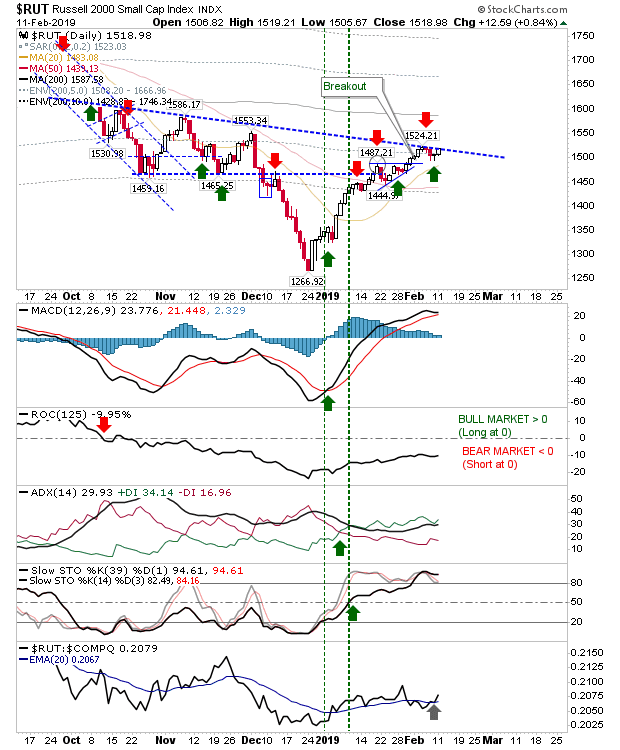

There wasn’t a whole lot to add today’s action as 200-day MAs dominate near term action. The only index which offered a little kicker was the Russell 2000; it posted a small gain which left it nestled against declining resistance. It has the look of an index which wants to break out, but it’s not there yet.

Aside from the Russell 2000 there wasn’t a whole lot going on. The Dow Jones Industrial Average is holding on to its 200-day MA despite a small loss today. I’ll stick to the ‘buy’ signal but today’s action was not encouraging. At least volume was light to the downside. On-Balance-Volume switched to a ‘sell’ trigger and the index continues to underperform the Nasdaq 100.

Let’s see what tomorrow brings.

You’ve now read my opinion, next read Douglas’ blog.

—

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Investments are held in a pension fund on a buy-and-hold strategy..

SOURCE: Fallon Financial Commentary – Read entire story here.