One counterexample, ONE, is sufficient to destroy the dangerous passive fad and ridicule index fund “Nobel” laureates. Don’t trust naive lists of unanalyzed stocks sold as “low fee” but high cost, no skill, zero work, volatile index funds. Past returns DO predict the future if, and only if, the manager is skilled. Top hedge fund managers like Warren Buffett and George Soros invest in talent NOT beta. Why avoid the best? Passive pimps claim George and Warren are just lucky! Lucky for 60 years?

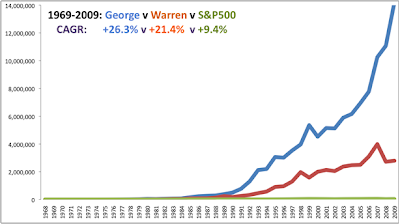

Warren prefers book value to measure his hedge fund’s performance but only his partnership valued at NAV. Desiring permanent capital, Warren switched to a listed closed end fund legal structure so shareholder sentiment affects returns. “Lucky” hedge fund managers Warren Buffett and George Soros’ returns since 1969 are charted below. Green line is speculator John Bogle‘s high risk index fund that buys 500 stocks S&P ACTIVELY pick and frequently trade! Bogle claims skill doesn’t exist and sells UNSKILLED toxic waste to risk-craving speculators. Not for me or any orphan, widow and retirees relying on savings.

Warren is correct that the best investment book in english is “The Intelligent Investor”. Runner up is “Alchemy of Finance” though hardly anyone tries to understand it, creating an edge for those that do. By far the top finance book in any language is Fountain of Gold, written by the best hedge fund manager ever. Rounding out the top are “Tunnel Thru the Air”, “Margin of Safety” and of course “Il Deserto dei Tartari” read in original Italian. If, like me, you master every page of each book, you will produce higher risk adjusted returns than 99{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} of professional investors. And 100{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} of Nobel prize “winners”.

Many investors avoid quality funds. Market benchmarks are too risky. How do you find great managers? With skilled due diligence it is possible to identify FUTURE outperformers in advance. George Soros and Warren Buffett’s skills were clear over 40 years ago so there was plenty of time to invest. Their successful absolute return strategies have brought major benefits for society and secure retirements for their grateful clients.

Mid-career professionals like Warren and George have delivered great returns while hedge fund managers aged under 80 build experience. Net of fees, George turned $1,000 into $14 million and Warren to $3 million in his actively managed closed end fund BRKA. He charges lower fees than passive managers and his hedge fund is open to all. The high risk S&P grew to just $0.039 million. Low fee funds are neither low cost nor low risk.

Warren Buffett runs the Berkshire Hathaway hedge fund and George Soros is the top performing living hedge fund manager. The optimal portfolio is investing 100{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} in talent and 0{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} in asset classes or funds that depend on their direction. Don’t random walk your way to poverty. Don’t fight the Fed and don’t fight Warren. He is 100{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} invested in skill.

Warren made money for clients every year of 1960s but George produced absolute returns every year of 1970s, a far more difficult decade. In due diligence I haven’t found anyone else that was able to do that. Warren has delivered a lot of alpha but George has made more. We can all be thankful to both of them for destroying the efficient markets hypothesis and the dangerous passive fad.

While Eugene Fama, William Sharpe, Robert Merton, Harry Markowitz, Myron Scholes were cooking up dumb “models” for portfolio “optimization” and how markets supposedly moved, REAL WORLD practitioners George and Warren were knocking the cover off the ball making a mockery of inbred academic stupidity. Follow the doers not idiot theorists on tenured salaries.

Samuelson set economics down the dangerous path it has taken since 1950s. True economists Adam Smith, Alfred Marshall and John Maynard Keynes must be spinning in their graves at the damage that he and followers wrought. Passive pimps cite Samuelson’s “Challenge to Judgement” in their ludicrous claim that no manager can beat the market. All he had to do was look at Warren or George’s (or John Templeton, Benjamin Graham, Ed Thorp, Munehisa Honma etc) track record. But he didn’t. Why let FACTS destroy dumb theory?

Investing in SKILL is the only prudent allocation. Talent and hard work are necessary to find alpha which is why so few managers produce it. Index funds charge outrageous fees for ignoring risk, doing no due diligence and just tracking someone’s list of stocks. Why wouldn’t you want your money managed by the best? Hedge fund managers never retire as the calling is for life. The only variable is which clients they accept. George now only manages for friends and family. Warren’s hedge fund is still open to YOU.

Portfolio performance is determined by manager mix NOT asset allocation. The more people believing in efficient markets the more inefficient markets become. Trillions in index funds creates more alpha capture opportunities. Benjamin Graham ran the Graham-Newman hedge fund from 1920s. Warren short sold cocoa futures in a special situations deal as far back as 1954. He also got into insurance to access the float and not need to borrow from prime brokers. In due diligence, I found so-called “first” hedge fund A.W. Jones mostly front ran analyst upgrades so was NOT skill-based and would be illegal today.

Warren is mainly a derivatives and hybrids trader though he does hold a few core stocks as a hobby. “We have long invested in derivatives contracts that Charlie and I think are mispriced, just as we try to invest in mispriced stocks and bonds”. Remember that when passive investing zombies claim active management and security analysis are “pointless”.

George and Warren generated high alpha from low frequency trading via various legal entities. Double Eagle – Quantum, Buffett Partnership – Berkshire Hathaway. Like many other hedge funds, they don’t report returns to databases, only to clients. Neither has CAIA or CFA but both have exceptional quant skills. I have never found a good manager that doesn’t, including if they run fundamental styles. Skilled managers do deliver reliable absolute returns and prove that market prices are NEVER correct.

George’s track record is better but Warren is richer. Why? The snowball of POSITIVE compounding for longer. Both were born in August 1930 and Warren ran his hedge fund from 1957 but George didn’t set up his until 1969. Warren was lucky to be in Omaha while Dzjchdzhe Shorash was in Budapest, more affected by WW2. Also Warren got into currency trading and philanthropy later. George’s outperformance is due to more international diversification and because reflexivity is ignored. Value investing is copied more than reflexivity investing. The 2008 subprime credit crisis was a quintessential examples of reflexivity.

The sad passive fad is reflexivity in action. So many securities’ pricing behavior are now driven by indices NOT economics. Index funds buy stocks because they are on a list not after thorough analysis and due diligence. The difference between benchmark stocks and bonds and those not in a widely tracked index are very noticeable. Such predictability creates even more ineffficiencies for the skilled to monetize. YES beta leads to alpha.

Warren ran a partnership from 1957-1969 and then implemented his strategies via Berkshire Hathaway. He first bought BRKA shares in 1962 at $7.60 and it’s now $120,000 for a 22{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} CAGR. But the Buffett Partnership did better with all 13 years positive. Gross returns of 29.5{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} were net 23.8{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} to investors after his 25{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} incentive fee above 6{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} hurdle. What if, instead of “retiring” in 1970, Warren had continued the partnership and performance had persisted? Investing $1,000 in 1957 would now be $100 million. Fees that Warren might have been “paid” for turning $1,000 into $100 million would be $1 billion. That’s good since clients would STILL have $99.9 million MORE than gambling on passive funds.

Warren, George and many others have destroyed efficient market hypotheses, random walk assumptions and the myth that asset allocation drives portfolio returns. BHB Brinson et al cost too many investors too much money and wrecked retirement plans, foundation spending and endowment budgets. In the real world fiduciary investors want ALL their capital in attractive opportunities and that requires skill. George and Warren’s alpha capture from security selection worked better than static beta bets. No-one says it’s easy but if you work hard it is possible as they have proved. Such teams CAN be identified at an early stage and charge whatever hedge fund fees clients are prepared to pay.

Academics say Warren is just an ex-post lucky outlier but some spotted his talents ex-ante. Were they lucky too? The S&P 500 also began in 1957 but has performed terribly by comparison – $1,000 would now be just $100,000, huge opportunity cost and pathetic “compensation” for its risk. Investing for absolute return using competitive edges and outside the box thinking has existed for centuries. Long only relative return is the fad. Passive indexing is even newer. The trouble with owning dartboards is that you get the treble 20 but you also tie up precious cash in 1s, 2s and 3s. With proper analysis, average hedge funds can be avoided just like average stocks. I prefer to identify the Phil Taylor of each strategy. How many darts must you throw to show skill? George and Warren have hit many treble 20s.

Warren wants to be judged on book value not stock price but you can’t eat book value and I evaluate fund managers by what investors really receive. Partnerships are marked at NAV but the switch to BRKA subjected clients to the irrational and highly inefficient public markets. In 2008 BRKA book value dropped -9.6{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} but shareholders lost -31.8{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}. George made money in that allegedly “challenging” year. While the stock has returned slightly more than book value due to the valuation premium, the volatility has been high. Warren’s actual Sharpe ratio is lower than his book value “Sharpe ratio”, dropping from 1.4 to just 0.6. Of course that is still much better than the high risk S&P 500. VFINX, SPY and its brethren have been disasters.

The Oracle of Omaha and the Brain of Budapest have “quit” before. George has hired “replacements” since 1981 and the extent of his involvement has fluctuated since though never without close knowledge of and implied oversight of the portfolio. For each Li Lu or Todd Combs there was a Jim Marquez or Stanley Druckenmiller. No man is an island and both sought out strong partners and talented employees from early on. Jim Rogers and Charlie Munger added significantly. Accredited investors – anyone with $80 – can access Warren and Charlie’s abilities through BRKB, a listed closed-end fund. The active stockpickers at benchmark construction firms missed 45 years of massive growth but then add it to their “unmanaged” index!

Would Warren and George have bothered managing outside money if they hadn’t been incentivized to do so and perform? It’s skill that adds value. No alpha, no incentive fee. George’s partnership fees were lower than Warrens’s for gross returns above 25{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}. Since George and Warren’s gross performance was in excess of 25{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6}, George’s fee structure was actually cheaper. Jim Simons and team have outperformed both for the past 20 years with much higher fees but the net returns of Medallion Fund were superior. The technological and personnel infrastructure requirements for high frequency trading cost more than for low frequency. If you don’t like the fees, don’t invest in hedge funds. Capacity for a good strategy is limited and demand exceeds supply of alpha. But it’s expensive and dangerous waiting to find out WHETHER bargain beta might one day deliver.

Those “outrageous” fees? George charged 1{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} and 20{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} no hurdle whereas Warren charged 0{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} and 25{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} on 6{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} hurdle, then offered his money management skills for FREE in return for permanent, leveraged capital. But you would have done much better going with Soros Fund Management in 1969 and paying those “high” fees than you would with BRKA. I am delighted for people to be well compensated for delivering what I need, ABSOLUTE ALPHA, from their RARE abilities. If someone turns $1,000 into $100 million from skill not luck or riding the market, they deserve $1 billion. Especially when manager interests are aligned with clients by them being the largest investor in their fund. When George or Warren has a bad month, they PERSONALLY lose more than any client. That INCENTIVIZES them to do their best to minimize the downside.

This chart assumes fees compounded without the manager needing to eat, live, pay employees, run the business etc. which of course they do. In recent years, with investor demands for larger teams, deep benches and operational infrastructure, fixed costs for hedge funds have risen to the 2 and 20 mode. Two people, a computer and a phone do not get institutional money today. Sad though to see an Omaha pension fund deep in a $600 million deficit when they could so easily have hired a local hedge fund run by Warren Buffett to get them into surplus. The Hungary retirement system is not in good shape either but they could have invested with George Soros and would now be doing fine. Why avoid top absolute return managers when you have ABSOLUTE LIABILITIES to fund?

You can’t eat relative returns but you CAN eat absolute returns and I’ll take $100 million over $100,000 every time. I assume you would too. Sadly most “advice” focuses on asset allocation NOT manager selection. Save fees or upgrade skills? So what if the manager becomes a billionaire? They deserve it for the essential entrepreneurial service they offer. If clients get rich, it is fine by me if the manager gets richer. Plenty of “discount” funds are available but at what performance? Avoiding “high” fees for alpha is like saying to a Porsche dealer you will only pay $100 for a new car because that is what the raw materials cost. Or that Shakespeare was just a lucky fool who “randomly” chose words from the dictionary. I am writing this on Apple AAPL hardware using Microsoft MSFT software uploaded to a service owned by Google GOOG. Using those products may further enrich several people who are already billionaires. Does it matter? Or do SHARED incentives work?

No-one is forced to invest in hedge funds. Investors are free to make do with passive beta and relative return if they can stomach the risk. I can’t. Some even say alpha doesn’t exist! If you flip a coin 10 times and get 8 heads it might be a fluke but NOT if you flip 1,000,000 coins and get 800,000 heads. Warren and George have flipped too many coins for their returns to be luck. They made their clients rich, deservedly got richer themselves and are giving their wealth away for the social benefit of the world. A rare financial win/win/win.

SOURCE: Hedge fund – Read entire story here.