The card_name is the newest entry into the ultra-premium business card category, with features similar to the card_name for consumers (you can have both at the same time). It has a large new-cardholder bonus, loads of perks, and a hefty annual fee. The net result is a first-year value of over $1,500! Let’s take a look at what it offers:

- 150,000 bonus miles (equal to $1,500 towards travel) when you spend $30,000 on purchases in the first 3 months from account opening.

- $300 Annual Travel Credit. Get up to $300 in annual statement credits when booking through Capital One Travel. Book your choice of flights, hotel nights, or car rentals. You can redeem these in partial amounts over the course of the year.

- 10,000 bonus miles (equal to $100 towards travel) every year, starting on your first anniversary.

- Up to $100 credit for Global Entry or TSA PreCheck®. Valid once every 4 years.

- Airport lounge access. Unlimited complimentary access for you and two guests to 1,200+ lounges, including Capital One Lounges, Priority Pass(TM) and Plaza Premium Group lounges.

- Elevate your stay at luxury hotels and resorts from the Premier Collection with a $100 experience credit and other premium benefits on every booking.

- This card has no preset spending limit, so you get purchasing power that adapts to your spending needs.

- Empower your teams to make business purchases while earning rewards on their transactions, with free employee and virtual cards. Plus, automatically sync your transaction data with your accounting software and pay your vendors with ease.

- This is a pay-in-full card, so your balance is due in full every month.

- Annual fee is $395. Free employee cards.

If you use your credit card to pay your income taxes, right now the lowest processing fee is only 1.85%. That means that as long as you have enough travel purchases to offset, the 2X miles per dollar spent in rewards from this card (effectively 2% back towards travel) will more than offset the payment processor fee, while also counting towards the bonus requirements.

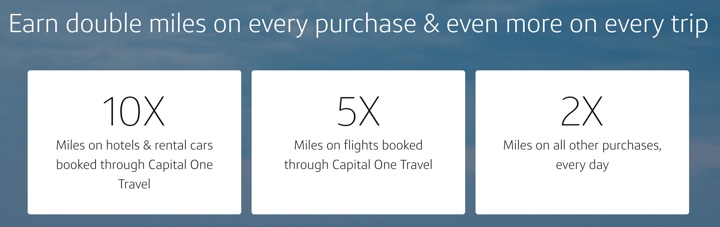

Here is the rewards structure on purchases:

- 10X Miles per dollar on hotels and rental cars booked through Capital One Travel.

- 5X Miles per dollar on flights booked through Capital One Travel.

- 2X Miles per dollar on every purchase, every day.

- Redeem miles for any airline, any hotel, rental cars, and more.

- Transfer your miles to your choice of 15+ travel loyalty programs.

Redemption details. Capital One “miles” can be redeemed directly for a cash statement credit on a 1 mile = $0.01 basis when offsetting any travel purchase made on the card within the past 90 days. In other words, 100,000 miles = $1,000 toward travel. That means you can fly on any airline or stay at any hotel, pay with this card, and then “erase” that purchase using your miles balance later. This even includes AirBNB vacation rentals, car rentals, and Uber rides.

This means that earning 2 miles on on every $1 in purchases essentially makes this a 2% back card when applied towards travel. Earn even higher rewards of 5 miles per $1 spent on on flights booked through Capital One Travel, and 10 miles per $1 spent on on hotels and rental cars booked through Capital One Travel.

The Capital One Travel portal offers price matching: if you find a better price on another website within 24 hours of booking, they will refund you the difference.

Miles transfer options. Capital One now allows you to transfer your “miles” into select airline miles programs as well. Here are the airline transfer partners:

- Aeromexico

- Air France/KLM

- Air Canada Aeroplan

- Cathay Pacific Asia Miles

- Avianca Lifemiles

- British Airways Avios

- Emirates Skywards

- Etihad

- EVA

- Finnair

- Qantas

- Singapore Airlines Krisflyer

- TAP Air Portugal

- Turkish Airlines

- Virgin Red

Hotel partners

- Accor Live Limitless

- Choice Hotels

If you know how to leverage one of these international airline miles programs, this can be a very valuable option. Otherwise, it’s nice to know you can always get a certain level of value by redeeming against any travel purchase.

Airport lounge access details. Capital One is creating their own lounges within select airports (currently in Washington DC’s Dulles Airport and Dallas/Forth Worth). Venture X Business cardholders get unlimited access and can bring 2 free guests per visit. Employee cards do not get lounge access benefits.

You also get Priority Pass membership, which includes access to 1,200+ participating VIP lounges and even included credits to spend at some restaurants, in more than 600 cities and more than 148 countries. You can bring yourself and up to 2 free guests.

Many people aren’t aware of the fact that they can apply for business credit cards, even if they are not a corporation or LLC. The business type is called a sole proprietorship, and these days many people are full-time or part-time consultants, freelancers, eBay/Amazon/Etsy sellers, Uber/Lyft drivers, or other one-person business owners. This is the simplest business entity, but it is fully legit and recognized by the IRS. On a business credit card application, you should use your own legal name as the business name, and your Social Security Number as the Tax ID.

Business cards from Capital One don’t show up on personal credit reports, so your outstanding balance, credit limit, and closure states won’t affect your credit score. You’ll still see a credit check on your personal credit report from the initial application.

Bottom line. The card_name is an ultra-premium business rewards card that earns a minimum of 2 Miles per dollar on all purchases, which you can either redeem against any travel purchase or transfer to one of their airline/hotel partners. There is a generous new-customer offer of 150,000 bonus miles (worth $1,500 towards travel). If you can take advantage of the $300 annual travel credit, $100 Global Entry fee credit, and add the 10,000 miles on every anniversary, then you’ve effectively offset the $395 annual fee in all future years. To top it all off, the airport lounge access is very nice.

Due to the $1,500+ first-year value, I will be adding this to my Top 10 Best Small Business Card Bonus Offers.