CPMG Inc (Trades, Portfolio), a prominent investment firm, recently expanded its portfolio with the acquisition of a substantial number of shares in Reata Pharmaceuticals Inc. This article provides an in-depth analysis of the transaction, the profiles of both

CPMG Inc (Trades, Portfolio) and Reata Pharmaceuticals Inc, and the potential implications of this significant investment.

Details of the Transaction

On July 28, 2023,

CPMG Inc (Trades, Portfolio) added 2,123,530 shares of Reata Pharmaceuticals Inc to its portfolio, a move that increased its holdings by 73.30%. The transaction was executed at a price of $167.19 per share, bringing

CPMG Inc (Trades, Portfolio)’s total holdings in Reata Pharmaceuticals Inc to 5,020,431 shares. This acquisition significantly impacted

CPMG Inc (Trades, Portfolio)’s portfolio, with Reata Pharmaceuticals Inc now accounting for 98.66% of its holdings. Furthermore,

CPMG Inc (Trades, Portfolio) now holds a 14.30% stake in Reata Pharmaceuticals Inc.

Profile of

CPMG Inc (Trades, Portfolio)

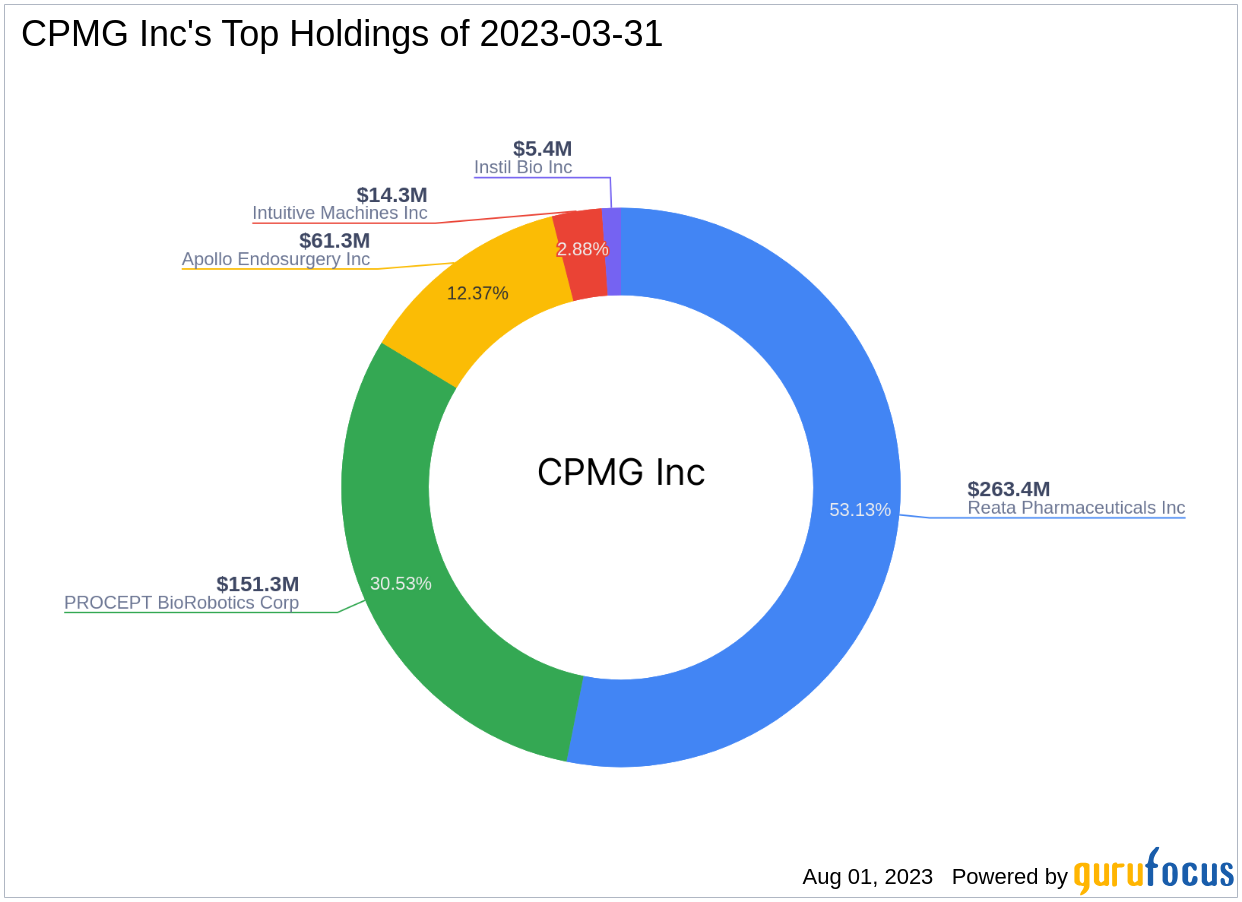

CPMG Inc (Trades, Portfolio) is a Dallas-based investment firm with a diverse portfolio. The firm’s top holdings include Apollo Endosurgery Inc (APEN, Financial), Reata Pharmaceuticals Inc (RETA, Financial), Instil Bio Inc (TIL, Financial), PROCEPT BioRobotics Corp (PRCT, Financial), and Intuitive Machines Inc (LUNR, Financial). The firm’s equity stands at $496 million, with a strong focus on the Healthcare and Industrials sectors.

Overview of Reata Pharmaceuticals Inc

Reata Pharmaceuticals Inc is a clinical-stage biopharmaceutical company based in the USA. The company focuses on identifying, developing, and commercializing therapeutics to address serious and life-threatening diseases by targeting molecular pathways. Its product pipeline includes bardoxolone methyl, Omaveloxolone, and others. The company operates under two segments: Other revenue, and License and milestone. As of the date of this article, the company’s market capitalization stands at $6.29 billion, with a current stock price of $166.1. However, the company’s PE percentage is 0.00, indicating that it is currently operating at a loss. Furthermore, GuruFocus has deemed the stock to be significantly overvalued, with a GF Value of 12.00 and a Price to GF Value of 13.84.

Performance of Reata Pharmaceuticals Inc’s Stock

Since its IPO on May 26, 2016, Reata Pharmaceuticals Inc’s stock has seen a significant increase of 1401.81%. The year-to-date price change ratio stands at 352.47%. However, the stock’s GF Score is 40/100, indicating poor future performance potential. The stock’s F Score is 1, and its Z Score is -0.34, suggesting potential financial instability. The stock’s cash to debt ratio is 2.72, ranking it 1035th in the industry.

Financial Health of Reata Pharmaceuticals Inc

Reata Pharmaceuticals Inc’s financial health is a cause for concern. The company’s ROE is -38758.59, and its ROA is -61.85. The company’s gross margin growth is 0.00, and its operating margin growth is -158.40. Over the past three years, the company’s revenue growth has declined by 58.80%, while its EBITDA growth and earning growth stand at 6.90% and 3.60% respectively.

Momentum of Reata Pharmaceuticals Inc’s Stock

The stock’s RSI 5 Day is 91.69, its RSI 9 Day is 88.34, and its RSI 14 Day is 84.91. The stock’s Momentum Index 6 – 1 Month is 119.03, and its Momentum Index 12 – 1 Month is 241.46. The stock’s RSI 14 Day Rank is 1598, and its Momentum Index 6 – 1 Month Rank is 18.

Largest Guru Holding Reata Pharmaceuticals Inc’s Stock

The largest guru holding Reata Pharmaceuticals Inc’s stock is the

Vanguard Health Care Fund (Trades, Portfolio). However, the exact share percentage held by the fund is not available at this time.

Transaction Analysis

The acquisition of Reata Pharmaceuticals Inc’s shares by

CPMG Inc (Trades, Portfolio) is a significant move that has greatly impacted the firm’s portfolio. Despite the financial challenges faced by Reata Pharmaceuticals Inc,

CPMG Inc (Trades, Portfolio)’s substantial investment suggests a strong belief in the company’s potential. However, given the stock’s current valuation and financial health, this transaction carries a considerable amount of risk. It will be interesting to observe how this investment influences both the stock and

CPMG Inc (Trades, Portfolio)’s portfolio in the future.

All data and rankings are accurate as of August 2, 2023.