On Thursday, I highlighted the March lows as a potential key level for EURUSD following the break below the double top that had formed over the prior few weeks (EURUSD – March Low Eyed on Break Below Double Top).

With the move now almost complete, the pair appears to be losing downside momentum and may even fall slightly short of the 12-year low set in March.

The most recent low on the 4-hour chart was not met with a corresponding low on the stochastic while the MACD histogram continued to show falling downside momentum. This divergence could be an early bullish warning sign.

Meanwhile, the euro has rallied back to the day’s highs where it has run into resistance. The resulting formation that may now be emerging is an inverse head and shoulders but this is far from complete at this stage.

It’s also important to note that even if it does form, only the break of the neckline is a completed formation and everything can often fall apart at this stage.

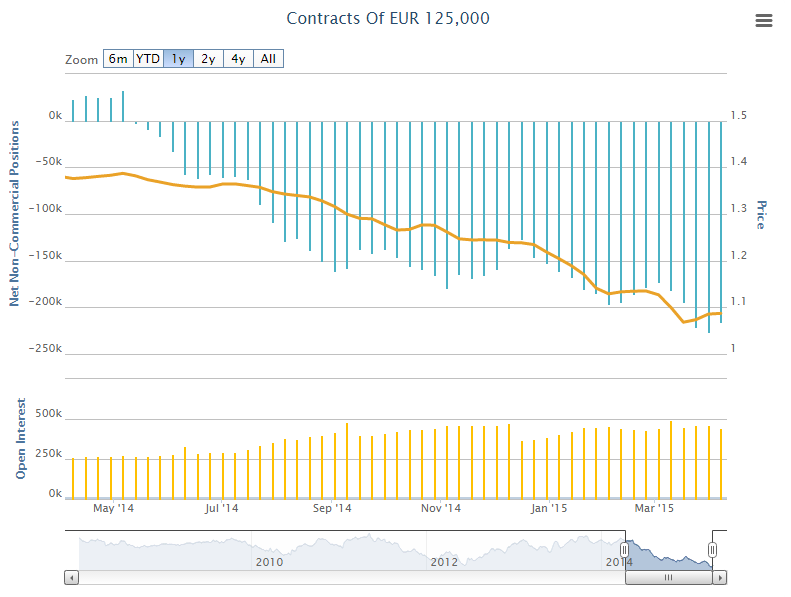

It’s still early on in this move at the moment but the early signs do suggest that the bears face a tough task at pushing this below the March lows. A look at the Commitment of Traders (COT) report, which is issued weekly by the Commodity Futures Trading Commission (CFTC), may support this with it showing that non-commercial traders bearish stance was reduced last week.

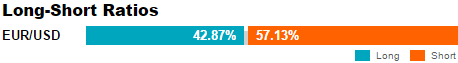

Despite net short positions among OANDA clients easing slightly today, they are more net short than they were on Thursday suggesting they see further room for manoeuvre to the downside. Unfortunately, as highlighted on Thursday, this is not necessarily a bearish sign, in fact, it could actually be seen to be more of a bullish than bearish indicator.

SOURCE: MarketPulse – Read entire story here.