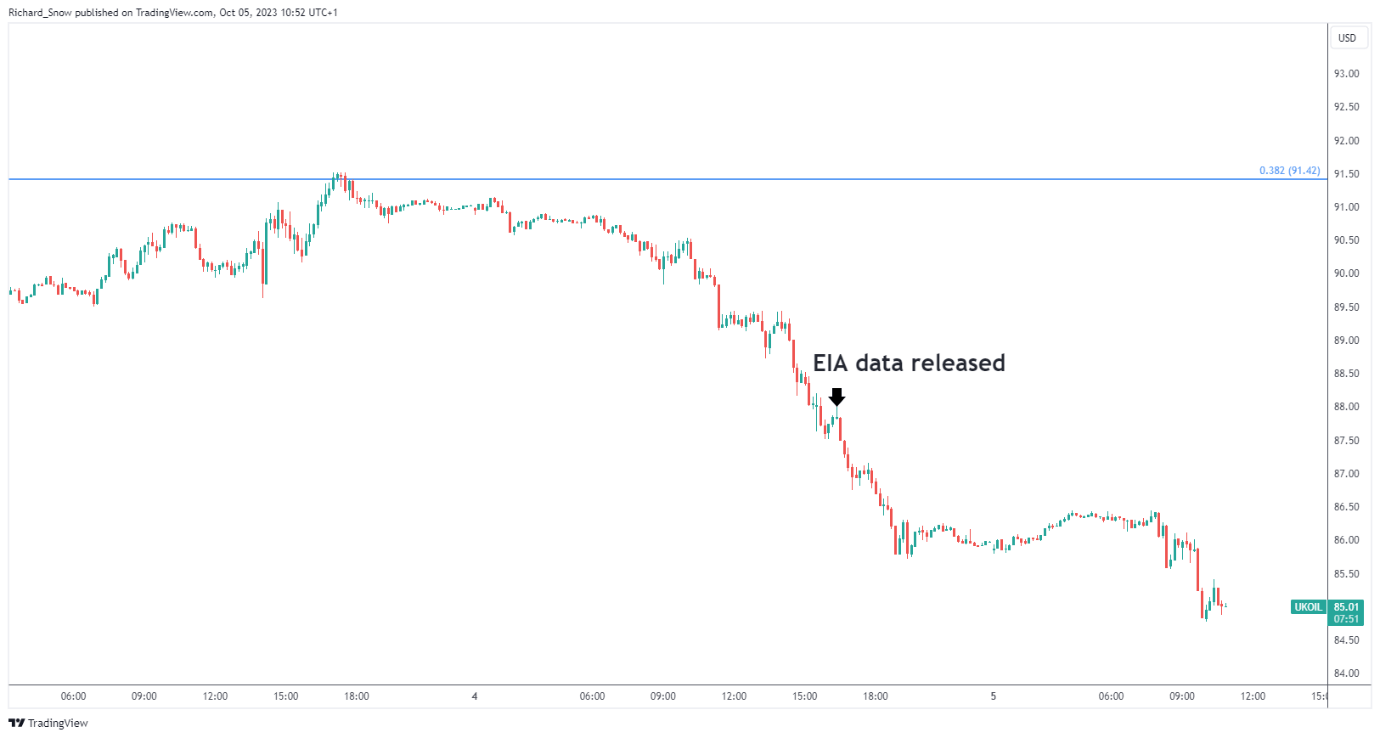

The 10-minute chart shows the exact time the EIA data was released, resulting in continued selling.

Brent Crude Oil 10-Minute Chart

Source: TradingView, prepared by Richard Snow

Oil is a market with a strong reliance on demand and supply factors. Take a look at the main fundamental drivers of this asset:

Recommended by Richard Snow

Understanding the Core Fundamentals of Oil Trading

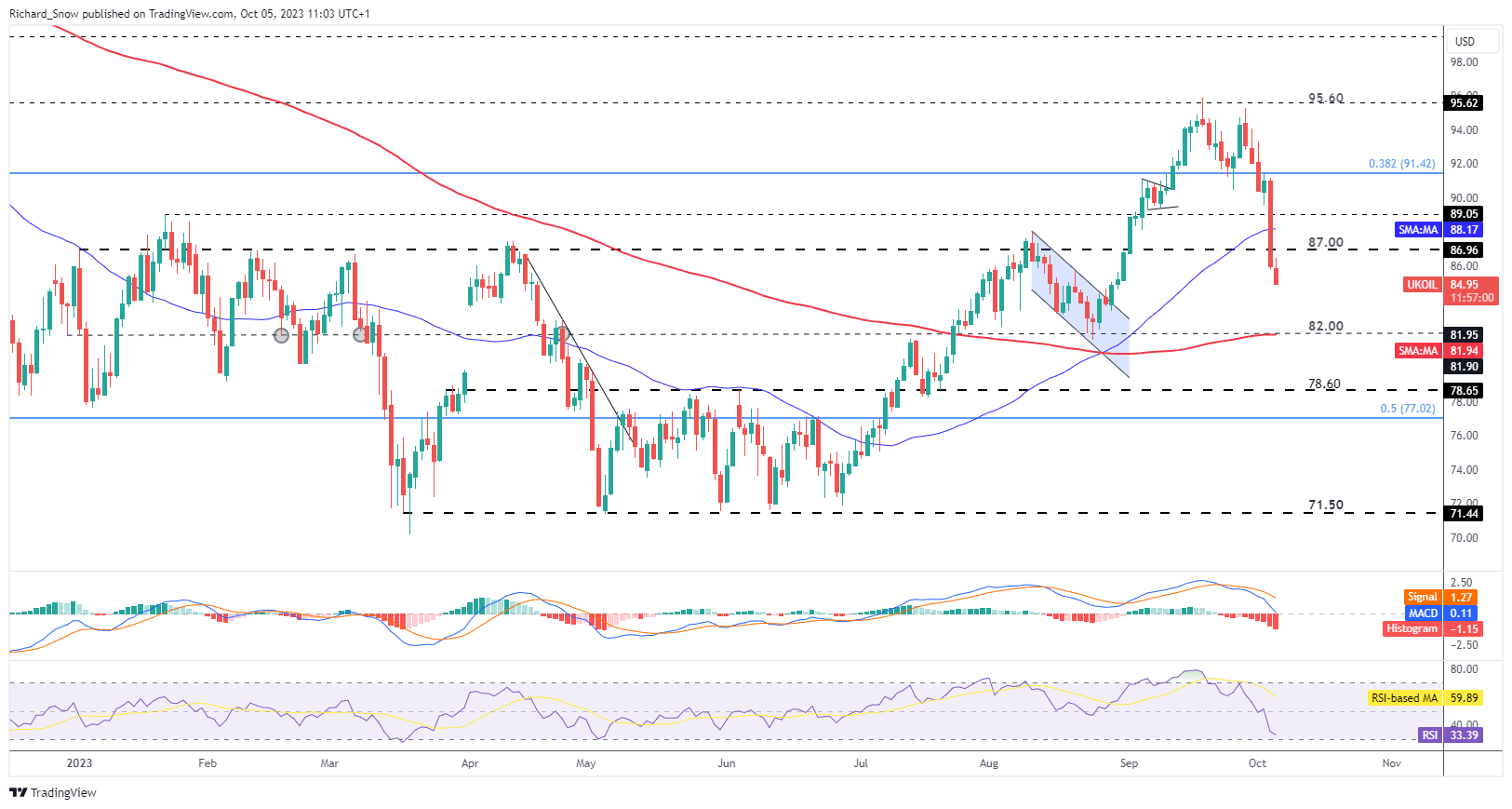

200 DMA Presents Potential Support in a Falling Market

Brent crude oil continues the decline today after losing around $5 to it price in yesterday’s trading. The decline took oil past the 50 simple moving average and $87 with ease. At the time of writing Brent crude trades below $85, with the 200-day simple moving average the next level of support at $82.

The MACD confirms bearish momentum is gaining traction and the RSI is hurtling towards oversold conditions but holds steady for now. It is commonly thrown about that it is unwise to try to catch a falling knife, this situation is no different as the selloff shows little indication of reversing. Resistance appears at $87.

Bullish continuation plays may be reconsidered in the event prices consolidate around $82/$80 as supply remains restricted.

Brent Crude Oil Daily Chart

Source: TradingView, prepared by Richard Snow

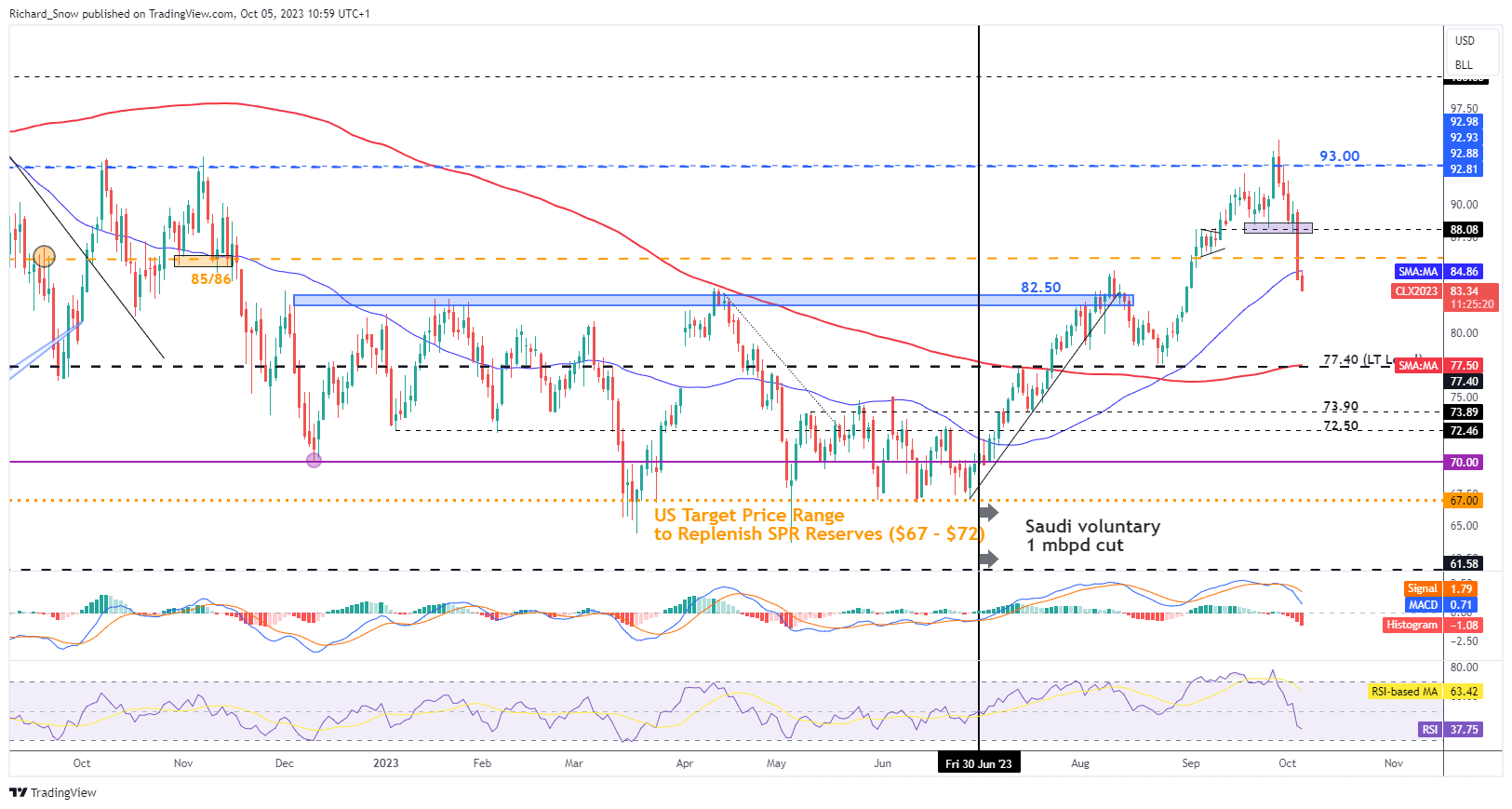

WTI experienced a fall of similar magnitude, also shedding around $5 of the WTI price. Prices now test the prior zone of resistance around $82.50 after breaking beneath the 50 SMA. The 200 SMA appears around the significant long-term level of $77.40 – which highlights a potential zone of support. Elevated US Treasury yields and a still elevated US dollar may work to extend the selloff in the short-term.

WTI Oil Daily Chart

Source: TradingView, prepared by Richard Snow

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX