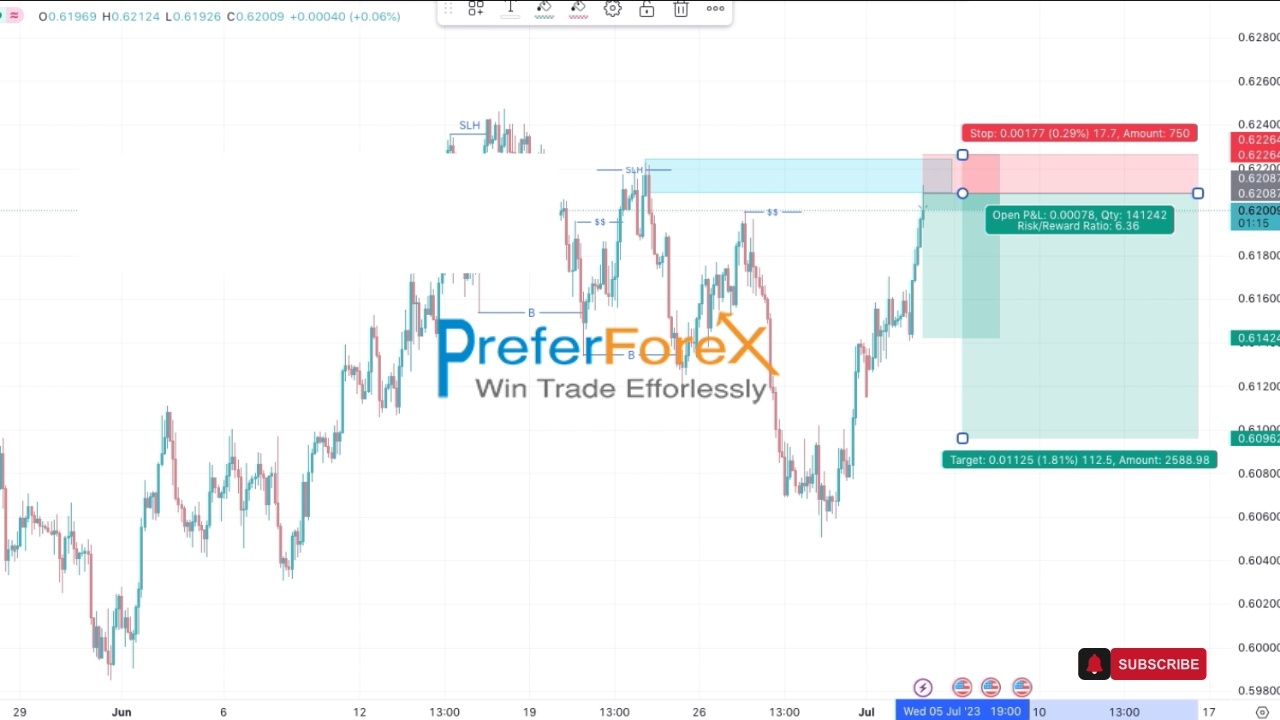

As per the price action, there is a short-term selling opportunity for NZD/USD. Here, we will discuss the trading potential of NZD/USD and focus on a trading plan that involves entering the market from the nearest supply zone.

The pairs experienced a temporary uptrend. But it’s crucial to recognize the presence of a nearby supply zone, which could act as a resistance area and potentially lead to a price reversal.

Based on our analysis, we anticipate a short-term upward trend. However, on the upside there is a nearby supply zone that could potentially act as a barrier, leading to a price rebound.

Identify the Nearest Supply Zone: Here we show the nearest supply zone on the NZD/USD chart. This area represents a potential selling opportunity.

Entry Strategy: Plan your entry by setting a sell limit order just below the supply zone. This approach allows you to enter the trade at an optimal price if the price retraces from the supply zone.

Risk Management: Place a stop-loss order above the supply zone or a level that offers a reasonable buffer. This helps protect your capital in case the price breaks out of the supply zone.

Profit Targets: Determine your profit targets based on your risk-reward ratio and consider setting them near support levels or previous swing lows.

To get our FREE trading signals in WhatsApp Join today!

visit youtube: https://www.youtube.com/watch?v=m4czGfJXpSM

All of the Analysis is based on the market order flow Method. It is one of the most popular methods for institutional traders.

In the premium member area, there is some discussion on the method like-

- Order Flow Principle

- Clear Market Structure

- BOCH

- CoCh