Manufacturing and construction give very mixed signals to start Second Half 2023 data

– by New Deal democrat

As usual, the month’s data started out with the ISM manufacturing report for last month, and construction spending for the month before last. Additionally, I am going to take a look at motor vehicle production, because I think it is unusually important right now.

Manufacturing contracted for about the 10th month in a row in July, while the more leading new orders component has now contracted for more than a year. The index did rise 0.4 to 46.4, and new orders subindex rose 1.7 to 47.3:

Any reading below 50 indicates contraction, and ISM itself indicates that a reading of 48.7 in the total index is the breakeven point for the economy. So at face value, this continues to be very negative.

This month I also want to spotlight the price paid subindex, which has been the most negative of all, down as low as 40 near the end of last year. It remains the most negative now at 42.6, up 0.8 for the month:

Here is the question: how much of the continuing steep decline in commodity prices paid by manufacturers has to do with declining demand, and how much due to increasing supply, as pandemic bottlenecks unspool? Stay tuned.

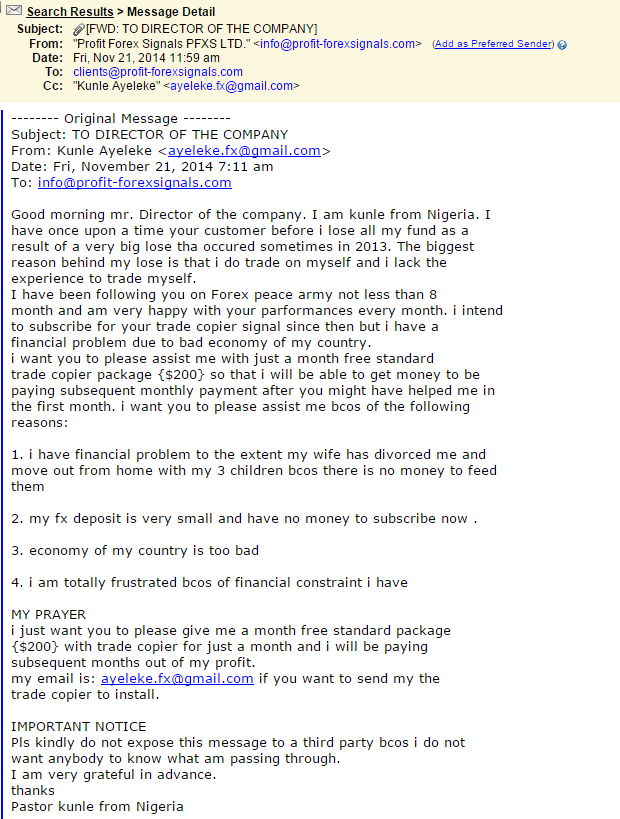

Next, motor vehicle manufacturers used to report customer demand every month. Now they only report quarterly, which is not timely enough to be very interesting to me. But the DoT does report monthly with a one-month delay. They reported June’s numbers at the end of last week, showing an increase to 15.7 M cars and light trucks bought on a seasonally adjusted annual basis, while heavy weight truck sales declined to 538,000 annualized:

Needless to say, motor vehicle production is a significant component of manufacturing. This tells us, importantly, that while most manufacturing is declining, per the ISM report, motor vehicle production is still ramping up as supply chain disruptions unspool. This is of a piece with the big increase in rail car deliveries I highlighted yesterday:

Heavy weight vehicle sales in particular are very cyclical, having turned down sharply well in advance of nearly every previous recession in the past 50 years.

This is important because the ISM index, discussed above, is a diffusion index. It does not weight its various components. This tells us that a very large component, vehicle production, has been a strong counterweight to the decline in other manufacturing industries.

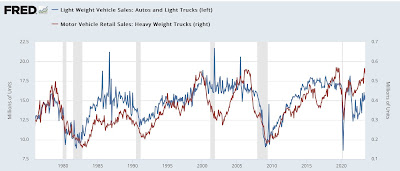

Turning finally to construction, nominally total construction spending rose 0.5% in June, while the more leading residential construction spending rose 0.9%:

But after adjusting for the cost of construction materials, while private residential construction spending did rise, it remains just off its worst post-pandemic levels:

The picture that emerges from this month’s opening data is very mixed. Manufacturing as a whole continues to decline, but against the weight of the very important expanding sector of motor vehicles; while construction continues to increase nominally, but the most leading component has rebounded only slightly in real inflation-adjusted terms.

Manufacturing and construction sectors continue downward pull-on economy, Angry Bear, New Deal democrat.