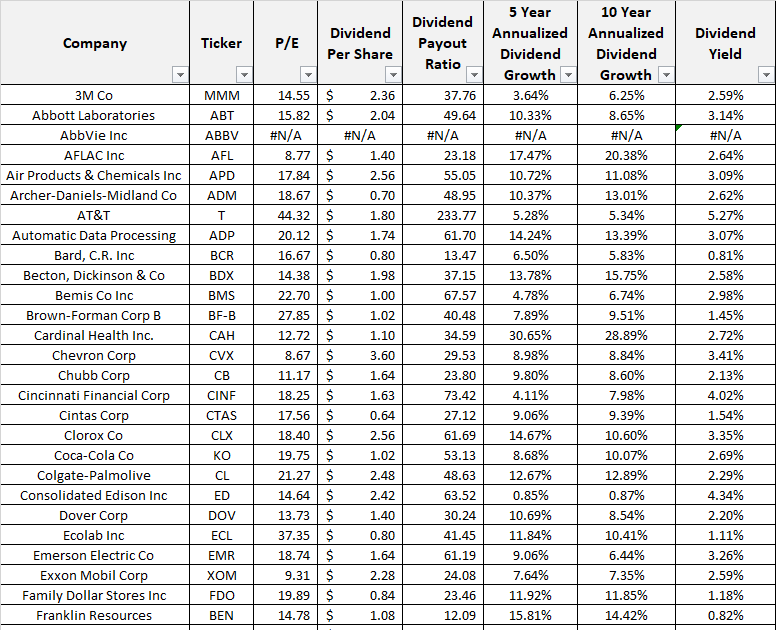

I obtained the list of Dividend Aristocrats for 2013 and created a test. There were 54 companies on the dividend aristocrats list as of the end of 2012. This is a list that was available for investors to use a little over 10 years ago. You can view the original list below:

Note: Data as of 12/31/2012

I have included the company name and. symbol The P/E ratio, dividend yield, and 5 and 10 year annualized dividend growth are as of 12/31/2012. That’s how they appeared at the time to investors.

To make the test, I assumed that a portfolio was equally weighted at the start. I then proceeded to trace how each company did between December 31, 2012 and July 31, 2023.

This presented some challenges, as some companies were acquired, and therefore the listing stopped being active. The companies acquired include Bemis, C.R. Bard, Family Dollar, Sigma-Aldrich. When they were acquired, I assumed that the money is invested in a portfolio of Dividend Aristocrats. I used the Dividend Aristocrats ETF as a proxy for this action, investing in it on the date stock for delisted.

There were three companies that cut dividends – AT&T, V.F. Corp and HCP Inc (now HealthPeak). In my investing strategy, I sell after a dividend cut. For the purposes of this exercise, I assumed that the investor kept holding on to those companies. This is mostly to reduce excess calculations on my part. You will notice that the dividend cutters were the worst performers of the group.

Abbott was split into two companies at the very end of 2012 – Abbott and AbbVie. The data shows information on legacy Abbott, include the P/E, dividend growth, etc. Both Abbott and AbbVie were determined to be dividend aristocrats. Even if they weren’t, passive investors would have held on to both.

With that being said, you can see the total returns performance for each company since then:

Note: Results for period 12/31/2012 – 07/31/2023

The best performers are surprising, because they are companies that few Dividend Growth Investors tend to talk about today. SPGI was attractively valued about 10 years ago, and we bought it when it was still called McGraw Hill. But the most discussed companies have average returns over the past decade.

This definitely reinforces my idea that we don’t really know what our best ideas are in advance, despite what we convince ourselves. Hence, it makes sense to diversify widely, and avoid concentrating at the start.

This is also a testament to the idea of cutting your losses, and letting your profits run. If an investor had sold Cintas and SPGI Global early, they would not have generated above-average the capital gains and dividend growth that these companies delivered. Their returns would have suffered. These companies delivered a majority of total returns, and those returns paid for so many losers and dividend cutters and eliminators.

Selling them would have been a mistake. This mistake would have been further compounded if the investor had added to the losers instead.

We don’t really know what our best ideas are in advance. In addition, we do not really know if the valuation today is cheap or expensive as well.

The best idea is to equal weight from the start, turn the drip on, and then let the companies do their thing without too much turnover. Turnover is costly in terms of paying capital gains in taxable accounts and potentially a steep opportunity costs.

You can view that investing $100 in each company would have cost $5,400. That investment would be worth $19,688 by July 31, 2023.

You can also view the developments in dividends per share for each company in the Dividend Aristocrats list from 2013. The four companies that were acquired have been excluded, as they are no longer publicly traded and a 2023 comparison cannot be made with 2013. I did include the dividend cutters for illustrative purposes. This mostly shows you that as a company fails, it ends up becoming a miniscule position. The companies that succeed end up commanding a higher weight, and their success more than compensates for any losers that the portfolio holds.

Thank you for reading. This analysis basically reinforces a few points I’ve tried to focus on for a while:

- Keep losses manageable, but let profits run

- It’s hard to know who the best performer is going to be.

- Owning quality in a diverse basket would likely result in good results over time

- Focus on the long run

- Maintain diversification

- Avoid concentration at the start

- Let portfolio concentrate on its own

- Selling is usually a mistake

- Your best ideas would propel portfolio forward, and pay for the worst ideas

- Valuation is tricky