“This time” is never different. The last few years in techland reminded many of us of the late 1990’s bubble. Sure, not every detail is identical. Back then the mega caps traded at crazy prices too (the Cisco’s of the world at >100 times earnings) but this time 25-30x for Apple, Microsoft, Google, or Facebook might be on the rich side, but not grossly overvalued. And just as last time we had Amerindo, Van Wagoner, and Navallier, now we have seen history repeat with ARK Invest.

Just as was the case 20 years ago, there will be great buying opportunities during this valuation reset. Netflix down 50%? Interesting. Amazon down 25%? Interesting.

I will share a list of tech that doesn’t look expensive anymore in the coming weeks (think: low to mid single digit price-to-sales ratios), but first let’s consider what kinds of situations still look frothy even after big declines. 15x sales isn’t attractive just because it was 30x six months ago. Current profits (or at least a clear path to get there within 1-2 years) are important.

Let me share one example where the price still looks silly; DoorDash (DASH) at a $40B valuation. Sure, it was $90B at the peak. All that tells us is how crazy things got. On the face of it, the pandemic should have instantaneously made DASH a blue chip name in the tech space that was raking in money. Other than maybe Zoom, which “pandemic play” would you have rather owned on fundamentals alone?

However, the numbers tell a different story. I think they illustrate the problem with the current Silicon Valley mentality of favoring TAM rather than profit margins when it comes to investing in the public markets. Every management team says they are mimicking the “Amazon model” but Amazon was never hemorrhaging money. They wrote the book on running the business at breakeven and reinvesting every penny generated back into the business. There is a big difference between flushing capital down the toilet and running at breakeven to try and maximize future free cash flow.

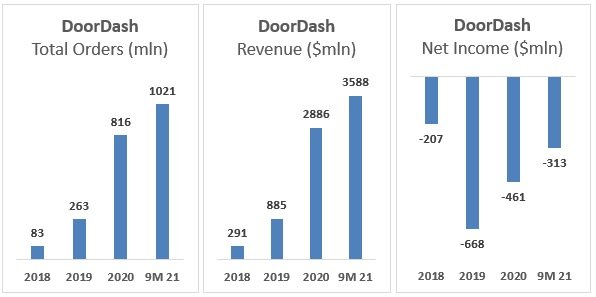

Here is how DASH’s financials have evolved as the largest food delivery service during the best possible operating environment imaginable: