- NZD/USD surged above the 0.5980 area, setting a three-day winning streak.

- US PMIs failed to meet expectations, but the US Service sector remains resilient compared to the leading economies.

- Lower yield and dovish bets on the Fed, weight on the USD.

In Wednesday’s session, the NZD/USD recovered ground, driven by a weak USD following the release of August S&P PMIs. Due to signs of a softening economy, US yields took a big hit, and markets seem to be betting on a less aggressive Federal Reserve (Fed). Investors now focus on Friday’s speech from Jerome Powell at the Jackson Hole Symposium.

The US Manufacturing PMI from August declined to 47, as opposed to the expected 49.3, while the Services index remained within the expansion category at 51 despite being lower than anticipated.

As the Federal Reserve (Fed) stated, decisions will depend on incoming data, weak PMI figures make markets bet that the Fed won’t be as aggressive as expected, and the US yields are showing sharp declines. With the 2, 5 and 10-year rates falling by more than 1%, the USD loses interest and trades weak against most of its rivals, and the DXY index fell towards the 103.30 area.

In line with that, according to the CME FedWatch tool, investors still are confident that the Fed won’t hike in September, while the odds of a hike in November fell to 35%.

NZD/USD Levels to watch

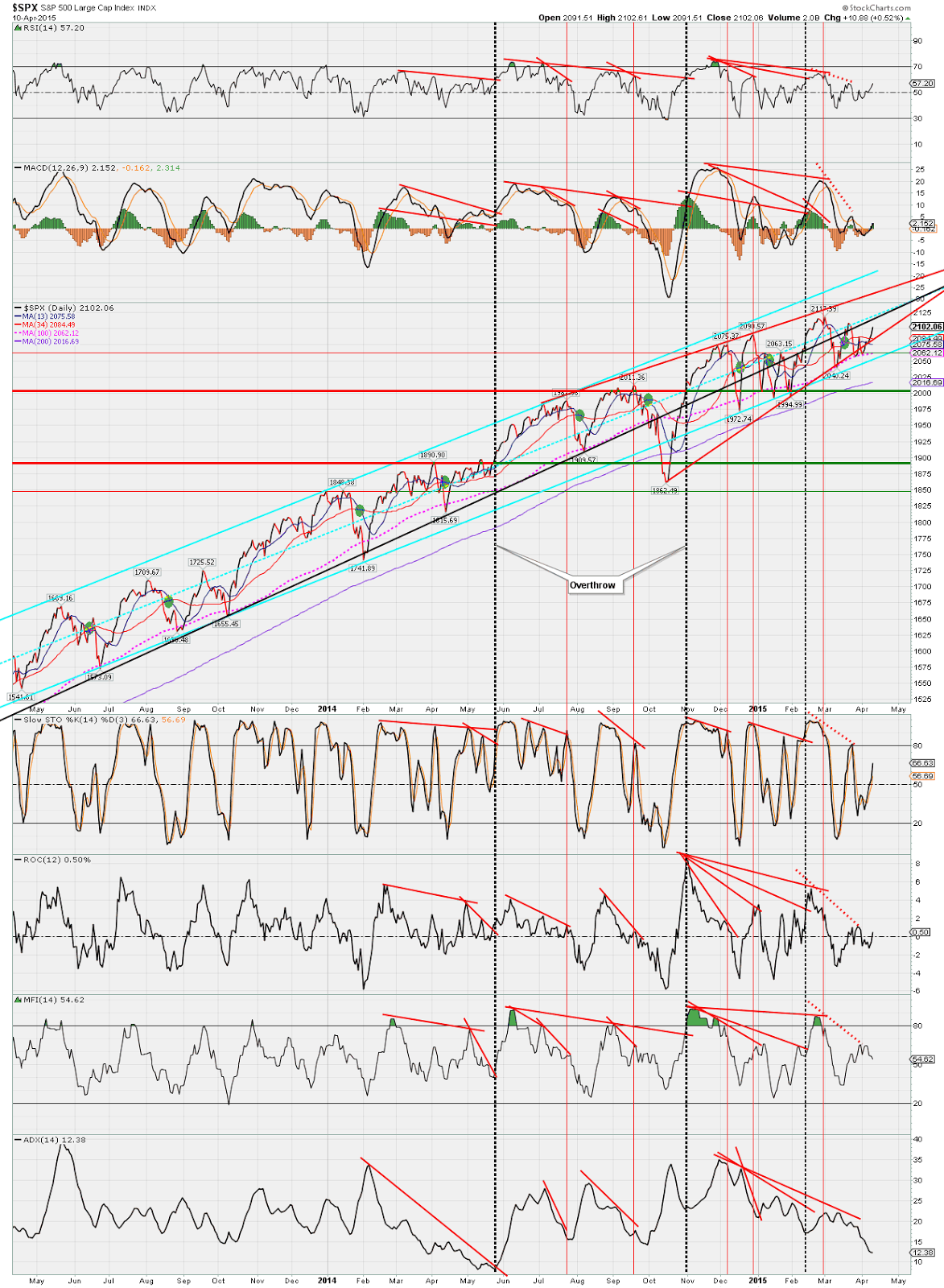

The daily chart analysis suggests a neutral to bullish outlook for NZD/USD, with the bulls gaining strength, although challenges persist. With a positive slope below its midline, the Relative Strength Index (RSI) signals a strengthening bullish sentiment, while the Moving Average Convergence (MACD) prints shorter red bars. Furthermore, the pair is below the 20,100 and 200-day Simple Moving Averages (SMAs), suggesting that the buyers are struggling to overcome the overall bearish trend and that the bears are still in charge.

Support levels: 0.6000, 0.6015, 0.6035 (20-day SMA)

Resistance levels: 0.5950, 0.5930, 0.5910.

NZD/USD Daily chart