It was not surprising to see the challenge of all-time highs rebuffed in the Nasdaq and Russell 2000. These were the indices most likely to see the benefit of buying strength, and both started off well. However, as the day wore on, bears were able to squeeze bulls out of their positions. Both of these key indices closed at lows.

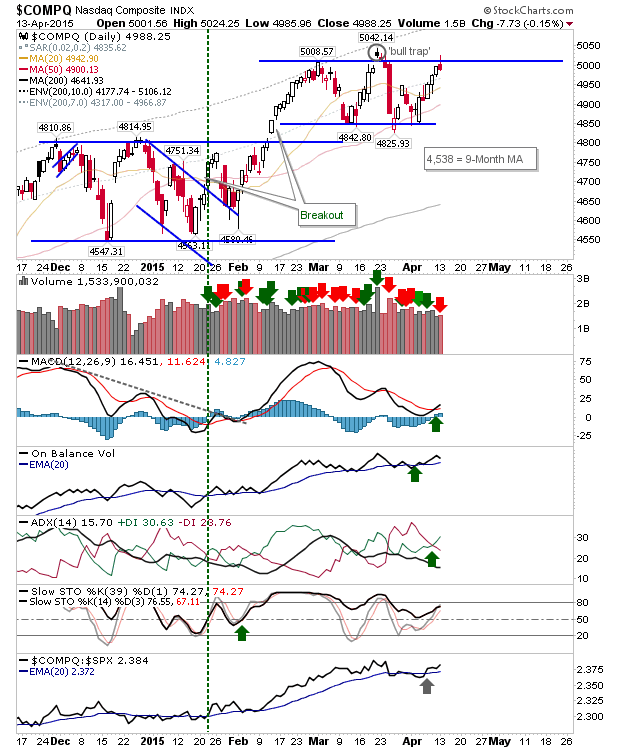

The Nasdaq finished with an inverse hammer as it attempted to challenge the ‘bull trap’. Volume climbed from Friday to register distribution, although it wasn’t particularly high volume overall. Tomorrow may see some follow through down, but there is plenty of support to work with, starting with 20-day and 50-day MAs.

The Russell 2000 also finished with a bearish ‘gravestone’ doji. It’s perhaps in a little better shape than the Nasdaq as it has a better defined rally. However, the MACD has flatlined and it’s struggling to regain the relative performance the Russell 2000 enjoyed against the Nasdaq.

The S&P wasn’t challenging highs and today’s selling cleared out Friday’s gains. It’s trading at a support level used to define the February ‘bull trap’, but it’s not a particularly strong support level.

It’s a similar story for the Dow, although today’s max occurred at the point of resistance which defined the February ‘bull trap’; i.e. the Dow is below resistance while the S&P is above such support.

For tomorrow, look for further weakness across the indices but this might be short-lived.

You’ve now read my opinion, next read Douglas’ and Jani’s.

—

Accepting KIVA gift certificates to help support the work on this blog. All certificates gifted are converted into loans for those who need the help more.

Dr. Declan Fallon is the Senior Market Technician and Community Director for Zignals.com, and Product Development Manager for ActivateClients.com. I do a weekly broadcast on Friday’s at 13:30 GMT for Tradercast, covering indices, FX and gold, silver and oil – all are welcome! You can read what others are saying about Zignals on Investimonials.com.

JOIN ZIGNALS TODAY – IT’S FREE!

SOURCE: Fallon Financial Commentary – Read entire story here.