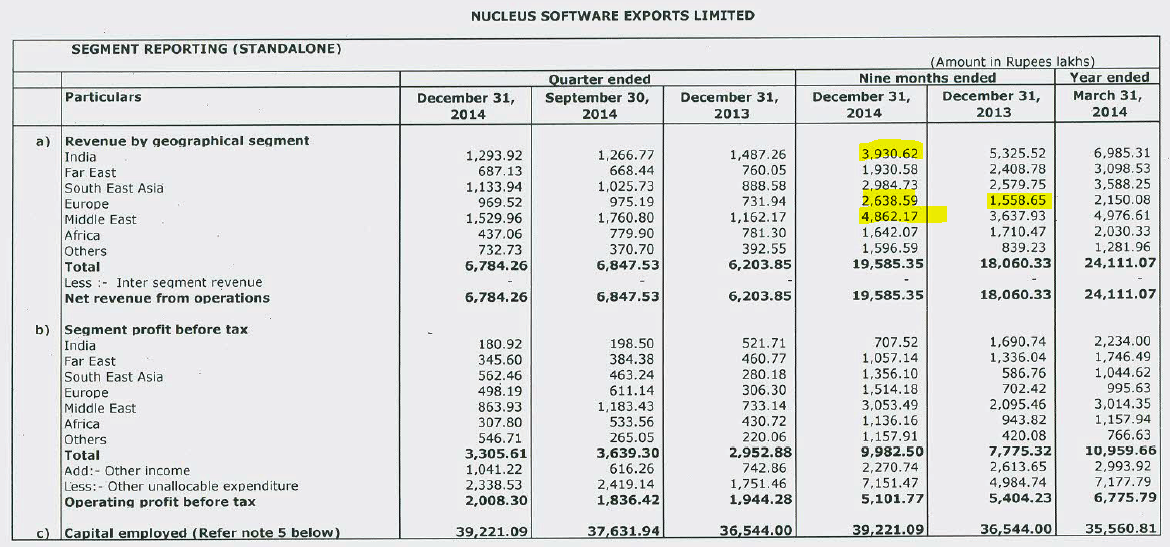

Looking at Nucleus Software’s massive eight years of yawning under performance made me look further back in its history. There is a lot wrong with the company and the company is generally compared with OFSS and Polaris. This may not be the right comparison, 80{01de1f41f0433b1b992b12aafb3b1fe281a5c9ee7cd5232385403e933e277ce6} of revenues of Nucleus are earned outside India.All continents account for nearly equal percentage of revenues now giving it multiple legs.

Annual revenues and Profits

|

Year

|

Revenues INR Crores

|

Profit After Tax INR Crores

|

|

2000-01

|

27

|

10

|

|

2001-02

|

40

|

10

|

|

2002-03

|

60

|

7

|

|

2003-04

|

54

|

10

|

|

2004-05

|

67

|

15

|

|

2005-06

|

94

|

28

|

|

2006-07

|

146

|

42

|

|

2007-08

|

288

|

61

|

|

2008-09

|

328

|

32

|

|

2009-10

|

291

|

38

|

|

2010-11

|

270

|

26

|

|

2011-12

|

282

|

35

|

|

2012-13

|

293

|

45

|

|

2013-14

|

346

|

64

|

|

2014-15

|

350E

|

65E

|

The company is dependent on a very narrow and niche segment with lumpy earnings and marked by absence of growth for multiple years at times.

– No Growth, Value Trap, Mediocre Management and a few more issues with the company.

Positives:

Intellectual Property, Product Based company, #1 in its Lending Niche, 103 / share cash (CMP 175) in hand, which makes me feel its a bargain. That said, I may give the company up to 4 quarters to perform or out.

Disclosure: Invested.

SOURCE: Long Term Equities – Read entire story here.